Looking forward to you becoming part of the Suvi Family

Suvi

What is it about?

Looking forward to you becoming part of the Suvi Family. Download Suvi - Mobile Banking today! Banking Simplified! One App Does it All!

App Screenshots

App Store Description

Looking forward to you becoming part of the Suvi Family. Download Suvi - Mobile Banking today! Banking Simplified! One App Does it All!

Suvi’s mission is to simplify banking, eliminate banking fees, and offer universal accessibility.

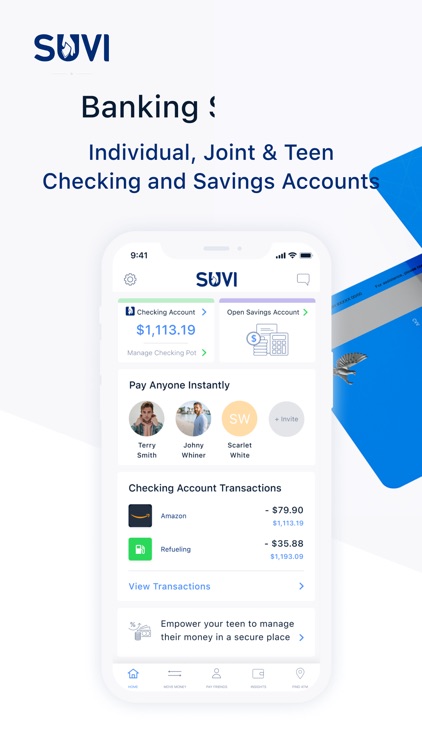

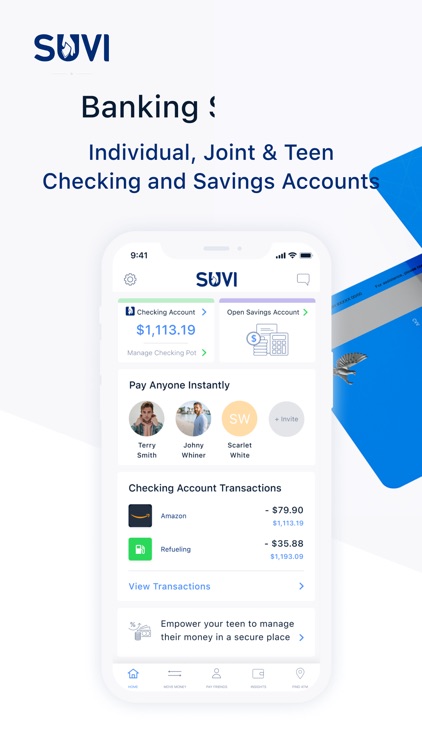

Suvi is the only next-generation fintech company that provides fee-free banking, instant payments, budgeting, and goal monitoring including joint and teen accounts.

Our own banking core and technology-first approach help us to rapidly innovate and provide increased functionality and unique value to our users versus other digital and traditional banks.

Banking Simplified - Fee-Free Joint & Teen Checking & Savings Accounts

Get Paid Early

Your paycheck is available to spend up to two days early*

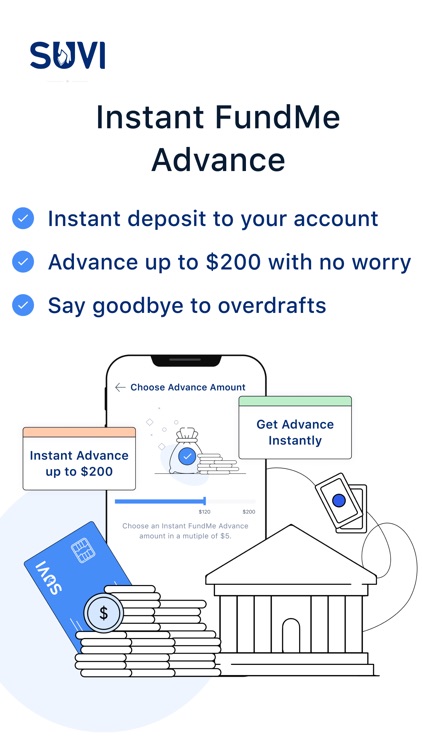

Fee-Free Overdraft

Overdraw without incurring any fees using Suvi’s FundMe**

No Hidden Fees

Reimagine a banking experience with zero surprise fees or charges

Lifetime Skills for Teens

Checking and savings accounts for your teens to help instill valuable money management skills

