Banking should work for you

Gazelle: Digital Banking

What is it about?

Banking should work for you. Your goals. Your money. The life you want and deserve. We want to equip you with the tools—including the right kind of bank—to make your money go further, faster.

App Screenshots

App Store Description

Banking should work for you. Your goals. Your money. The life you want and deserve. We want to equip you with the tools—including the right kind of bank—to make your money go further, faster.

That’s why we created Gazelle—a new banking experience that aligns with the debt-free principles we teach at Ramsey, with banking services provided by our partner Pathward, N.A., Member FDIC. Gazelle helps you outrun the normal, debt-driven banking experience. To really win with your money. Because you’re doing the hard work to live like no one else.

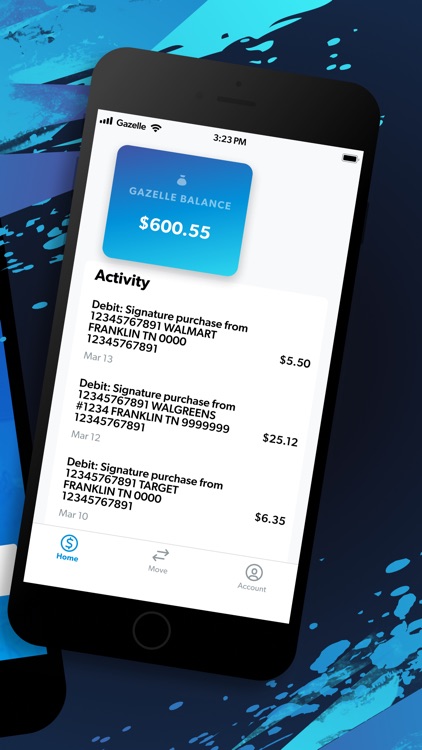

How is Gazelle different? The Gazelle debit card functions the same as your standard debit card with the same protections. BUT we’ve eliminated the distractions so you can stay focused and attack your money goals. PLUS it offers benefits other accounts don’t – like no monthly fees² and getting paid up to two days faster³ with direct deposit.

What You'll Get with Gazelle:

•Debt free banking, with banking services provided by Pathward, N.A., Member FDIC. We won’t push debt on you.¹ No distractions so you stay focused on your goals for your money.

•Gazelle Debit Card. Designed by Ramsey with modern features like contactless payments.

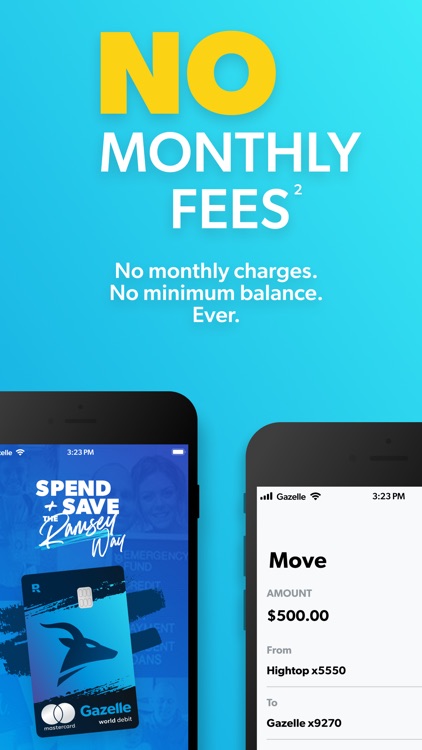

•No Monthly Fees.² No monthly charges. No minimum balance.

•Faster³ Direct Deposit. We release the funds as soon as we get them, up to two days early.

•32,000+ Fee Free ATMs.⁴ Get the cash you need without fees at over 32,000 locations.

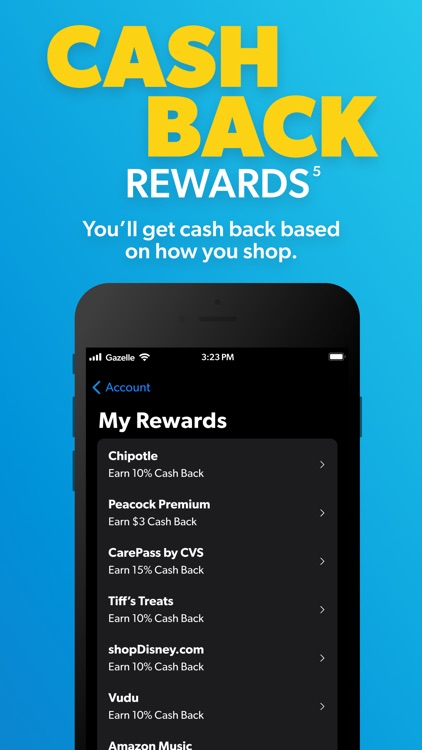

•Cash Back Rewards.⁵ You'll get cash back based on how you shop for budgeted items.

•Unrivaled Support. Get top-notch support from real people.

•We Got You Covered. Your money is FDIC insured⁶ up to $250,000 with our banking partner Pathward, N.A.

Show the world you’re Gazelle intense. Outrun normal. IT’S GAME ON!!!

Deposit Account opening is subject to registration and ID verification.

1 Pathward, N.A., and Mastercard are not affiliated in any way with this statement.

2 Other fees may apply, see your Deposit Account Agreement for details.

3 Faster funding claim is based on a comparison of the Pathward, National Association, policy of making funds available upon receipt of payment instructions versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the time of payor’s payment instruction.

4 No ATM owner surcharge or ATM Cash Withdrawal Fees for domestic ATM withdrawals at MoneyPass ATMs (”in-network ATMs”). Visit the Gazelle Mobile app for a list of in-network ATMs. All other ATMs may apply an owner’s surcharge fee in addition to the ATM Cash Withdrawal Fee disclosed in your Deposit Account Agreement.

5 Optional Netspend Payback offers are based on individual shopping habits. See the program FAQs and Terms and Conditions in the Gazelle app for additional details about how and when you get rewarded. Program sponsor: Netspend Corporation. Pathward, N.A., and Mastercard are not affiliated in any way with this program and do not endorse or sponsor this program.

6 Upon successful activation and registration of the Account, funds on deposits at Pathward, N.A., Member FDIC, are insured up to the standard maximum deposit insurance limit. Coverage limit is subject to aggregation of all of Accountholder's funds held on deposit at Pathward, N.A.

Gazelle is a demand deposit account established by Pathward, National Association, Member FDIC, and the Mastercard Debit Card is issued by Pathward, N.A., pursuant to license by Mastercard International Incorporated. Netspend is a service provider to Pathward, N.A. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787.

MastercardⓇ and the circles design are registered trademarks of Mastercard International Incorporated. Card may be used everywhere Debit Mastercard is accepted.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.