Whats my Pay

Whats my pay? AU 2019-2020

What is it about?

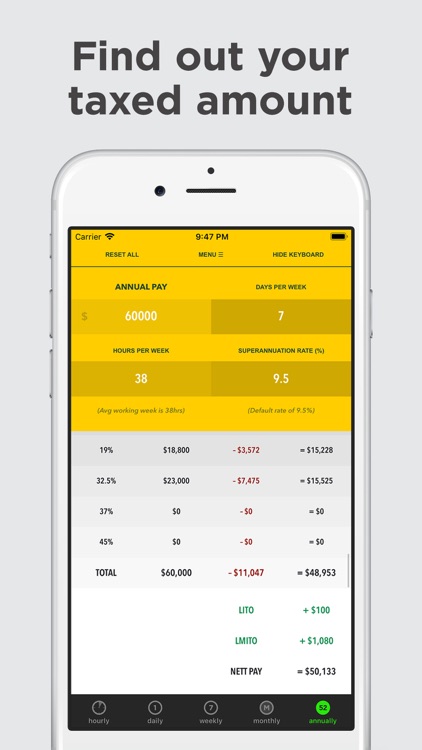

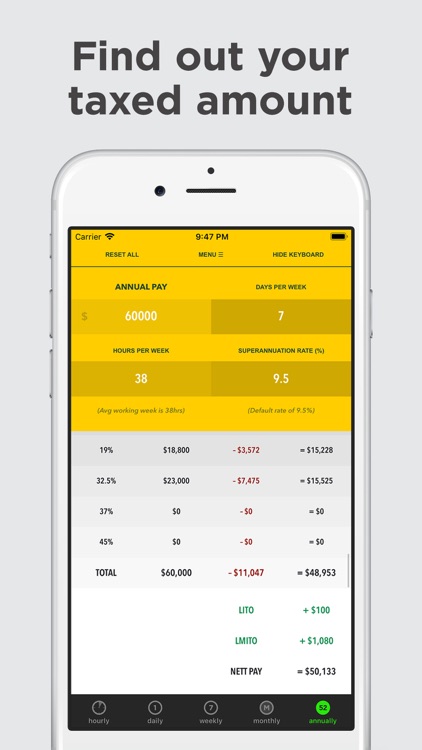

Whats my Pay? Australia 2019-2020 shows what your income converts to in hourly, daily, weekly, fortnightly, monthly and annual segments.

App Screenshots

App Store Description

Whats my Pay? Australia 2019-2020 shows what your income converts to in hourly, daily, weekly, fortnightly, monthly and annual segments.

Simply choose which income you want to insert from: hourly, daily, weekly, monthly or annually. Then tailor the hours/week, days/week and Superannuation rate according to your situation!

Includes calculations for low income tax offset, low and medium income tax offset, medicare and medicare levy surcharge (if applicable).

So, once you've inputted the relevant values, scroll down and review these three separate sections to understand how tax is deducted from your pay:

PART 1:

Gross Pay + Superannuation = Total (before-tax)

PART 2:

Gross Pay - Income Tax + LITO + LMITO = Nett Pay (after-tax)

PART 3:

Nett Pay - Medicare = Total

Note:

Superannuation – 9.5%

LITO – Low income tax offset

LMITO – Low to medium tax offset

Medicare – 2% in most cases

iPhone apps designed with purpose.

alansally.com

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.