*** Features current financial years FY 20-21 -> FY 23-24 ***

ATO Tax Check

What is it about?

*** Features current financial years FY 20-21 -> FY 23-24 ***

App Screenshots

App Store Description

*** Features current financial years FY 20-21 -> FY 23-24 ***

*** Includes new Superannuation Rates ***

*** Includes 21-22 increased Tax Offsets ***

| *** Overview *** |

ATO Tax Check takes the hard work out of calculating your tax and pay! Easily check to make your you are getting paid correctly!

Simply enter your salary, select the options based on your personal situation and let ATO Tax Check calculate your net pay.

ATO Tax Check uses up-to-date official ATO tax, ATO PAYG, tax offsets, student loan, Medicare tables & formulas with the largest amount of tax options to calculate the most accurate tax estimate of any app on the Australian App Store.

| *** Key Features *** |

Why ATO Tax Check is the best Australian Tax Calculator:

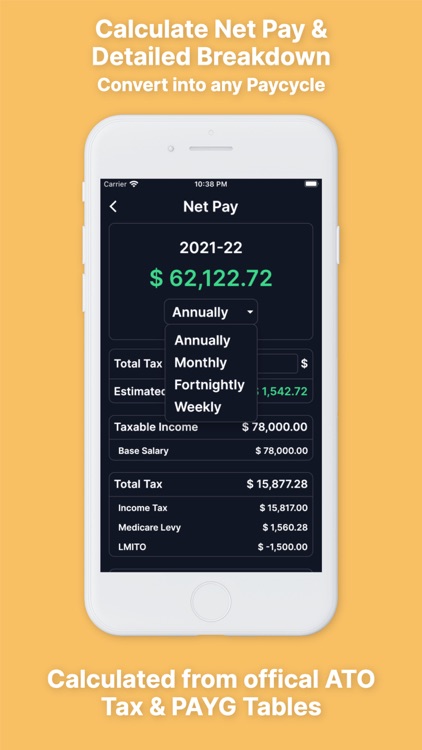

1. Easily convert your net pay between weekly, fortnightly, monthly and annual amounts.

2. Calculates on current financial years: FY 20-21 -> FY 23-24.

3. Calculates Salary Sacrifice

4. Calculated Medicare Levy and Medicare Levy Surcharge

5. Medicare Exemptions (Half / Full)

6. Includes new Superannuation rate changes for each FY

7. Detailed breakdown of your Income, Tax & Super.

8. Includes up-to-date tax offsets (Cost of Living Tax Offset)

9. Offers more tax options than any tax calculator on the Australian app store

10. Calculates Estimated Tax Return and allows actual Tax Withheld input for more accurate estimate*

11. Offers additional inputs (Capital Gains, Business Income, Tax Credits etc.)*

12. Many more features & options!

| *** Features & Options *** |

Input Options:

- Financial Years: FY 2020-21, FY 2021-22, FY 2022-23, FY 2023-24

- Salary Input Pay Cycle: Weekly, Fortnightly, Monthly, Annually

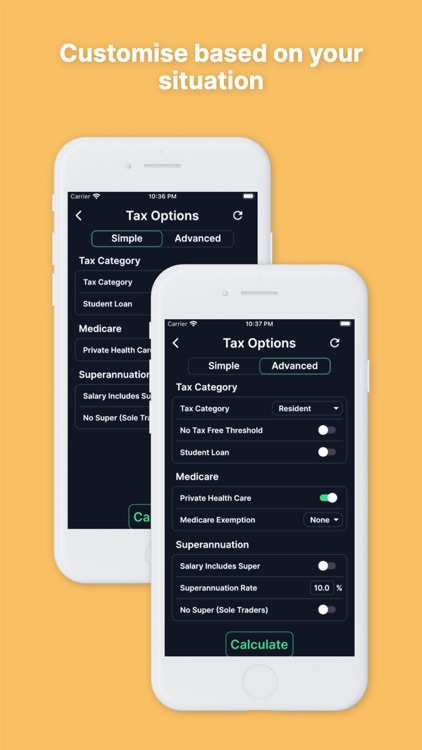

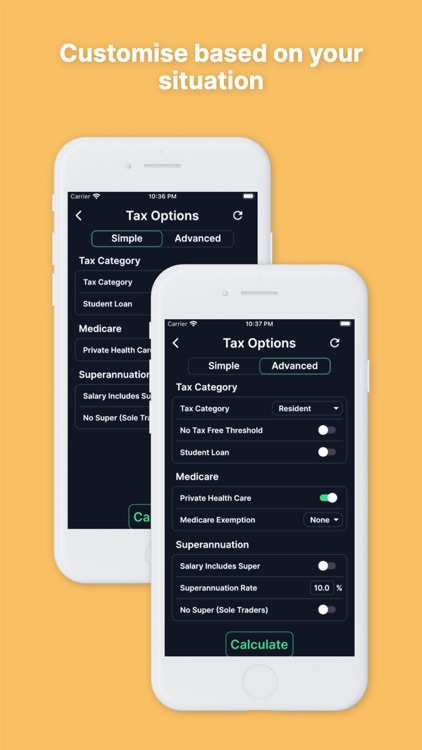

Tax Category Options:

- Tax Category: Resident, Non-Resident, Backpacker

- No Tax-Free Threshold: Y/N

- Student Loan (HECS, HELP): Y/N

Medicare Options:

- Private Healthcare: Y/N

- Medicare Exemption: None / Half / Full

Superannuation Options:

- Salary Includes Super: Y/N

- Superannuation Rate: Defaults to FY rate (Can enter custom rate)

- No Super (Sole Trader): Y/N

Salary Sacrifice Options:

- Enter Salary Sacrifice amount & frequency (Weekly, Fortnightly, Monthly, Annually)

Results:

- Convert Net Pay between Weekly, Fortnightly, Monthly & Annual amounts

- Detailed breakdown Total Income, Tax & Superannuation

| *** Pro Features *** |

*Upgrade to Pro to remove ads and unlock the following additional options & features:

Estimated Tax Return:

- Estimate Tax Return – Based on difference between PAYG withholding & EOFY Tax payable

- Enter actual Tax Withheld amount to get more accurate tax return estimate

Deductions:

- Enter Annual Tax Deduction

Other Income/Losses/Credits:

- Capital Gains

- Annual Allowances

- Other Income

- Other Losses

- Business Income

- Tax Credits

| *** Disclaimer *** |

ATO Tax Check uses up-to-date tax tables, brackets and data from the ATO to ensure very accurate calculations however, your specific situation may not be able to be accurately captured within this app. All calculations in this app are to be used as indicative estimates only.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.