FINCART – an online mutual fund investment app by Financial Industry experts; unparallel researched investment expertise that picks the right Mutual Fund giving you a happy investment experience that is true to the label of Mutual Fund Sahi Hai

Fincart - Investment App

What is it about?

FINCART – an online mutual fund investment app by Financial Industry experts; unparallel researched investment expertise that picks the right Mutual Fund giving you a happy investment experience that is true to the label of Mutual Fund Sahi Hai

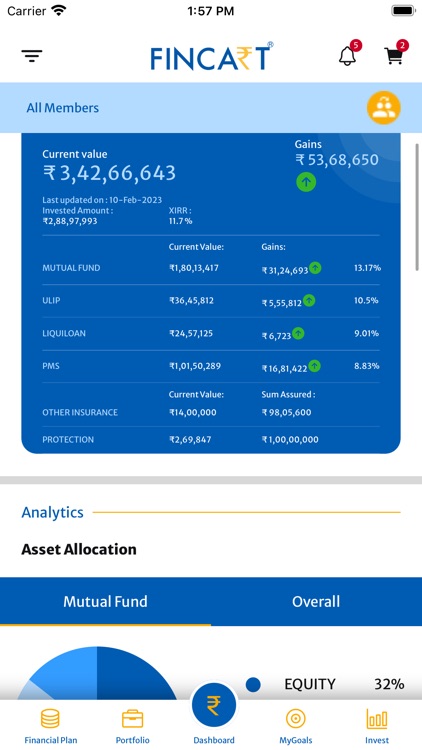

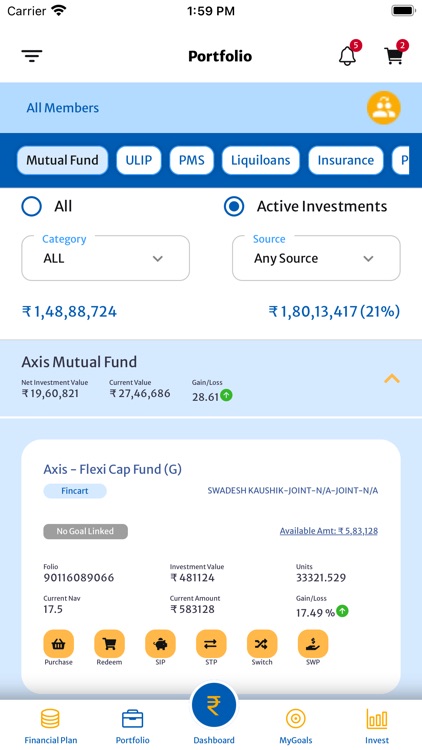

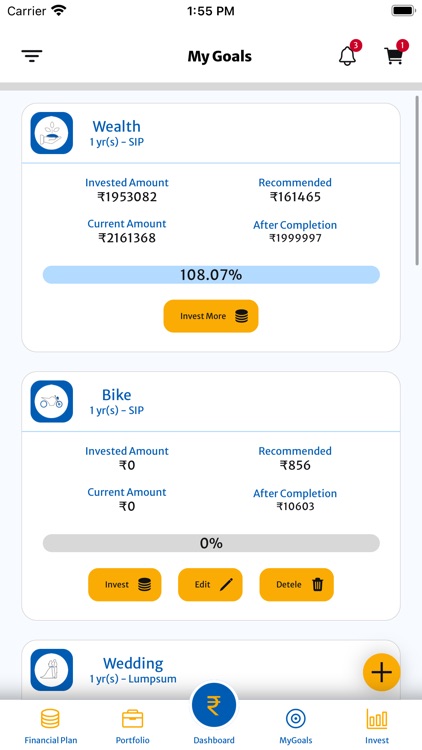

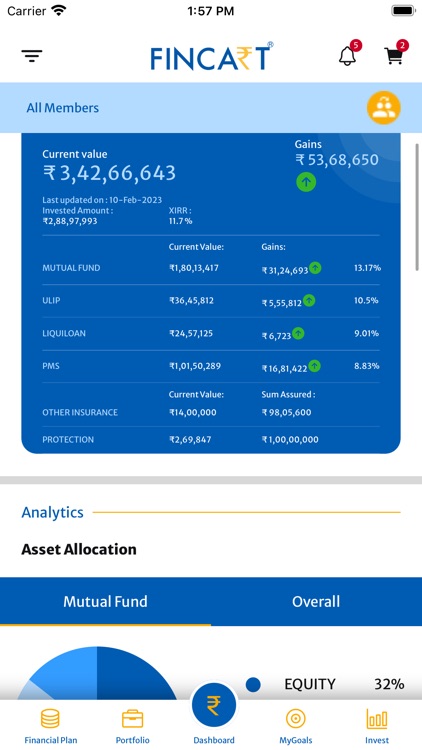

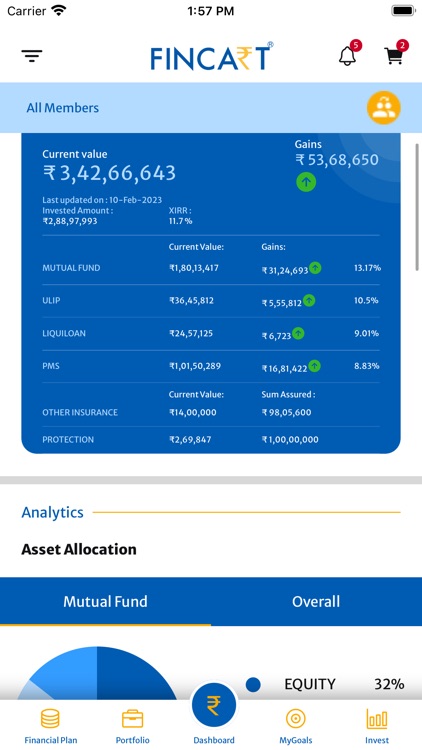

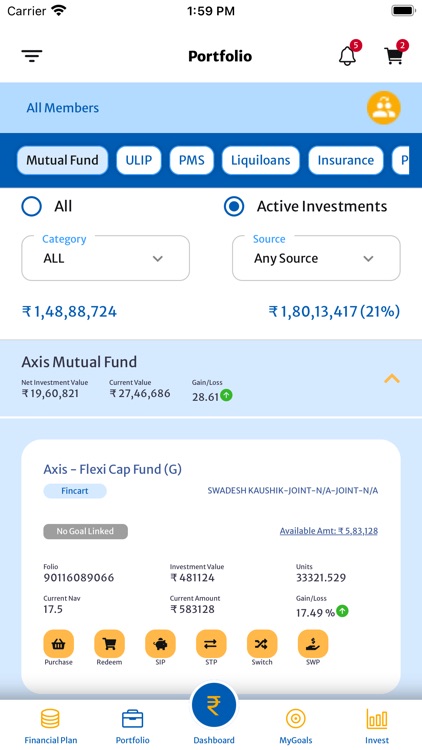

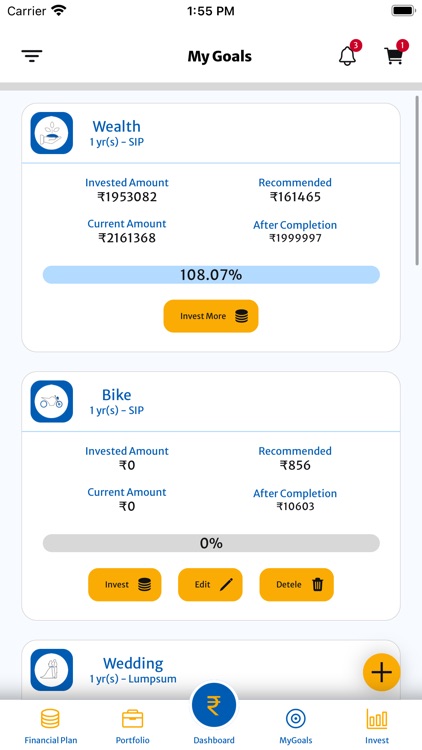

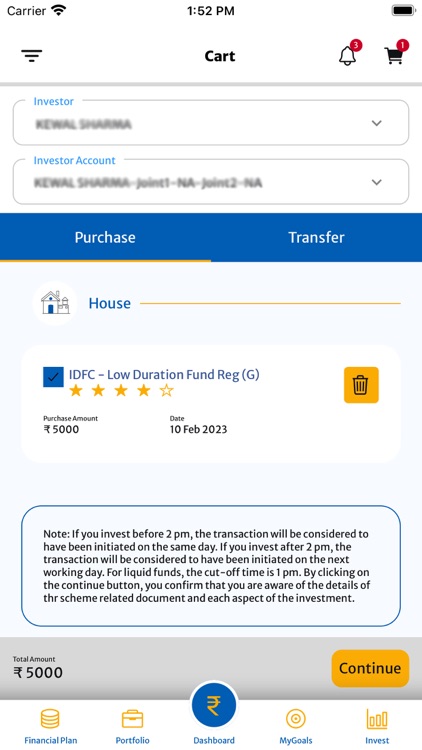

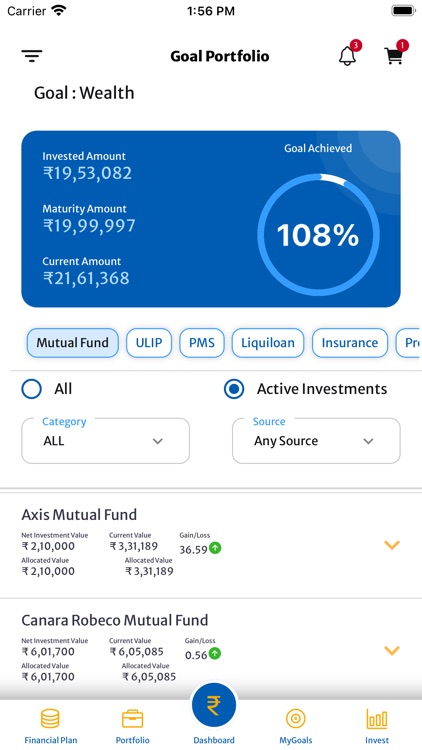

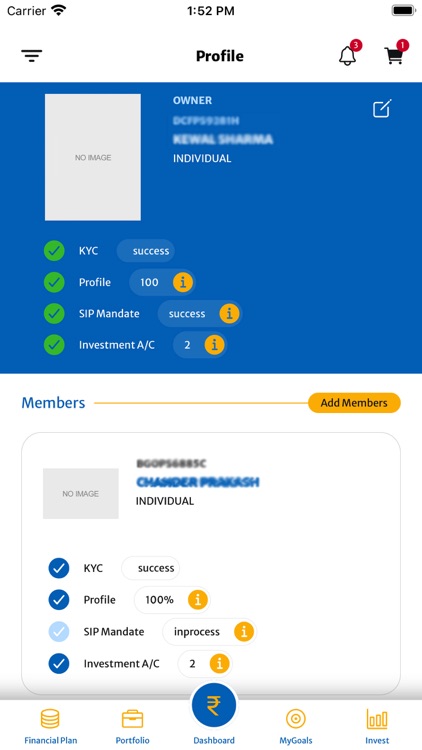

App Screenshots

App Store Description

FINCART – an online mutual fund investment app by Financial Industry experts; unparallel researched investment expertise that picks the right Mutual Fund giving you a happy investment experience that is true to the label of Mutual Fund Sahi Hai

#MutualFundSahihai

Plan – Quick SIP, Children’s Education, Children’s Marriage, Retirement Planning and Comprehensive Financial Planning now. Tax Planning & Mutual Fund wala Fixed Deposit coming soon. Call our advisor for Term Insurance & Health Insurance Planning.

