Welcome to Spindie - Helping Oklahomans live a more local lifestyle

Spindie

What is it about?

Welcome to Spindie - Helping Oklahomans live a more local lifestyle.

App Screenshots

App Store Description

Welcome to Spindie - Helping Oklahomans live a more local lifestyle.

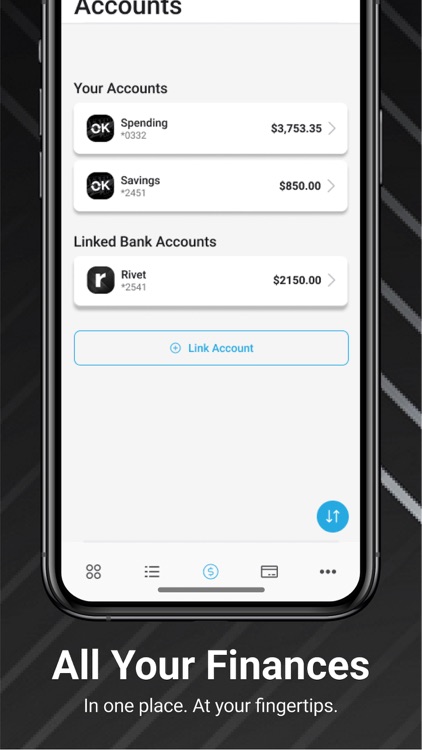

We love Oklahoma’s small businesses and we know that you do too, but it can be easy to settle for the convenience of big box stores and chain restaurants. That’s why we’ve partnered with Tulsa-based financial technology company, Rivet, to create Spindie (spend + indie) - a new digital banking experience (MasterCard debit card, spending account & mobile app) that rewards you for eating, shopping and playing local at small, independent shops, restaurants and service providers every day. With banking services provided by First Pryority Bank (Tulsa), N.A., Member FDIC, Spindie will help you prioritize spending your money locally and investing it back into the community that you love by giving our small businesses the support they deserve.

* HERE’S HOW IT WORKS

Download and sign up for a Spindie account in a matter of minutes. The signup process is simple and fast and it won’t affect your credit score.

* DIGITAL WALLET

Connect your Spindie debit card to your Apple Wallet for easy access.

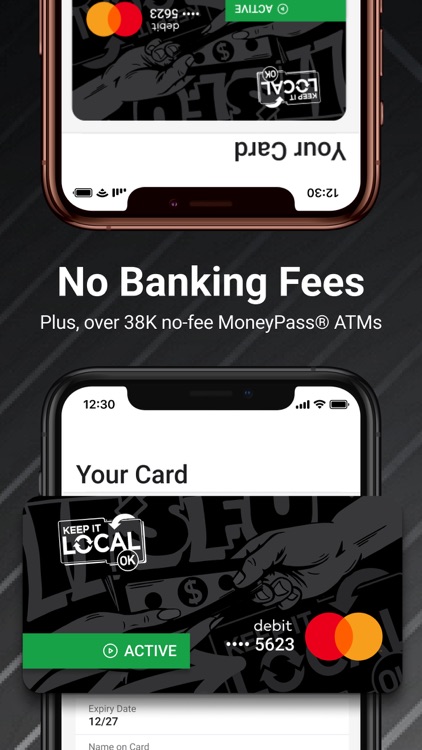

* FEE-FREE ATMs

Use the ATM Finder to get cash without fees1 at over 37,000+ MoneyPass® ATM locations.

* GET PAID EARLY

Get your paycheck up to two days early with direct deposit.2

* NO MONTHLY FEES

No monthly charges. No minimum balance. Ever.3

* STAY TUNED

New features that will help you live a more local lifestyle are coming soon to the Spindie App!

Spindie is a mobile payments platform, not a bank. Banking services provided by First Pryority Bank, Member FDIC. The Spindie Card is issued by First Pryority Bank, Member FDIC, pursuant to a license from Mastercard and may be used everywhere Mastercard debit cards are accepted. ATM withdrawals fees may apply. Other fees such as third party fees may apply.

¹ Use your card at any of the ATMs listed within the application without paying a surcharge. If an address has more than one ATM, please look for the MoneyPass® logo on a sign at the ATM or displayed on the ATM screen to avoid paying a surcharge.

² Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

³ No fees for most services. No overdraft. No minimum balance. No monthly fees.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.