Cu (Copper) Parachute is a powerful Monte Carlo simulation-based retirement income calculator to help you plan your financial independence

Cu Parachute

What is it about?

Cu (Copper) Parachute is a powerful Monte Carlo simulation-based retirement income calculator to help you plan your financial independence. Whether you are currently in your working years, or already in retirement, you will find this to be an important tool for retirement success.

App Store Description

Cu (Copper) Parachute is a powerful Monte Carlo simulation-based retirement income calculator to help you plan your financial independence. Whether you are currently in your working years, or already in retirement, you will find this to be an important tool for retirement success.

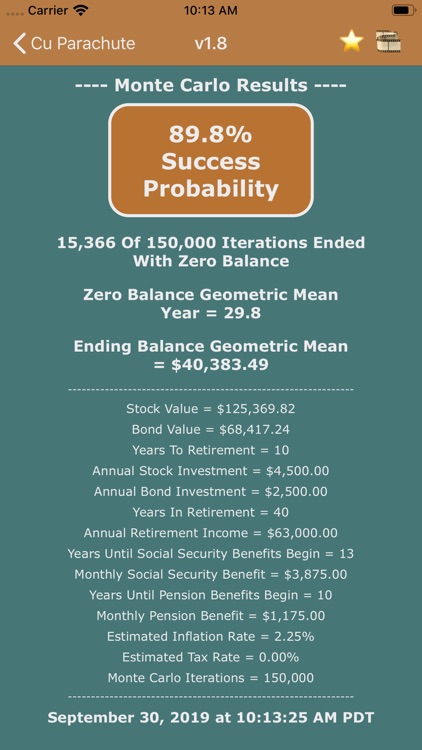

Cu Parachute will estimate the probability of success in achieving your retirement income plan by performing a complex Monte Carlo Simulation of up to 150,000 complete retirement scenarios. This will include not just the best case scenario, but the worst case, and 149,998 cases in-between.

Cu Parachute is a tool you can use to continuously monitor your retirement income plan status by updating your personalized inputs and re-evaluating your plan. Sensitivity analyses can easily be performed to better understand how to increase your plan's probability of success (i.e. how does putting off retirement 2 years affect my plan's success, how does saving an extra $1,000 a year affect my plan's success, etc.).

A successful retirement income plan will be a balance between not running out of money and living too frugally in retirement. The target success probability in Cu Parachute is between 85% and 100% and will be highlighted with a copper colored background. An 85% probability target would be for those who would like to use all of their money during retirement. A 100% probability target would be for those wanting to leave most of their money to their heirs. Your own probability of success goal may be something different depending on your risk tolerance.

App features include:

- Random selection of annual real (inflation adjusted) returns for stocks (S&P 500 Index since 1928) and bonds (10-Year Treasury Bonds from 1928-1975, US Aggregate Bond Index after 1975)

- Monte Carlo Simulation with up to 150,000 iterations of complete retirement scenarios

- Extensive sensitivity analysis capabilities

- Results screen with simulation results, inputs, and time stamp

- Ability to save full resolution screen captures of results for future reference

Cu Parachute works like this:

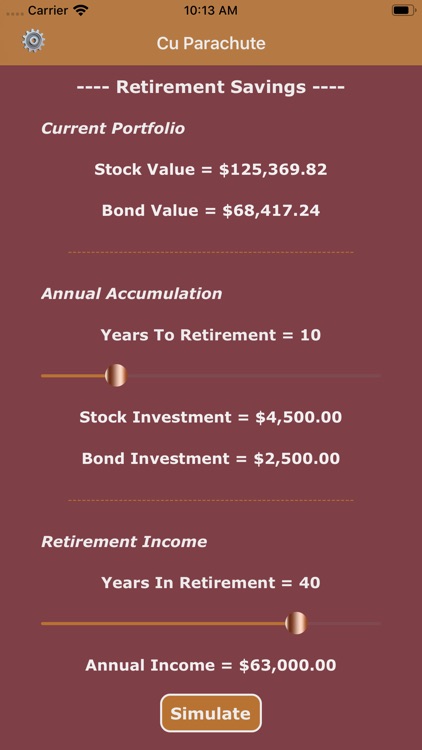

1. You set the 14 customizable inputs to create your initial retirement income plan and press the "Simulate" button.

2. For each of the years in your retirement plan (years to retirement + years in retirement), the app randomly selects a yearly real (inflation adjusted) return for your stock and bond portfolios and computes the ending balance for that year taking into account all of the 14 inputs you have selected.

3. The app runs through each year to the end of your retirement and determines your final ending balance if there is one.

4. This process will be repeated up to 150,000 times (150,000 complete retirement scenarios).

5. The number of iterations that the ending balance did not go to $0 will determine the probability of your plan's success.

6. Modify your inputs as often as your portfolio value changes, or other parts of your plan change and re-run the simulation.

7. Rate the app to help others discover the benefits of Cu Parachute!

Notes:

Annual Income = How much money do you need each year of retirement. If you have the Tax Rate set to 0%, your Annual Income will be before tax income. If you have the Tax Rate set to anything other than 0%, your Annual Income will be after tax income and a larger amount (to cover taxes) will be deducted each year of retirement.

Inflation Rate = The % your Annual Income will need to increase each year of retirement to keep up with inflation.

Tax Rate = An estimate of the total tax on your retirement income (Federal + State, etc.).

Social Security estimates can be obtained on the Social Security website even if you are decades away from retirement. Use estimated value in today’s dollars.

I am an engineer, not a financial professional. Everything related to this app reflects my own opinions and should not be considered financial advice.

** I hope you download Cu Parachute and discover how it can help you achieve your retirement goals **

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.