Loan amount: From $25,000 to $500,000 - change to $5,000 to $1,000,000

Blue Nile Finance

What is it about?

Loan amount: From $25,000 to $500,000 - change to $5,000 to $1,000,000

App Screenshots

App Store Description

Loan amount: From $25,000 to $500,000 - change to $5,000 to $1,000,000

Interest rates: From 7% to 30% per annum - change to 3% to 30% per annum

Tenure: 2 to 5 years - change to 1 year up to 5 years

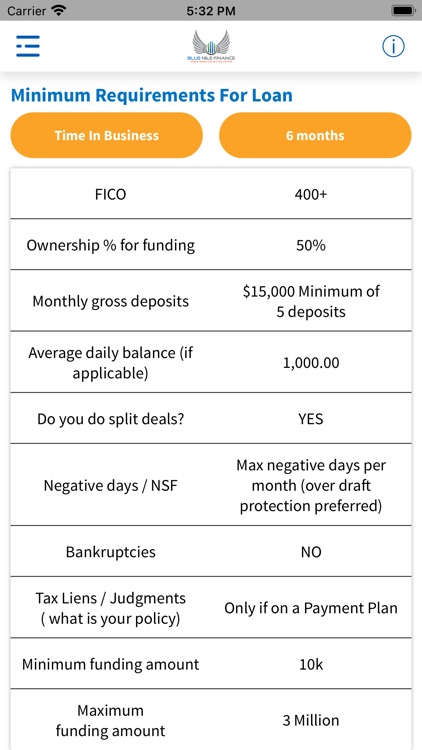

Blue Nile Finance, aka Blue Nile Money, is a money lending App that supports the functionality of our website bluenilefinance.com.

Our specialty is helping small and medium sized businesses to obtain capital to either start a business or for operating expenses. We help businesses obtain no credit checks and unsecured business loans. We help businesses qualify for small business administration (SBA) loans, merchant cash advance loans, equipment financing, etc.

Also, we help consumers pay down their debt in less than half of the time they are scheduled to pay off their loans utilizing our proprietary strategies, which includes tax-free products. We achieve this without increasing any current monthly payment obligations that the client is already making.

We help our clients with debt reorganization and credit repair.

In all, we are an all around consulting firm for raising capital and eliminating debt.

We have many solutions for increasing cash flow, having multiple streams of income, reaching financial independence, creating wealth, and building multiple generational legacies.

Inquiries can be submitted directly from our website or our App Blue Nile Money.

Personal Loan for Salaried example:

Loan amount: USD. 50,000

Tenure: 12 months

Interest Rate: 20% per annum

Processing Fee: USD. 1,250 (2.5%)

New customer onboarding Fee: USD. 200

Total Interest: USD. 5,581

EMI: USD. 4,632

APR: 23.2%

Loan amount is USD. 50,000. Disbursed amount is USD. 48,289. Total loan repayment amount is USD. 55,581

Fees & Charges

Interest rates range from 0%-29.95% with equivalent monthly interest rate of 0%-2.49% only.

A small processing fee is charged for loans e.g. for low risk customers 0% - 3% of the principal, for very high-risk customers 2.5% - 7%*.

Charges one-time service fee while onboarding or during upgrade which is $20-$350 depending on the risk profile.

*The charges and repayment tenures vary based on creditworthiness and repayment ability of the customers. Penalty is charged only when someone delays their scheduled payment.

The APR for different products is separate as per the risk profile of the customers. The APR for different personal loan products: low risk customers is 0%-36%, medium risk customers is 18%-39%, high risk customers is 24%-42% and very high-risk customers is 24%-70%.

We look forward to helping you achieve financial success.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.