The Singlife Plan & Protect App is the Philippines’ first and only all-in-one digital insurance solution that lets you SAVE for, PLAN, and PROTECT your finances using your mobile phone

Singlife Plan & Protect PH

What is it about?

The Singlife Plan & Protect App is the Philippines’ first and only all-in-one digital insurance solution that lets you SAVE for, PLAN, and PROTECT your finances using your mobile phone.

App Screenshots

App Store Description

The Singlife Plan & Protect App is the Philippines’ first and only all-in-one digital insurance solution that lets you SAVE for, PLAN, and PROTECT your finances using your mobile phone.

The Singlife Plan & Protect App has everything you need to take control of your financial future, from growing your wealth to ensuring that you will always get comprehensive life insurance coverage and have money when you need it most.

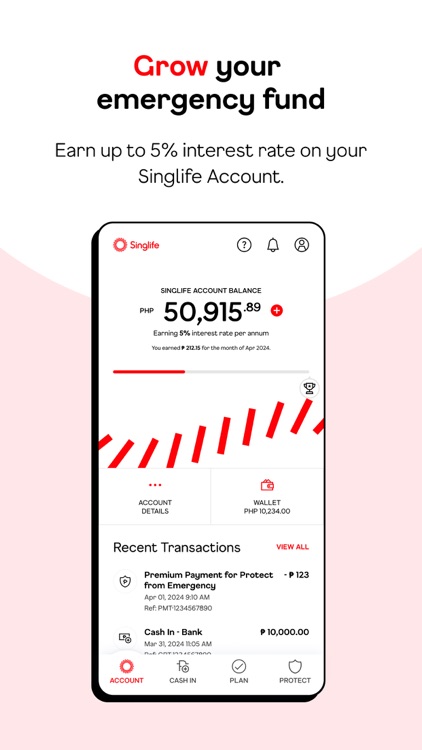

* SAVE: Grow your money

Open a Singlife Account that lets you earn up to 15% yearly net interest* with the Singlife Super Boost Program. Enjoy a welcome gift worth ₱300 insurance credits to help kickstart your journey toward financial independence!

Plus, get a free Singlife Visa debit card linked directly to your Wallet in the Singlife Plan & Protect App, so you can withdraw cash from any ATM, with no fees at UnionBank ATMs. You can also use it for payments at merchants.

* PLAN: Set and track your financial goals

Have your own personalized smart financial planning tool that helps you set, track, and protect your financial goals.

* PROTECT: Access investment and insurance more efficiently

Secure affordable investment and life insurance products—including medical, death and disability, and VUL insurance—in just a few steps all through your mobile device.

SINGLIFE SUPER BOOST

Start your journey today and earn up to a 15% yearly interest rate,* tax-free, on your Singlife Account.

Boost: All customers are given a 5% yearly net interest rate* when they download the Singlife Plan & Protect App and create their Singlife Account. Balances of up to ₱500,000 in the Singlife Account will earn a 5% yearly net interest rate,* while amounts exceeding ₱500,000 but not more than ₱1,000,000 will earn 2% yearly net interest.*

2x Boost: Customers with Protect from Emergency and Protect Your Goals products in any of its variants (Savings, Education, and More Goals) can double their monthly earnings up to 10% yearly net interest* by maintaining their coverage.

Super Boost: Customers can triple their monthly earnings to up to 15% yearly net interest rate* by building and maintaining financial protection with other insurance and investment solutions in the Singlife Plan & Protect App. You can also voluntarily top up at least ₱2,000 in your active Protect Your Goals (in any of its variants: Savings, Education, and More Goals) policy to enjoy super boosted rewards.

*For the complete terms and conditions, visit https://singlife.com.ph/about/blog/super-boost/.

CUTTING-EDGE AND SECURE TECHNOLOGY

The Singlife Plan & Protect App is built on advanced technology that adheres to the highest security standards, so your money and data are kept safe.

OUTSTANDING CUSTOMER EXPERIENCE

Singlife Philippines, through the Singlife Plan & Protect App, earned multiple awards at the 2024 Digital CX Awards from The Digital Banker:

* Best Insurance Provider for Digital CX in the Philippines

* Best Insurtech for Digital CX

* Best Digital CX – Account Opening and Customer Onboarding (Insurance)

* Highly Acclaimed for Best Digital Life Insurance

For any questions or concerns, send us an email at help@singlife.com, reach us through Messenger at https://www.facebook.com/SinglifePhilippines/, or call 24/7 Customer Support at +632-8299-3737.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.