Don't know if you have to money to take your significant other to that nice restaurant

CannyPig Budgeting

What is it about?

Don't know if you have to money to take your significant other to that nice restaurant? Setting a budget with CannyPig will give you the confidence you need to live your life without worrying about overspending every day. We make budgeting an easy and rewarding experience and take out a lot of the monotonous work so you can spend less time sorting through transactions and more time with your life.

App Screenshots

App Store Description

Don't know if you have to money to take your significant other to that nice restaurant? Setting a budget with CannyPig will give you the confidence you need to live your life without worrying about overspending every day. We make budgeting an easy and rewarding experience and take out a lot of the monotonous work so you can spend less time sorting through transactions and more time with your life.

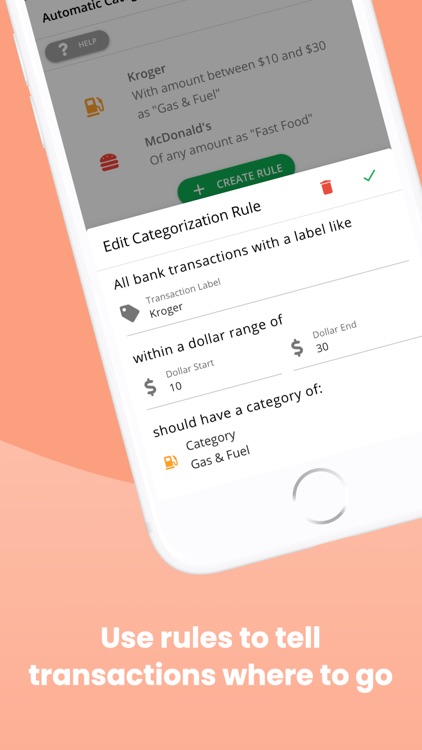

Automatically assign transactions to your budget

Connect a bank and automatically import transactions. If the default rules don't fit your budget, create custom rules to automatically place incoming transactions in each of your budgets

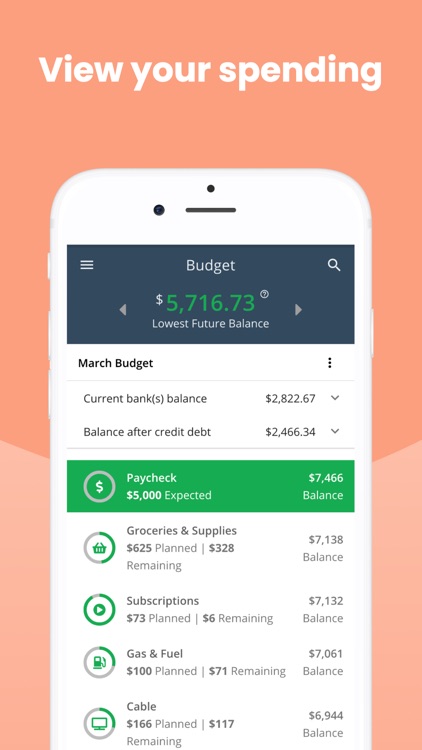

Budgeting based on account balance rather than income

Many budgeting apps require you to enter a static income amount and budget based on the amount you entered. And while that’s a solid approach, it doesn’t factor in what your actual bank account balance is. If you overspent one month and forgot to update your budget or underspent and forgot to inform the budget app that you want to carry over that extra profit, your account balance could be lower or higher than you realize and requires a lot of work to adjust your budget.

Instead CannyPig keeps you aware of your account balance through every budget. You will see your current bank account balance at the top of the budget and that amount will decrease budget by budget after that budget’s remaining balance is subtracted from your bank account balance. At the end of your budgets you will be seeing your estimated bank account balance after all budgets & bills are subtracted.

Other features include:

- Ability to trust your budget without the fear of a negative account balance

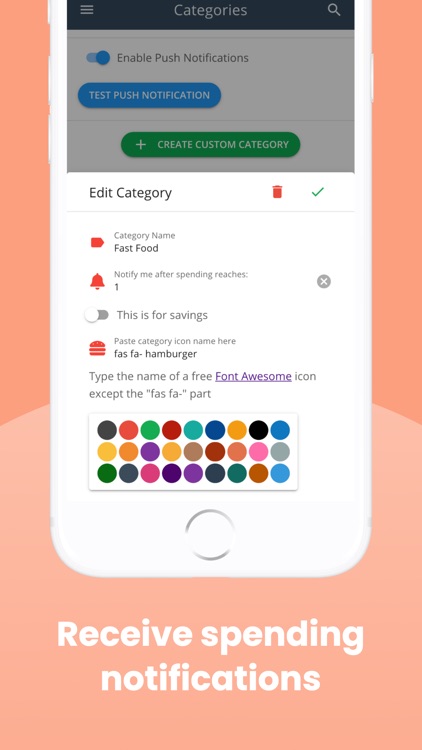

- Category spending notifications (according to your settings)

