Federal Tax Principles, Practices & Tips

US Federal Tax Notes

What is it about?

Federal Tax Principles, Practices & Tips.

App Screenshots

App Store Description

Federal Tax Principles, Practices & Tips.

With this app you can learn on the Go & everywhere. Our Learners Don't just meet standards, They exceed them.

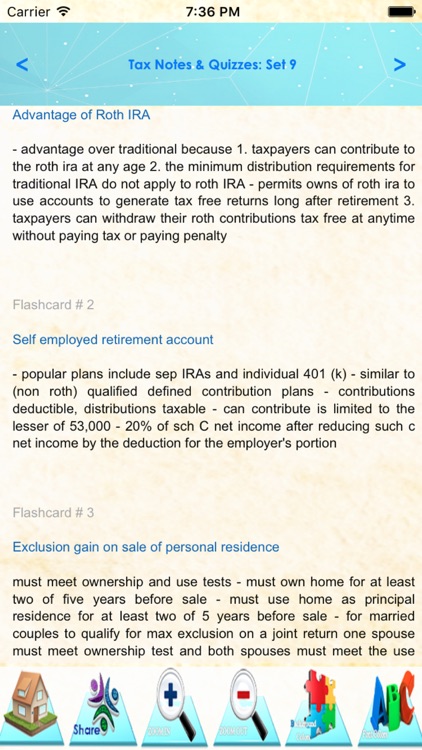

This is a Combination of sets, containing practice questions and study cards for exam preparation on the topic of Fiscal duties, & federal & individual tax.

This application allows you to expand your fiscal knowledge, widen your tax expertise, improve your practice skills, Broaden your career & academic horizons.

Get +1600 Exam quizzes , Study notes, & practice cases and Prepare and Pass Your Tax Exam easily and guarantee the highest score.

Invest in your Success Now.

Your investment in knowledge, professionalism & expertise is durable with a High added value, it's a High return investment.

This app is suitable not only for CPA students but also for CMA, CIA, ACCA, CA, ACA, CFA, CFE, CISA, PMP, AP, CGAP, CRMA, CTP, CPP, CFP candidates.

-The Content & design of this application is developed by students to satisfy the exact exam candidates needs

-We keep the application as simple as possible to let the learner focus only on the content

