How to get a credit card of Rs 25,000 limit in 3 minutes

GalaxyCard

What is it about?

How to get a credit card of Rs 25,000 limit in 3 minutes?

App Store Description

How to get a credit card of Rs 25,000 limit in 3 minutes?

1. Download GalaxyCard

2. Add your PAN and Aadhaar

3. Add your Bank Statements

4. Use your limit!

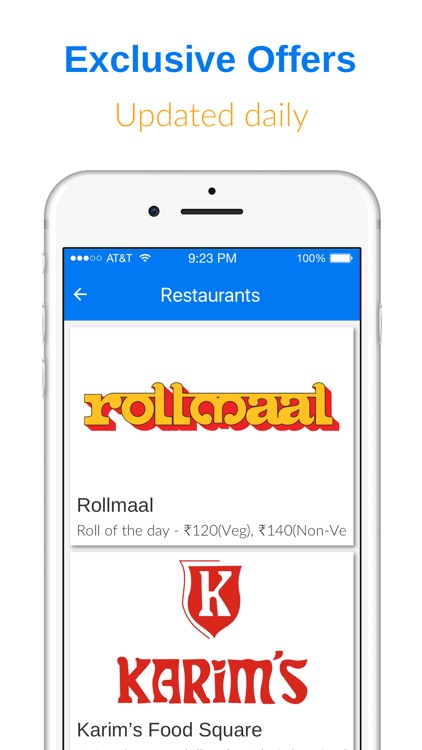

Enjoy 45 days interest-free credit with zero annual charges. Use it to recharge your mobile, pay DTH, Utility, Broadband bills and for shopping across the country!

-------------------------------------------------------------------------------------

More About GalaxyCard :

What is GalaxyCard ?

GalaxyCard is a mobile based instant use credit card. Simply sign-up on our mobile app, and provide your Aadhar and PAN no and get started with your instant credit limit. We need very basic KYC documents and approve your application instantly without any manual intervention. As soon as your application is approved you will see your credit limit on the screen. Your credit card is now active.

How long do I have to wait for approval?

There is no wait. There is no manual intervention, there is no credit officer who will evaluate your application. Everything is done by our intelligent credit underwriting algorithm. All applications are processed instantly.

How long do I have to wait to start making payments

There is no wait. You can start paying with your GalaxyCard app immediately. There is no need to wait 2-3 weeks for a physical card.

How do I pay at a store using GalaxyCard?

Pay with GalaxyCard by scanning any QR code inside the GalaxyCard app. We work with all QR codes from all major wallets like PayTM, Freecharge and BharatQR. You can also choose a store from a list of nearby stores which will automatically appear based on your location

Will I get need a physical card also?

No. You won't need a physical card. Your phone is now your credit card

Is there a joining fee or an annual fee?

No. GalaxyCard has 0 Joining fee and 0 annual fees.

How do I make the credit card payment?

You can pay your GalaxyCard dues from inside the app itself using UPI / NEFT / IMPS

What is the credit card APR ?

You get upto 45 days interest free. Thereafter we levy a 3% interest per month.

Know more about GalaxyCard at our website : www.galaxycard.in

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.