Introducing Chinmay: Your Ultimate Personal Loan Solution

Chinmay - Personal Loan App

What is it about?

Introducing Chinmay: Your Ultimate Personal Loan Solution

App Screenshots

App Store Description

Introducing Chinmay: Your Ultimate Personal Loan Solution

Looking for a hassle-free way to secure a quick personal loan of upto ₹3 lacs? If you are a professional individual with stable income then look no further. Chinmay is one of the best loan apps revolutionizing the lending experience. If you need a personal loan online for unforeseen expenses, a dream vacation, home improvements, or any other personal endeavour, Chinmay has got you covered with its quick, secure, and seamless online loan application process.

Chinmay, one of the leading partner NBFC (Chinmay Finlease Limited - Registration #: B.01.00558) instant personal loan providers to being your trusted financial buddy. Our app ensures the highest level of security and compliance.

Benefits that make Chinmay one of the best online personal loan apps in India:

• Instant Loan Approval: Need funds urgently? Chinmay's instant loan approval, ensures you receive the financial support you need within minutes

• Flexible Loan Option: If you are looking for a personal loan online, Chinmay is the ideal solution for you to provide cash loans up to ₹ 3,00,000/-

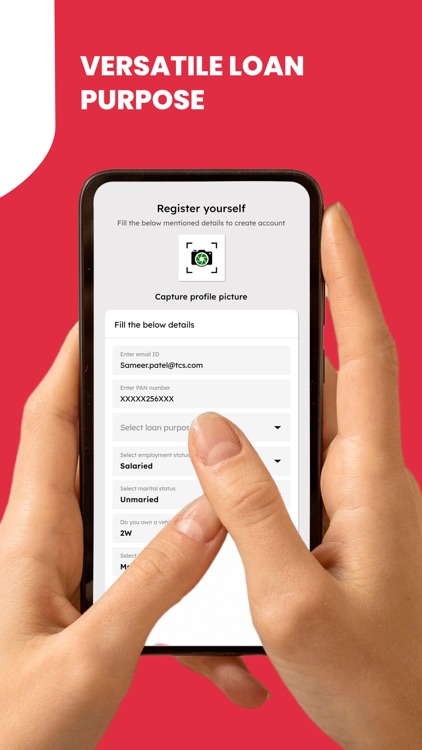

• Easy Application Process: Applying for a personal loan with Chinmay's intuitive online loan application process enables you to apply online with minimal effort

• Trusted and Reliable: Chinmay is a name you can trust. As an RBI-registered online loan app, we adhere to the highest standards of integrity and security

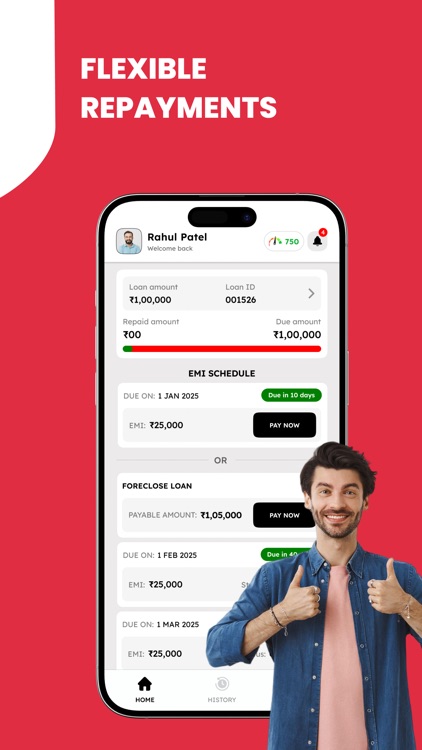

• Flexible Repayment Plans: Everyone's financial situation is unique. That's why Chinmay offers flexible repayment plans that suit your individual needs

• Lowest Interest Rates: At Chinmay, we offer some of the most competitive interest rates in the market.

Features of Chinmay:

• Loan Amount: ₹10,000 - ₹3 lacs

• Quick Turn-around Time- 15 minutes

• Repayment Tenure: up to 365 days (12 months)

• 100% Paperless loan application

• No guarantors or collateral

• No Subscription or upfront Fees

Interest and Additional Fees:

• Interest Rates: 28 to 36.5% per annum

• Processing & Other Applicable charges: Starts from 5% of the loan amount

• Documentation charges of 1%

• ₹200 for online convenience charge

• Bounce charges: ₹500 + GST as applicable

• APR range - 26% to 36%

• Please note that GST charges will be added to the process charge, document charges, online convenience charge.

Eligibility Criteria:

• Working Professionals with Stable income

• Age- 21 to 55 years

• Minimum take home income of 20,000/ month

• Aadhaar Card Verification

• PAN Card Verification

• Bank Account where income gets deposited monthly

• All borrowing should be in good standing

APR disclosure of Personal Loans : -

• Loan amount: ₹30,000 with a 28% interest rate per annum

• Loan Duration: 180 Days

• Total interest on the personal loan: ₹4,104

• Processing charge (5% of the loan amount) + Documentation charges (1% of the loan amount) + Online convenience = ₹2,000

• Total Deductions (Processing charge + Documentation charges + Online convenience + GST): ₹2,360

• Net Disbursed Amount: Loan Amount - Total Deductions = ₹27,640

• Total Repayable Amount (Loan Amount + Interest): ₹34,104

• PF +DC + GST are deducted upfront during the loan disbursal.

*This is an indicative calculation, interest and other charges vary based on the profile

For any queries contact us on support@chinmayfinlease.com or call us at 7600012589

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.