Instantly Pay Anyone

Instantly send money to anyone, whether your friends have a Suvi account or not. Receive or request funds from friends

3.00% APY interest on Savings Account

Earn a 3.00% APY interest on high yield Savings Account^. Periodically save and plan in ways most convenient for you.

One App Does it All

The only digital app with free joint & teen accounts—instantly pay anyone, budget, and save, all in one app

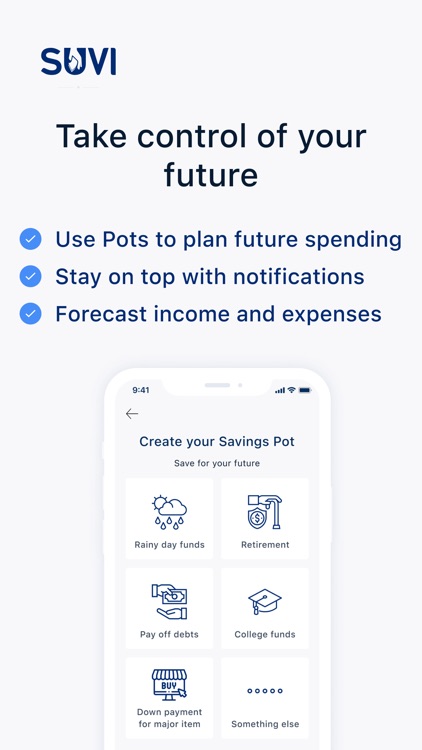

Personalized Budgeting

Stay proactive with your finances through AI and machine learning to help forecast your income and expenses.

Stay on Top of Expenses

Categorize expenses and monitor your net savings on a periodic basis

No Fee ATM Withdrawals

80,000+ fee free in-network ATMs and cashback locations^^

----------------------

Banking services provided by Community Federal Savings Bank, member FDIC. The Suvi Visa Debit Card is issued by Community Federal Savings Bank pursuant to a license from Visa U.S.A. Inc.

* Early access to direct deposit funds depends on timing of the payer’s submission of deposits. We generally make these deposits available on the day we get notified, which may be up to 2 days earlier than the payer’s scheduled deposit date.

** Suvi FundMe is an optional service with no fees, interest, or request for tips. To qualify, you will require a single deposit of $200 or more in qualifying direct deposits to the Suvi Spending Account each month. Based on your Suvi account history, direct deposit frequency and amount, spending activity, and other risk-based factors, you may be eligible for FundMe of up to $200 for debit card purchases. Your limit is displayed on the Suvi mobile app or at suvicash.com. Your limit may change at any time, at Suvi’s discretion. FundMe does not cover non-debit card purchase transactions, including ATM transactions, ACH transfers, Pay Friends transfers, or Suvi Checkbook transactions. See Terms and Conditions. Chase, Wells Fargo, and Bank of America overdraft fees are based on their respective websites as of September 15, 2021.

^ Earn 3.00% Annual Percentage Yield (APY) on Suvi Savings Account on balances of up to $3,000 (including Pots linked to Savings Account and Teen Savings Account). APY is variable and may change at any time. To earn 3.00% APY, the Suvi Savings Account must meet the following requirements: $500 or more in qualifying direct deposits and debit card purchase transactions in the calendar month. In addition, the Suvi Checking Account and Suvi Savings Account balances must not drop below $0.00 on any calendar day of the month.

^^ Out-of-network ATM withdrawal fees apply except at any Moneypass or Visa Plus Alliance ATMs. Other fees such as third-party and cash deposit fees may apply.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.