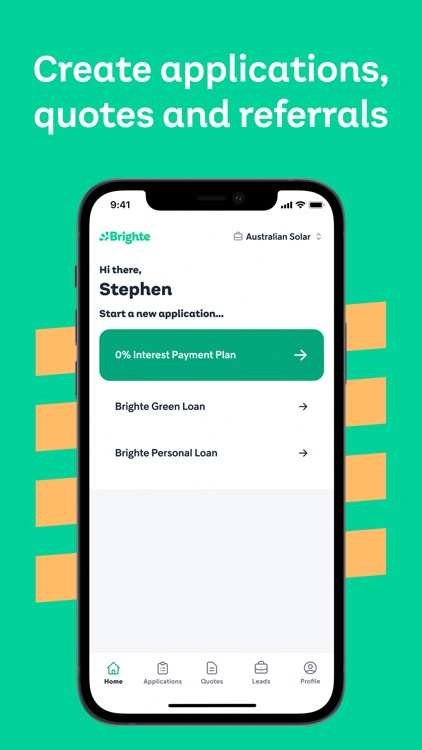

The Brighte Accredited Vendor App

Brighte Vendor

What is it about?

The Brighte Accredited Vendor App. This app allows Brighte partners to create and track any financial referrals for a customer to sustainably upgrade their home. This app makes a Brighte vendor's point-of-sale a simple process for customers who need financial support from Brighte. The following Financial Products are supported on the Brighte Vendor App:

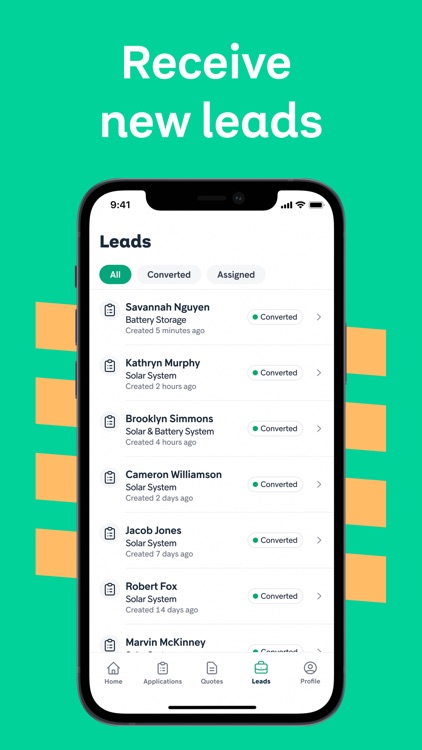

App Screenshots

App Store Description

The Brighte Accredited Vendor App. This app allows Brighte partners to create and track any financial referrals for a customer to sustainably upgrade their home. This app makes a Brighte vendor's point-of-sale a simple process for customers who need financial support from Brighte. The following Financial Products are supported on the Brighte Vendor App:

- 0% Interest Payment Plan (0% Interest Payment Plan – Finance available up to $45,000 )

- 6-120 month terms, by default repayments are due fortnightly, but we support monthly.

- Brighte Green Loan (Green loan for solar panel installs & energy efficient products )

- 2-10 year terms, by default repayments are due fortnightly, but we support monthly.

- Brighte Personal Loan* (Personal Loan – fixed interest rate for home improvements )

- 2-7 year terms, by default repayments are due fortnightly, but we support monthly.

- Australian Capital Territory's SHS (The ACT Sustainable Household Scheme )

- 2-10 year terms , by default repayments are due fortnightly, but we support monthly

- Tasmania's – Energy Saver Loan Scheme (The TAS Energy Saver Loan Scheme )

- 1-3 year terms, by default repayments are due fortnightly, but we support monthly

*For a Brighte Personal Loan comparison rate calculated on an unsecured loan amount of $30,000 over a term of 5 years based on fortnightly repayments. The comparison rate is true only for the example given and may not include all fees and charges. Different loan terms, fees or loan amounts might result in a different comparison rate.

Comparison rate*

- 12.69-16.67% p.a.

Interest rate**

- 11.49-15.49% p.a.

Estimated total minimum amount repayable from $34,400.24 up to max. of $35,799.883.

**The advertised interest rate is our lowest rate based on a customer with an excellent credit profile. The final interest rate and repayment amount will be provided if an application for credit is approved. Information and interest rates are current as at 1 February 2024 and are subject to change. Minimum finance amount $2,000. All applications for credit are subject to Brighte's credit approval criteria. Fees, Terms and Conditions apply.

The minimum amount repayable includes:

- The $2.70 Weekly Account Keeping fee (which is calculated daily).

- The establishment fee start from $99

Fixed Interest rate which is calculated daily on the outstanding balance

For all details associated with any of Brighte Financial Products, please ensure you refer to our Commercial Terms and Conditions and our Brighte Support Agreement. All Brighte vendors are expected to operate in alignment with our Code of Conduct and their associated Vendor Agreement.

We're on a mission to make every home sustainable. Help your customer make their dream home a reality with Brighte.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.