This is just the beginning

Finfit

What is it about?

This is just the beginning! Finfit is exploring ways we can help make you financially fit, but we can’t do it alone. We need your opinions, suggestions, and your honest feedback as we figure out ways to put you in control of your credit rating and spending. While we uncover personalized insights into your spending patterns, our vision is to help you define and reach your financial goals. We’re in this together.

App Screenshots

App Store Description

This is just the beginning! Finfit is exploring ways we can help make you financially fit, but we can’t do it alone. We need your opinions, suggestions, and your honest feedback as we figure out ways to put you in control of your credit rating and spending. While we uncover personalized insights into your spending patterns, our vision is to help you define and reach your financial goals. We’re in this together.

Take your first step right now and check out the benefits of downloading Finfit :

1. Credit Score

• Get your credit score for free without any impact to your rating.

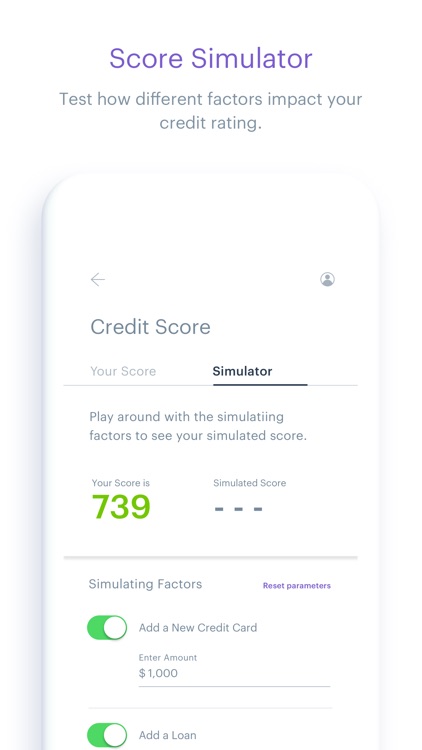

2. Credit Score Simulator

• Finfit lets you test how different factors impact your credit rating.

• Simulate adding a credit card, taking out a loan, or purchasing a vehicle. We let you know how all these factors affect your rating.

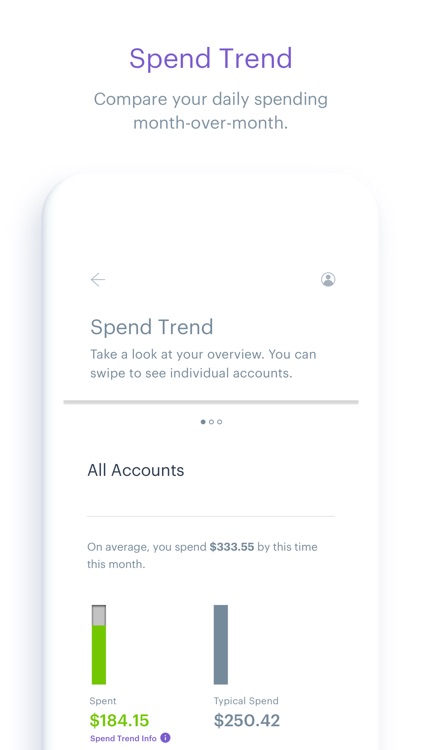

3. Spend Trend

• Know if you’re spending more or less compared to prior months to make informed decisions without the pain of creating a budget.

• Finfit accounts for all of your spending, from credit cards and chequing accounts, to chart your spend trend.

4. Safe to Spend

• Know how much you can safely spend in between pay cheques and keep out of overdraft.

• We consider all upcoming bill payments and pay cheques to provide you with an accurate Safe to Spend figure for each chequing account.

5. Insights

• We give you insights that keep you on top of what’s going on across your accounts such as an accidental double charge or subscription rate increase.

• Learn how you spend by category so that you can become a smarter spender.

6. Security

• Nothing’s more important than protecting your information. We use bank level security to ensure your data remains safe.

PRIVACY

Finfit may need to access device services for certain features. For a full list of features, check out https://joinfinfit.com/legal

You can get more information about RBC digital channel privacy at http://www.rbc.com/privacysecurity/ca/online-privacy.html

For help removing Finfit from your device follow the instructions at https://help.joinfinfit.com/hc/en-us/articles/360001577211-How-do-I-uninstall-Finfit- or email help@joinfinfit.com

Additional contact information for Finfit is available at https://joinfinfit.com/contact or through the app, within the settings tab.

LEGAL

When you select to install Finfit, you’re consenting to any future updates or upgrades. Depending on your device, operating system or user-initiated settings, these might be automatically installed. You’re able to withdraw your consent by uninstalling Finfit from your device.

If you download Finfit, you must review, and are subject to, the Legal Terms of use found at https://joinfinfit.com/legal

®/™ Trademarks of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.