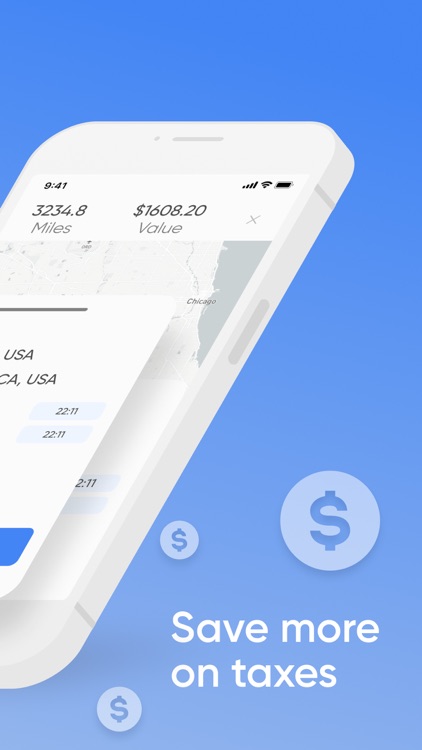

If you're a business owner, self-employed contractor or employee, our mileage tracker finds an average of $4-8k a year in potential tax savings

Good Mileage Tracker

What is it about?

If you're a business owner, self-employed contractor or employee, our mileage tracker finds an average of $4-8k a year in potential tax savings.

App Screenshots

App Store Description

If you're a business owner, self-employed contractor or employee, our mileage tracker finds an average of $4-8k a year in potential tax savings.

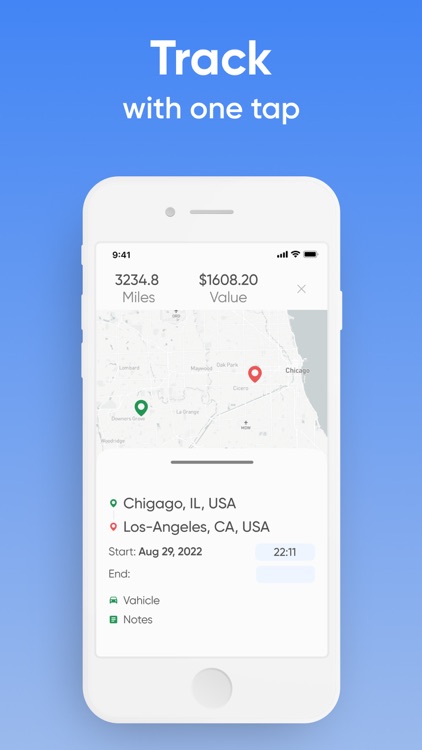

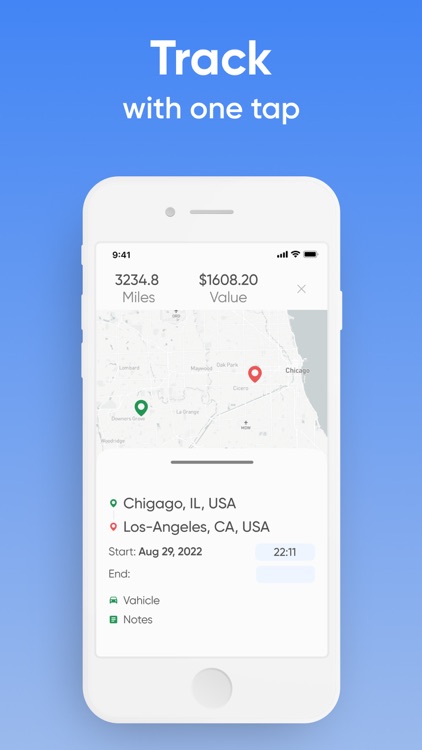

TRACK

• Start a new trip manually.

• Tracking on the go without opening the app.

• The address of start and end points are logged, as well as all stops throughout each trip.

• Just enable GPS on your phone to have all your trips tracked automatically.

• Auto-detects driving to start trips.

• Forgot to log a trip? no problem! You can log any trip completed in the past by simply entering your past departure time.

MILEAGE RATES

• Tax-deductible mileage rates in the USA.

• Value of your drives for taxes or reimbursements is calculated automatically.

• You can add custom reimbursement rates that suit your needs.

• Mileage rates provide rules for expensive trips based on daily, monthly or annual distance threshold. You can, for instance, set one rate for the first 10000 miles logged in a fiscal year, and another rate for each mile over 10000.

• You can create shared mileage rates for a team of drivers or employees.

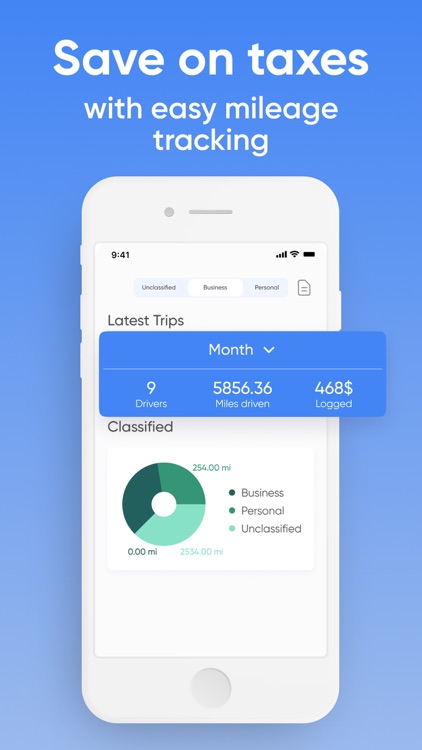

CLASSIFY

• Classify your business and personal trips.

• Expenses are calculated immediately based on mileage rates.

• Sort trips by any hashtag.

REPORTS

• Generate a monthly or yearly report automatically.

• Reports can be configured by custom date.

VEHICLES

• Create additional vehicles in the app to separate mileage logged with your private car vs. your company car, for different fiscal entities, different clients, projects, etc.

The app uses GPS to track your location in the background. We have made extensive tests with all iOS devices to ensure minimal battery drain while the app is running. However, keep in mind that continued use of GPS can dramatically decrease battery life.

This app includes an auto-renewable subscription (Premium Subscription): Premium Subscription provides all features. And you get full access to the app.

A subscription is required to use the app. Payment will be charged to your Apple account at confirmation of purchase and will automatically renew (at the duration/price selected) unless auto-renew is turned off at least 24 hrs before the end of the current period. Account will be charged for renewal within 24-hours prior to the end of the current period. Current subscription may not be canceled during the active subscription period; however, you can manage your subscription and/or turn off auto-renewal by visiting your Apple Account Settings after purchase. Any unused portion of the free initial period will be forfeited when you purchase a subscription.

You can cancel a subscription anytime in the Settings of your device at least one day before each billing date:

https://docs.google.com/document/d/1TqaOVyPN_50a9o0G6i4E5UKpH-4LUwdUmKXPXp_jgiI/edit?usp=sharing

More features coming soon to automatically track your trips & tax deduction with more useful stuff.

Learn More:

Terms of Service: https://docs.google.com/document/d/13hot9H_9DL2fcM5wu1gTbmJ9IIcuQ8nmNBUUJ6iwD7Q/edit?usp=sharing

Privacy Policy: https://docs.google.com/document/d/1-uPjTef-howKn7VL22Ilpvsc3m01CX0ww4J5PdL8D6s/edit?usp=sharing

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.