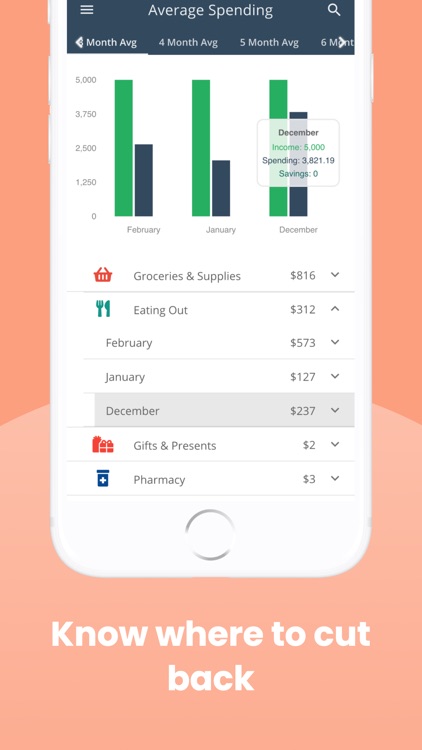

- Average spending charts to give you the information you need to decide where to cut back

- Suggested budgets based on your transaction history so you don't have to start from scratch

- Custom budget month start date

- Sharing your account with your partner

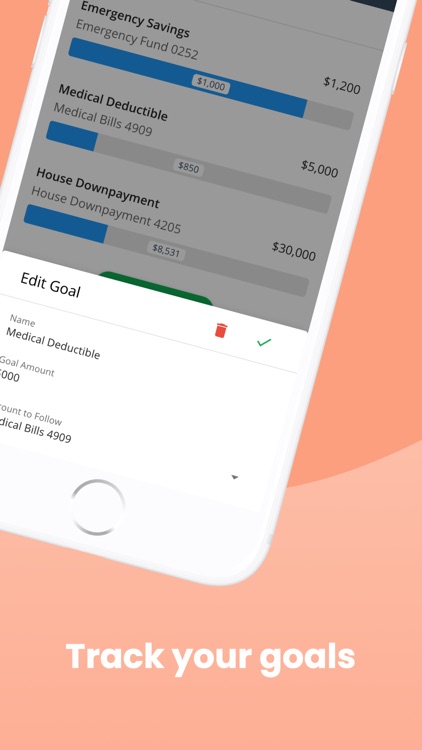

- A progress meter for a sense of accomplishment as you reach your saving goals

- Ability to create custom categories if the default ones don't work for you

- Warning colors when your bank balance drops too low

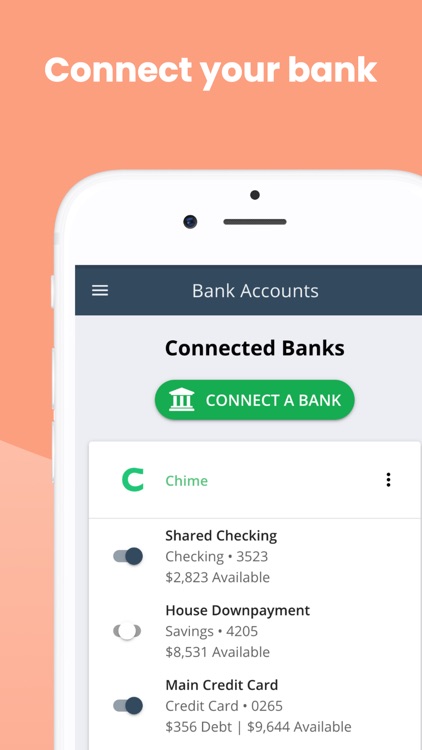

- Connect more than 1 bank

- High level bank security with Plaid

See our Terms of Use and Privacy Policy here:

https://app.cannypig.com/terms-of-service

and here:

https://app.cannypig.com/privacy-policy

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.