The app which will keep you from losing track of your expenditures

Cash Journal

What is it about?

The app which will keep you from losing track of your expenditures! On the go, on vacation, business trips, household expenses, we’re always spending money – large and small amounts. It’s easy to lose track, a credit card’s limit is quickly reached and when that happens, it is always at the most inconvenient time. Or you were on a business trip and find a receipt in your bag many weeks later, that you would have needed to submit long before – unfortunately, these things start adding up. Therefore, there are many reasons why it is important to keep on top of your daily expenses. And for that, this app is your perfect partner:

App Details

Cash Journal is FREE but there are more add-ons

-

$0.99

Upgrade to ad-free version

App Screenshots

App Store Description

The app which will keep you from losing track of your expenditures! On the go, on vacation, business trips, household expenses, we’re always spending money – large and small amounts. It’s easy to lose track, a credit card’s limit is quickly reached and when that happens, it is always at the most inconvenient time. Or you were on a business trip and find a receipt in your bag many weeks later, that you would have needed to submit long before – unfortunately, these things start adding up. Therefore, there are many reasons why it is important to keep on top of your daily expenses. And for that, this app is your perfect partner:

- enter your earnings and expenditures in a flash

- manage as many credit cards, debit cards, cash and other payment methods as you wish

- current balances are always easily accessible without complicated retrieval

- set up your own cost types or simply use the ones already included – for an immediate start without the need for further preparation

- export data to continue working on it in a spreadsheet

This app was created with the goal of providing the best possible overview of expenditures together with a minimal amount of time spent entering data – because only then is today’s good intention to keep better track of your expenses of long-term feasibility.

On the welcome screen you will see all your entries in the main account. You can sort these by date, cost type, and payment type. You decide the order in which the cost types and payment methods are displayed. For example, if you find the cost of fuel for your car to be the most important, then simply establish that these entries are to be displayed first.

From this same screen you can make a new entry, as well as take a look at the details of already existing entries and edit them, if necessary.

When making a new entry simply enter:

- date

- cost type

- payment method

- amount

If you like, you can also enter a short or detailed text. Now you already have a solid basis for a lasting management of your expenses.

You can see the current balances of your payment methods on the second tab. Without your having to refresh or do anything after submitting a new entry, their up-to-date status will always be clearly displayed.

Under settings you can choose your cost types and payment methods. The cost types already include a standard sign, so that you don’t have to pay attention to a plus or minus when making an entry. If you would like to correct an entry, for example because you exchanged something, simply use the sign change button when making the correction. Add as many and as detailed cost types as you need.

You can also individually select your payment types. It is completely up to you which and how many payment types you would like to manage.

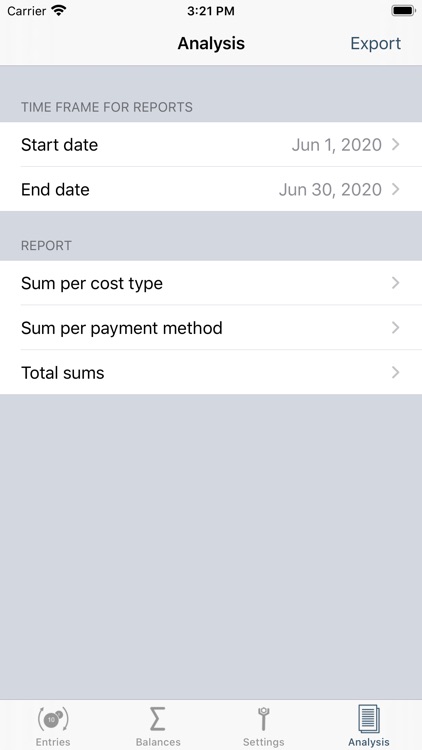

In addition to the constantly up-to-date balances, using the analysis function you can decide on a time frame for which you want to be shown the sums per cost type or payment method or show a comparison of earnings to expenditures. For example, on the last day of the month, the sum of your expenses from the 1st to the 31st. You can also use the export function to change entries and analyses into files that you can then make further use of or archive in a spreadsheet or other suitable program.

You can use this app in German, English, or simplified Chinese.

With this app, unknowingly surpassed credit limits and unwelcome surprises at the end of the month due to unexpectedly high expenditures are history!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.