Invest – Invest across all leading Mutual Fund Houses via SIP, lump-sum Investments, Systematic Transfer (STP), Redeem, Switch across funds; Monthly withdrawal options (SWP – Systematic Withdrawal Plan). Open your investment account in 2 minutes.

Prosper – Track your Mutual Fund performance live.

Investment Mobile App with the human-touch – Our Certified Financial Planners can hand-hold you in your investment journey.

Frequently Asked Questions:

How can I learn more about Financial Planning, Investments in Mutual Funds and SIP?

What do I need to do to start investing?

A one-time exercise of opening an online investment account as per SEBI regulation; it takes only two minutes, keep the following three things ready –

a. PAN Card

b. Aadhar Card

c. Bank Account Details (the account that you wish to link for transaction).

These documents help us in doing KYC as per SEBI regulation.

Are these documents necessary, while opening the bank account?

Yes, as per SEBI requirement these documents are necessary (one-time exercise) for completing the KYC.

How does this platform work? I invest in Fincart and then Fincart invests for me?

No, FINCART is only a facilitation platform. The money is invested with the mutual fund company directly. On withdrawal the money will get credited to client’s bank account directly.

How safe is your transaction platform?

We ensure the utmost security and privacy when it comes to your account:

Bank-Level Security – We use 256-bit SSL encryption and securely store your data.

Fraud Protection – We protect your account from unauthorized activity.

Privacy Protection – We will never sell your personal information to a third party.