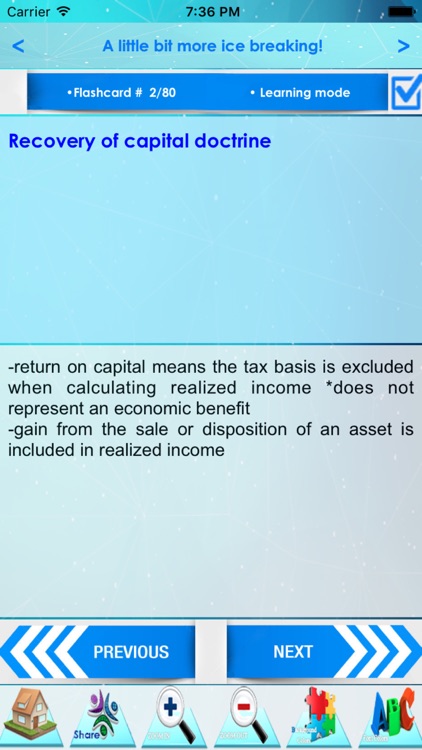

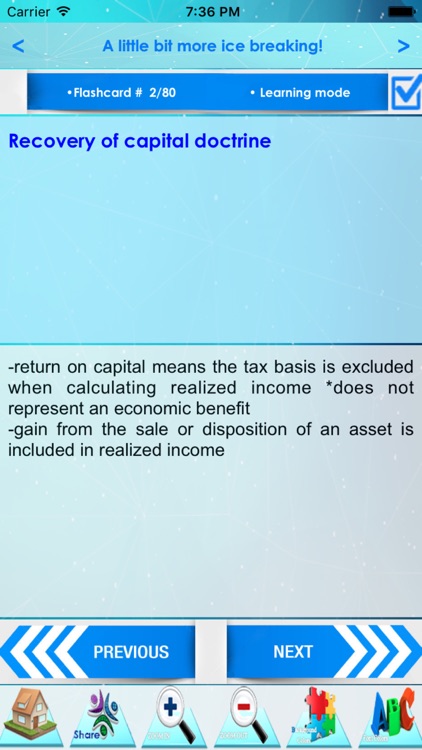

-The Flashcards are exam oriented and designed to enhance quick memorization

-The application is designed to let you gain time and efficiency

-The Flashcards wording enhances easy understanding to ensure higher exam score.

This App energized your creativity, showcases your talents and strength your self-confidence during the exam & daily work.

You will get better understanding, less preparation time & a better score in the exam.

-This application is downloaded and used by graduate & undergraduate students, teachers, lecturers, professionals, PhD, researchers, reviewers not only in the US but also in Philippines, Canada, India, Australia, Turkey, Russia, UK, GCC, India, Saudi Arabia, Nigeria, and all over the world.

Main Features:

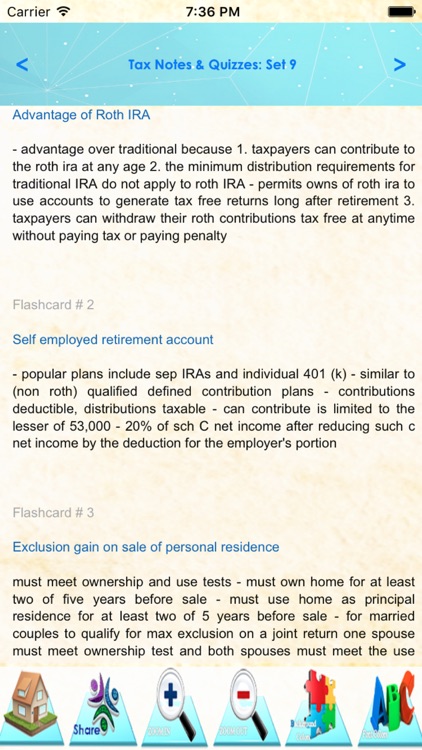

- +1600 exam questions and study notes

- 5 study modes

- Shareable content

- Settings: with flexibility to change font size & background control

In this application you will get over 20 Exam sets.

Taxes are imposed on net income of individuals and corporations by the federal, most state, and some local governments. Citizens and residents are taxed on worldwide income and allowed a credit for foreign taxes. Income subject to tax is determined under tax accounting rules, not financial accounting principles, and includes almost all income from whatever source. Most business expenses reduce taxable income, though limits apply to a few expenses. Individuals are permitted to reduce taxable income by personal allowances and certain nonbusiness expenses, including home mortgage interest, state and local taxes, charitable contributions, and medical and certain other expenses incurred above certain percentages of income. State rules for determining taxable income often differ from federal rules. Federal tax rates vary from 10% to 39.6% of taxable income. State and local tax rates vary widely by jurisdiction, from 0% to 13.30% of income, and many are graduated. State taxes are generally treated as a deductible expense for federal tax computation. In 2013, the top marginal income tax rate for a high-income California resident would be 52.9%.

Types of taxpayers

Taxes may be imposed on individuals (natural persons), business entities, estates, trusts, or other forms of organization. Taxes may be based on property, income, transactions, transfers, importations of goods, business activities, or a variety of factors, and are generally imposed on the type of taxpayer for whom such tax base is relevant. Thus, property taxes tend to be imposed on property owners. In addition, certain taxes, particularly income taxes, may be imposed on the members of organizations for the organization's activities. Thus, partners are taxed on the income of their partnership.

With few exceptions, one level of government does not impose tax on another level of government or its instrumentalities.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.