Viva Money is now LIVE in Maharashtra, Gujarat & Karnataka

VIVA MONEY - Credit Line App

What is it about?

Viva Money is now LIVE in Maharashtra, Gujarat & Karnataka!

App Screenshots

App Store Description

Viva Money is now LIVE in Maharashtra, Gujarat & Karnataka!

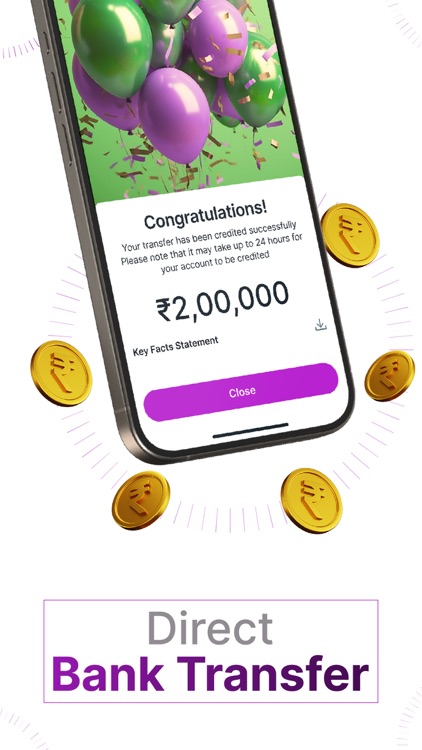

With Viva Money Credit Line & Instant Personal Loan App, you can get instant approval and unlock an Interest-Free Line of Credit up to ₹2 Lacs in just 15 minutes!

VIVA Money is India's top-ranked interest-free loans & credit line app, which offers instant personal loans online with 0% interest for up to 51 days. Get a Quick Instant Loan with a credit line from ₹5000 up to ₹2,00,000 at 0% interest in less than 15 minutes.

VIVA Money - Instant Personal Loan App is powered by Fincfriend Private Limited, an NBFC duly registered with the Reserve Bank of India (RBI).

Why VIVA Money?

VIVA Money is India’s one of the Best Personal Loan App with features like

• Credit line loan for up to ₹2,00,000

• 0% interest for up to 51 days.

• Instant loan approval in less than 15 minutes

• Revolving line of credit

• Money transferred directly to your bank account

• Pay interest only on the amount withdrawn

• 100% online process with zero paperwork

• Take instant personal loans

• Flexible EMIs: Convert loans to 5, 10, 20 months

How do we work?

Example:

On January 1, Tanmay successfully applies for VIVA Money’s Instant Personal Loan (credit line). His credit line is approved for ₹1,50,000. However, for the next 1 month, Tanmay doesn't utilize any funds from the approved credit line.

On February 1, Tanmay decides to withdraw ₹50,000 from his credit limit to buy a laptop. As a result, he will only be charged interest on the withdrawn amount of ₹50,000. He still retains access to ₹1,00,000 from his credit line for any future requirements, and he won't incur any interest charges on this amount until he withdraws it. Your borrowing experience will be smoother with this Instant Personal Loan feature.

As we provide a grace period of up to 51 days, if Tanmay repays the amount by 20th March, he does not need to pay any interest or other charges. The processing fee, a one-time charge of 1.5%, is required and is payable only once for a lifetime.

In case Tanmay doesn’t want to repay the amount within the grace period then he can make the payment through EMIs (5,10 or 20 months)

We offer interest rates ranging from 18%-36% APR (Annual Percentage Rate)

As an example:

Loan amount: 50,000

Loan Tenure: 5 months

Rate of Interest: 36% per annum

Processing fee: 1.5%= ₹750 + GST = ₹885

Total Interest: 5971

Total cost of the loan: ₹885 + ₹5,971 = ₹6,856

How can you get an instant credit line loan?

Get a Personal loan in less than 15 minutes by following the below steps:

• Download the VIVA Money Credit Line App

• Log in with your phone number.

• Submit your PAN & Aadhaar details and check your eligibility.

• Complete the KYC verification and you are good to go

• After the approval, your desired amount will be available as a credit line which you can transfer to your bank account anytime.

The process is very easy with the Best Instant Personal Loan App being India’s first Interest-Free Credit Line Loan App

Eligibility criteria to get a quick personal loan:

Eligibility criteria for a quick loan

• Indian citizens only

• Minimum monthly income: 15,000

• The user must be in the age group of 21 to 64.

Details to get an instant loan

• Selfie

• PAN Number

• Aadhaar Number

With the digital way of lending money through the Viva Money - Instant Loan Online App, you can take multiple instant personal loans easily & hassle-free. VIVA Money - Instant Credit Line App aims to provide a quick & easy process of taking credit lines with lower interest rates.

Privacy & Security:

Your privacy is our top priority. We adhere to strict data security measures to protect your personal and financial information. We use advanced encryption technologies to safeguard your data from unauthorized access.

VIVA Money - Personal Loan App requires the below permissions to function properly:

• SMS

• One-time access for - camera, microphone, location & storage

Contact us:

E-mail us: chat@vivamoney.in

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.