Bangkok Bank’s iCash Application, a new digital banking service for small and large business is a channel for conducting online financial transactions via mobile phones

iCash–Transaction Banking

What is it about?

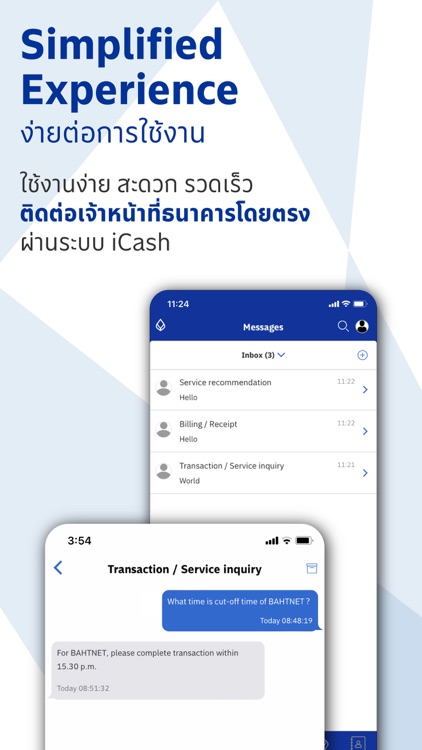

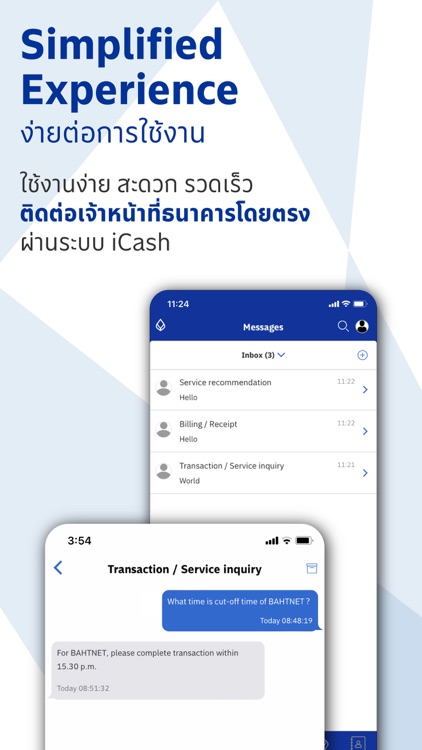

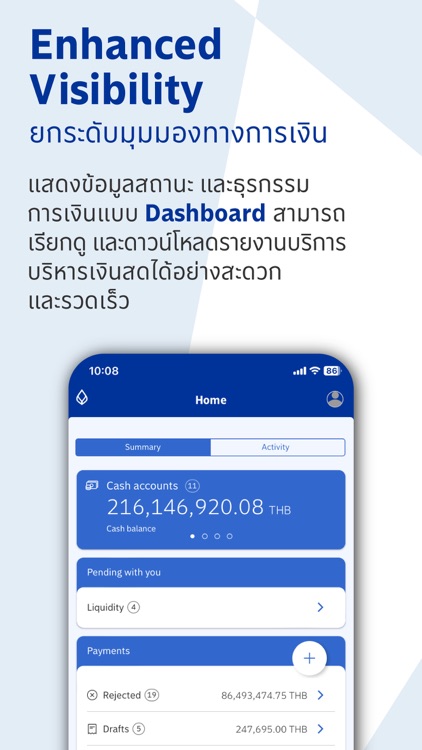

Bangkok Bank’s iCash Application, a new digital banking service for small and large business is a channel for conducting online financial transactions via mobile phones. You can streamline and seamlessly manage your financial transactions any time, any day. So, it enables you to swiftly and easily manage your cash management needs.

App Screenshots

App Store Description

Bangkok Bank’s iCash Application, a new digital banking service for small and large business is a channel for conducting online financial transactions via mobile phones. You can streamline and seamlessly manage your financial transactions any time, any day. So, it enables you to swiftly and easily manage your cash management needs.

Account Services

- Details of cash position, loan position and investment position (Mutual Funds, Fixed Deposits), credit facilities, and funds, with Bangkok Bank cash reporting both domestic and foreign.

- Details of counter foreign exchange rates including special offers and forward contracts with the Bank.

