Introducing Briezi, your go-to app for seamless insurance management and financial solutions in India

Briezi

What is it about?

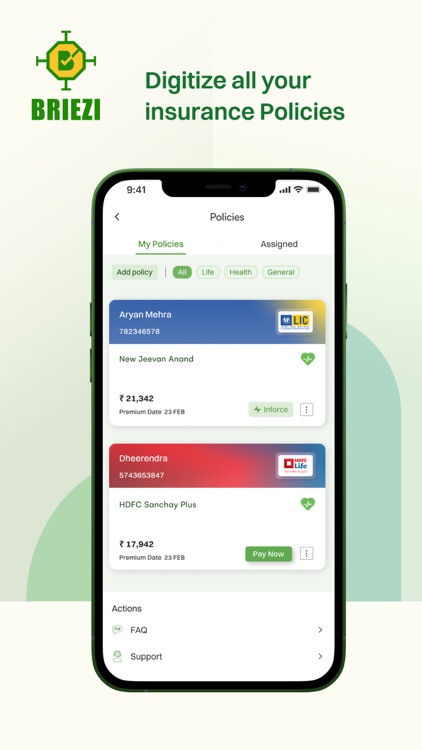

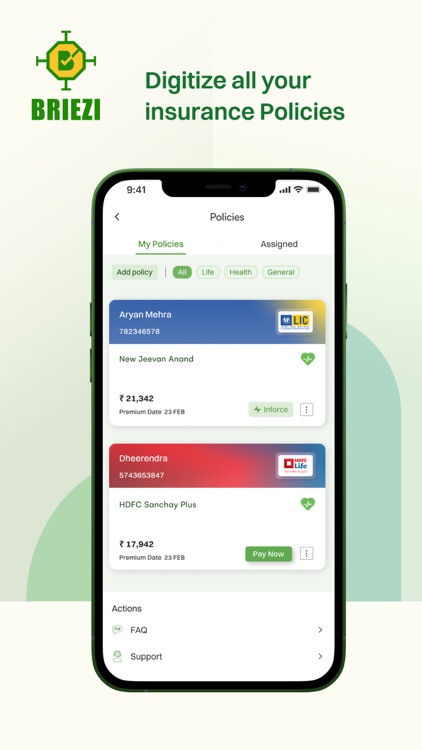

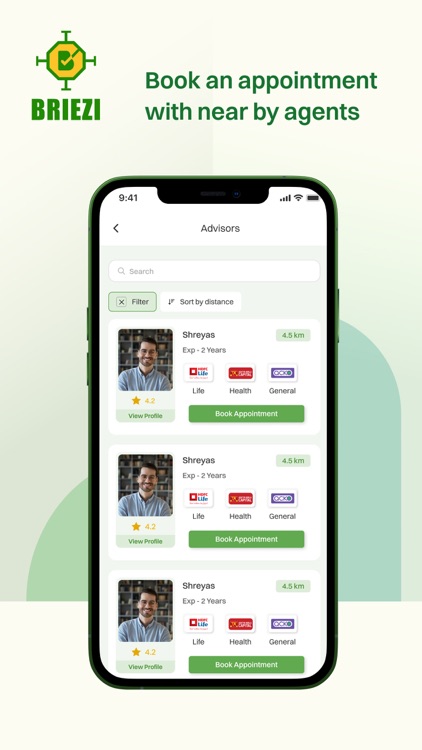

Introducing Briezi, your go-to app for seamless insurance management and financial solutions in India! Briezi empowers you to understand your coverage better. Easily make premium payments, manage policies, and enjoy the following key features:

App Screenshots

App Store Description

Introducing Briezi, your go-to app for seamless insurance management and financial solutions in India! Briezi empowers you to understand your coverage better. Easily make premium payments, manage policies, and enjoy the following key features:

Risk Coverage Without the Cost:

Assign your insurance policy to Briezi and continue enjoying comprehensive risk coverage at zero additional cost. Experience peace of mind without the extra financial burden.

Premium Financing at Your Fingertips:

Convert your insurance premiums into manageable EMIs with annual interest rates ranging from 14% to 18%. Briezi makes premium financing simple and accessible.

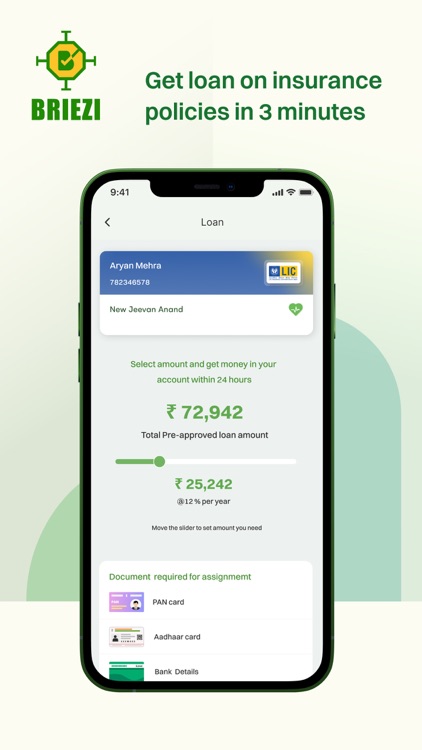

Insurance Policy Loans:

Need extra financial support? Avail loans against your insurance policies at a competitive annual interest rate of 12%. Briezi is here to offer you flexible and convenient financial solutions.

Loan against insurance

Our APR varies from 12% to 18% & you can choose a wide range of repayment options starting from 6 to 60 months.

Key features:

• Loan amount: ₹ 15,000 - ₹ 15 lacs

• Tenure: 6 – 60 months

• Minimal paperwork

• Interest Rate: 12%

Here’s an example of how a loan against insurance work

• Minimum Tenure - 6 Months

• Maximum Tenure - 36 Months

• Loan amount: ₹ 50,000

• Processing fee (2% of loan amount * 18% GST) : ₹ 590

• Total Loan amount: ₹ 50,590

• Interest: 12% p.a. (on reducing principal balance interest calculation)

• Tenure: 12 months

• Your EMI: ₹ 4,495

• Total Amount to be paid: ₹ 4,495 x 12 = ₹ 53,940

• Total interest paid: ₹ 53,940 - ₹ 50,590 = ₹ 3,350

• Total cost of loan: ₹ 3,350 + ₹ 590 = ₹ 3,940

• APR (Annual Percentage Rate): 14.2%

Eligibility Criteria

• Saving insurance policy with surrender value

• Above 18 years

Loan against insurance interest rates and other charges

Below are the applicable fees and charges for loan on insurance

Interest rate: 12% p.a. (on reducing principal balance interest calculation)

Processing fee: Up to 3% of the loan amount

Bounce charges: ₹ 1180

APR (Annual Percentage Rate): 14.2%

Late payment charges: 2% of the loan amount whichever is higher as per the overdue amount

Stamp duty: 0.1% of loan amount

Pre-closure charges: ₹ 2% of outstanding loan amount

Our Partner NBFCs

• Radiant Equity Management Pvt Ltd

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.