E-file IRS HVUT Form 2290 with us and get your Stamped Schedule 1 in minutes

Etax2290 - E-File Form 2290

What is it about?

E-file IRS HVUT Form 2290 with us and get your Stamped Schedule 1 in minutes.

App Screenshots

App Store Description

E-file IRS HVUT Form 2290 with us and get your Stamped Schedule 1 in minutes.

Etax2290 is introducing user-friendly Mobile Application to provide you easiest way to E-filing your IRS HVUT Form 2290 from anywhere at any time.

With the Etax2290 app, e-file your Form 2290 taxes simple and easiest go on the way. Truckers are always on the road move and hardly find time to file their 2290 tax returns. To serve truckers and you, developed a simplest APP to E-filing 2290 Form. Our App keeps you off from the IRS office's long queues and waiting for the Stamped Schedule 1 so that you are not wasting your time. By e-filing your HVUT form with Etax2290 to reducing the stress through simple e-filing techniques. More importantly, you will get answered for your queries and get assistance throughout the 2290 filing process anytime.

BENEFITS OF HVUT FORM 2290 E-FILING WITH ETAX2290 APP

It’s a FREE Download App and helps you deal with the IRS directly about your 2290 HVUT Taxes. If you are not convinced with these benefits to get the Download, don’t worry. Lot more benefits are there for you and hit on Dowload to E-file your 2290 truck taxes quickly.

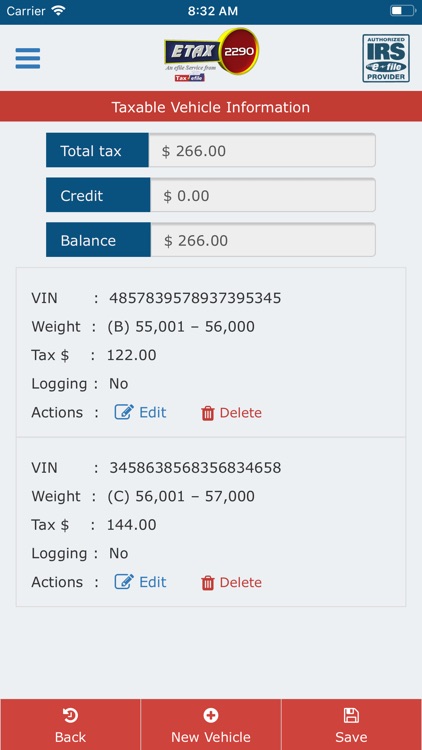

Tax Calculations:

As a common person, it is always creepy and complicated to do the IRS tax calculations. Etax2290 calculates your 2290 tax amount automatically by the tax calculator while you start filing the IRS HVUT 2290 Form with us. All you have do is to provide your business information, check the tax amount and hit the pay button.

Access Anywhere & at Any time:

Another main advantage of e-filing Form 2290 is that all your records are digitalized and there is no way you are going to lose it. Etax2290 is more concerned about your shared information with us and we use the latest technology to secure your files. For future reference, you can simply retrieve the information from our dashboard. In addition, you can also download the Stamped Schedule 1 once you receive from the IRS at any time.

HOW TO E-FILE HVUT FORM 2290 VIA ETAX2290 APP?

Step 1: Register An Account for Free

To start e-filing your IRS 2290 form, register with us. Enter the basic information like name, contact number and email to create a new account free.

Step 2: Login into Account

After creating an account with us, login to your account and you will be directed to Etax2290 dashboard. From the dashboard, you start e-filing the Form 2990. In addition, you can check the submission status; and download the Schedule 1 from the dashboard.

Step 3: Enter Vehicle Tax Information

Fill your business information such as name, contact address, Vehicle Identification Number (VIN), Employer Identification Number (EIN) and other required information for the first time. This information is saved automatically to Etax2290 and next time when you e-file it is auto-generated.

Step 4: Choose a Payment Method

The IRS does not accept debit or credit cards as a form of payment prior to the tax year 2018-19. Instead there are three other options to make your payments.

• Electronic Funds Transfer (Direct Debit)

• EFTPS (Electronic Federal Tax Payment System)

• Mail a check or money order (Paper File)

You can select anyone of the payment option and for each payment related information is provided while you efile the Form 2290 online.

Step 5: Review Before Submit to IRS

Before submitting the 2290 form to the IRS, review your filled application and make sure, whether the entered information is correct. Submit the Form to the IRS and after the process, it takes few seconds to receive the Stamped Schedule 1.

Note: If your 2290 Form is rejected for any reason, we help you to find out the errors and resubmit the edited Heavy Vehicle Use Tax (HVUT) 2290 Form for FREE.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.