Payment Services

- Standard Electronic Payments

• Transfers between Bangkok Bank accounts (Book Transfer - Own and 3rd Party Accounts)

• Pay employee salaries (Payroll)

• Make payments to your business counterparts (Direct Credit)

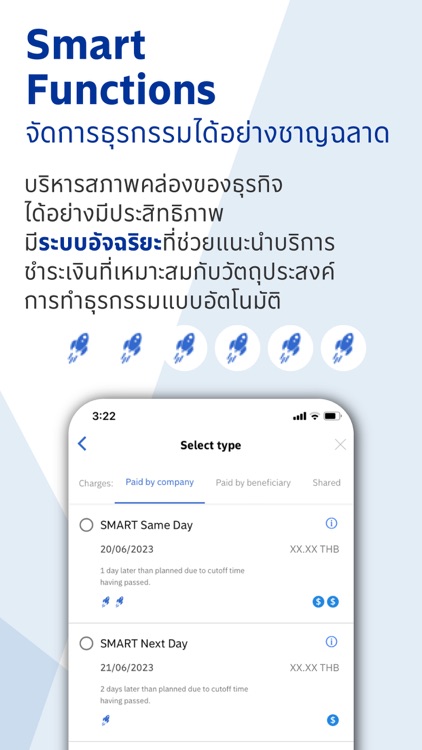

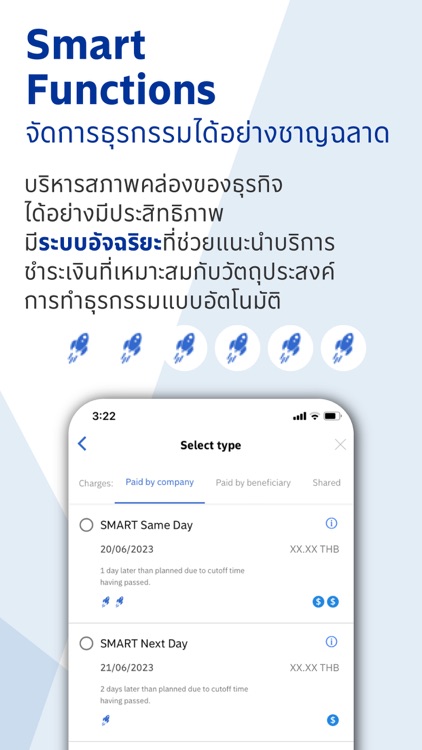

• Domestic fund transfers to other banks (SMART/BAHTNET)

• PromptPay

• International Outward Fund Transfer

- Smart Payment Advisory Services – Once the details and objective of the transaction have been specified the system will automatically show the best transaction option to the user.

- Customer Self-service: Stop/Hold Payment Instructions

- Other Services

• Transaction advice – Specify additional payment information in the payment advice.

• Beneficiary Validation – Verify the accuracy of the beneficiary account.

• Make transactions using counter foreign exchange rates, special foreign exchange rates and forward contracts.

Liquidity Management

- Cash Aggregation Report: Intraday sweeping and end of day sweeping.

- Intercompany Lending Report

- Cash Investment report: Intraday savings account sweep and end of day saving account sweep.

- Sweep Structure Summary Report: Summary report of the company's accounts that have been linked in the system.

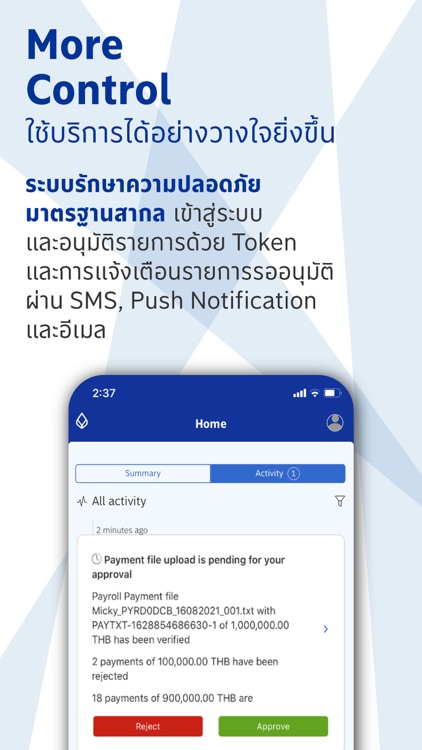

Alerts and Reports

- Transaction Alert for approver

Security

- Digital Token and Advanced Biometric Authentication

Customer Self-administration

- Customer Administration Management - and reset user login.

- Customer Preference Management - Choose language and change profile picture.

For more information, please contact Corporate Service Center 0 2031 7888 every day from 08:00 a.m. – 08:30 p.m.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.