Version 2 of the IR35 Calculator allows UK contractors / freelancers to calculate the types of return they can expect from a contract that falls inside the current UK IR35 legislation and rules

IR35 Calculator

What is it about?

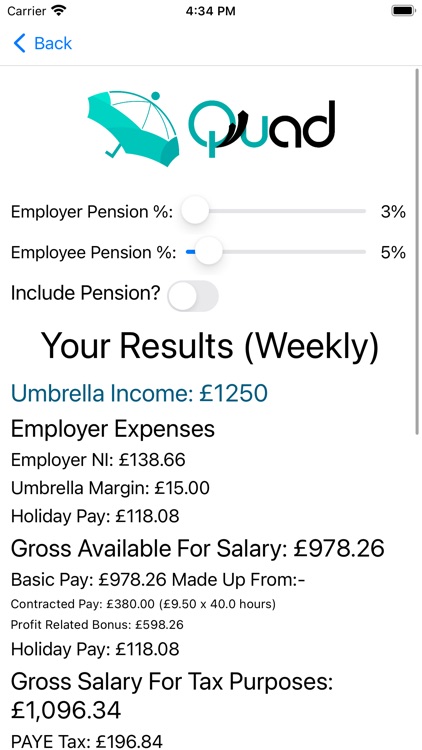

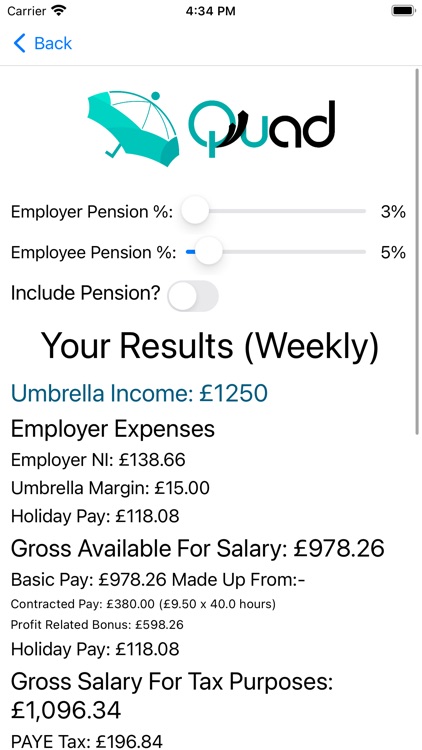

Version 2 of the IR35 Calculator allows UK contractors / freelancers to calculate the types of return they can expect from a contract that falls inside the current UK IR35 legislation and rules. This will be the majority of contracts placed within the UK from April 2021 onward, certainly until the repeal takes effect in April 2023 - now cancelled so IR35 is here to stay. All PAYE Umbrella Companies should produce similar returns, the only difference being the contractors circumstances and the Umbrella margin charged, version 2 of the IR35 calculator now allows you to set the margin and opt out of the Apprenticeship Levy. The calculator can be used to give an estimated return from any number of Umbrella companies, once you know their margin/AL status, you can see what to expect. It will also show you how a reduced margin impacts your take home. Interested in salary sacrifice? Use pension sliders to see how pension contributions affect not only your NET pay but your overall contract retention via tax and NI savings.

App Screenshots

App Store Description

Version 2 of the IR35 Calculator allows UK contractors / freelancers to calculate the types of return they can expect from a contract that falls inside the current UK IR35 legislation and rules. This will be the majority of contracts placed within the UK from April 2021 onward, certainly until the repeal takes effect in April 2023 - now cancelled so IR35 is here to stay. All PAYE Umbrella Companies should produce similar returns, the only difference being the contractors circumstances and the Umbrella margin charged, version 2 of the IR35 calculator now allows you to set the margin and opt out of the Apprenticeship Levy. The calculator can be used to give an estimated return from any number of Umbrella companies, once you know their margin/AL status, you can see what to expect. It will also show you how a reduced margin impacts your take home. Interested in salary sacrifice? Use pension sliders to see how pension contributions affect not only your NET pay but your overall contract retention via tax and NI savings.

The IR35 Calculator can calculate returns (and give breakdowns) for both day and week rates. Alternatively it can be be used to reverse lookup take home Net pay if you currently have a earnings target, after tax, in mind. Want to know how contracting would compare to your current full time/permanent role? The IR35 calculator also takes care of that including allowances for any employer pension contributions that may be currently paid.

In order to simplify things a number of assumptions have been made regarding a contractors circumstances and so the figures produced are indicative only and will vary on personal circumstances. Current release calculations are correct to UK legislation as at the 29th of September 2022.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.