Bursaku

Bursaku.Id

What is it about?

Bursaku.id established in 2019 in Indonesia is a platform which provide personal financial planning tools for users. We are building mobile apps which allow user to manage their financial budgeting and goals, set billing payments and schedules, making purchases (public utilities services), invest, loan, subscribe insurances and card application and others personal finance activities make payment through our third parties partnerships API connections (the complete features will be explained below). Why we provide a complex services to the users because we believe in order to get a comprehensive picture of our financial statistic we need to connect all of our personal financial transactions in one platform. The advantages of our apps are; users can manually or automatically record their transactions in the apps which provide them with their personal electronic financial records statements, to help them analyze their financial behavior and manage it to reach their desire financial goals. User can choose which method will comfortable for them to record their financial transactions, whether the transactions are obtained from their in apps transactions or through connections to their banking or wallet e-statement or they record it manually.

App Screenshots

App Store Description

Bursaku.id established in 2019 in Indonesia is a platform which provide personal financial planning tools for users. We are building mobile apps which allow user to manage their financial budgeting and goals, set billing payments and schedules, making purchases (public utilities services), invest, loan, subscribe insurances and card application and others personal finance activities make payment through our third parties partnerships API connections (the complete features will be explained below). Why we provide a complex services to the users because we believe in order to get a comprehensive picture of our financial statistic we need to connect all of our personal financial transactions in one platform. The advantages of our apps are; users can manually or automatically record their transactions in the apps which provide them with their personal electronic financial records statements, to help them analyze their financial behavior and manage it to reach their desire financial goals. User can choose which method will comfortable for them to record their financial transactions, whether the transactions are obtained from their in apps transactions or through connections to their banking or wallet e-statement or they record it manually.

in our apps there are top features we are developing that will help users in fulfilling their financial management needs such as :