Can I withdraw my investment anytime?

Yes, you can withdraw your investment anytime on a simple click except ELSS that has a lock-in period of 3 years.

What is the minimum SIP amount of investment?

Start SIP with a minimum of Rs 1000 per month.

What can of help can an advisor provide?

Our advisors will help in understanding the schemes – how it works and why is the best suited; account opening & online transaction.

What do you mean by mapping best suited schemes?

Each scheme is back-tested over 25 years, the inference is then matched to the goal or time horizon of your investments; giving positive investing experience.

Can I save tax by investing in mutual funds?

Yes, you can invest in tax saving mutual fund schemes know as ELSS (Equity Linked Saving Schemes) to save tax under section 80C.

What are the charges for using Fincart?

Fincart app is free. A small fee is paid by the mutual fund companies for the services we provide.

What are the other apps for mutual funds?

Competing mobile apps are Assetplus, ET Money, Fisdom, FinoTrust, Funds Easy, FundsIndia, Groww, Invetica, Paytm MF,Paytim SIP and Scripbox..

What sets FINCART apart from other Mobile App providers?

Beyond product features – The only ones who have a large team of advisors assisting 5000 clients across 500 cities and 10 countries across the world.

Can Fincart help me evaluate my earlier investments?

Yes, you can speak with the financial planners by calling our helpline number 011-30018181 between 9:30 am to 6:30 pm for

guidance.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.