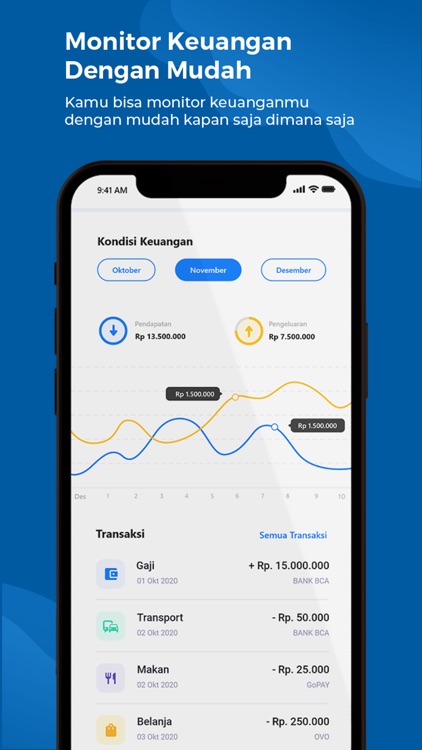

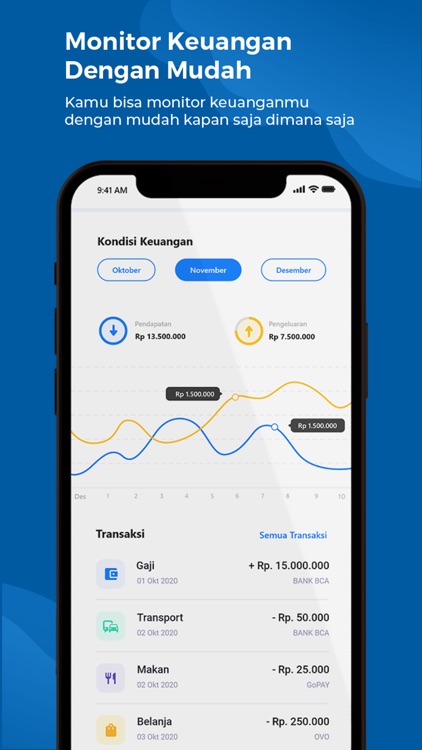

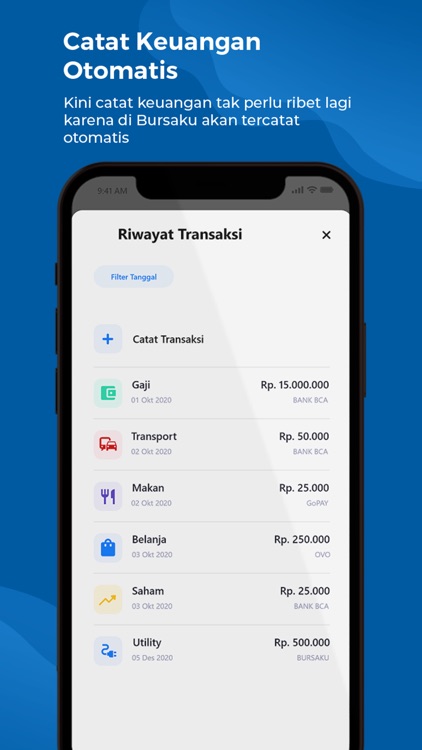

- Financial records - users can record their daily, weekly, monthly financial transactions both manually or automatically by connecting their Wallet or bank e- statement to our apps, our apps will provide account classifications and calculator to provide the statistics (in publishing)

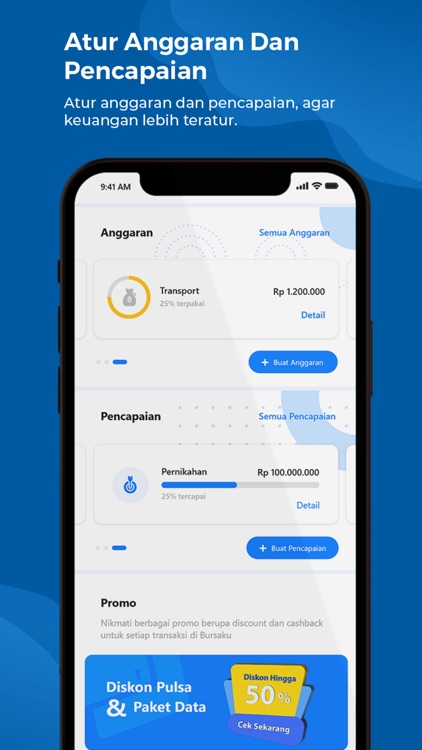

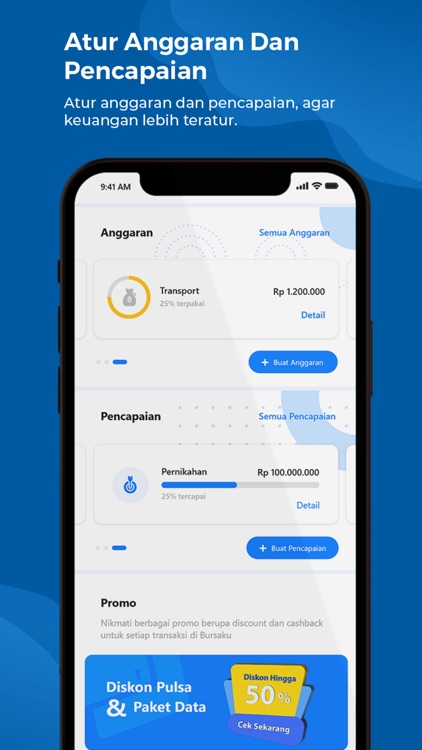

- Budgeting - users can set their weekly and monthly money budgeting which connected to their financial records in the apps. (in publishing)

- Setting goals - users can set their financial goals and connected to their financial records in the apps (in publishing)

- Open Banking account - we partnership with banks in serving their client in opening bank account online through API connections. ( on progress)

- Loan application - in this features we partnership with P2P lending platform to help customer in their loan application and analyze their loan scorecard through their financial records in the apps ( on progress)

- insurance - in this features we partnership with Insurance provider or aggregator to provide insurance list which will meet user's insurance needs ( on progress)

- Utility payment - users can pay utilities usages, pay credit card, buy utilities usages token, pay TV cable subscriptions, tax, reload E-wallet and mobile credit, etc. In this part we also provide a reminders for regular payment. ( in publishing part1)

- etc

In the future we will invite and connect to more product provider partners or aggregators, technologies partners to join us, exploring new technologies, and making more useful experience in serving our users through our apps and help them to represent their financial records and statistic more accurately.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.