INTUITIVE SPENDING

Kroo Bank - Mobile Banking

What is it about?

INTUITIVE SPENDING

App Screenshots

App Store Description

INTUITIVE SPENDING

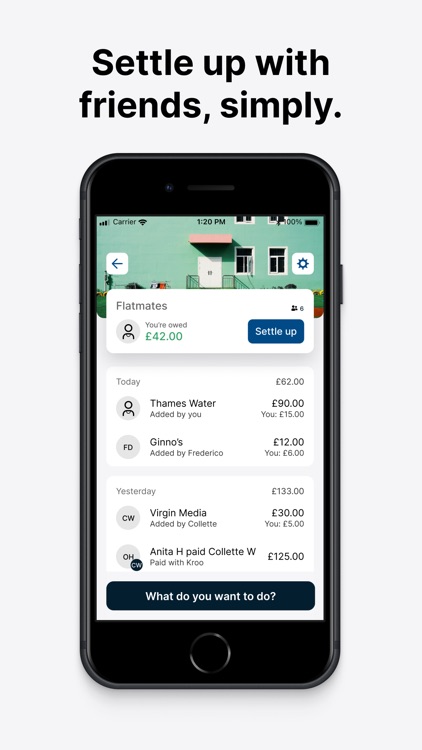

One home for your money. Spend. Track. Settle up with friends. You’ll also get real-time spending insights. These break down and categorise your transactions. Lovely.

NO MONTHLY FEES

Our current account is free to open with no monthly fees. And you can apply to access an overdraft (subject to status), currently by invitation only.

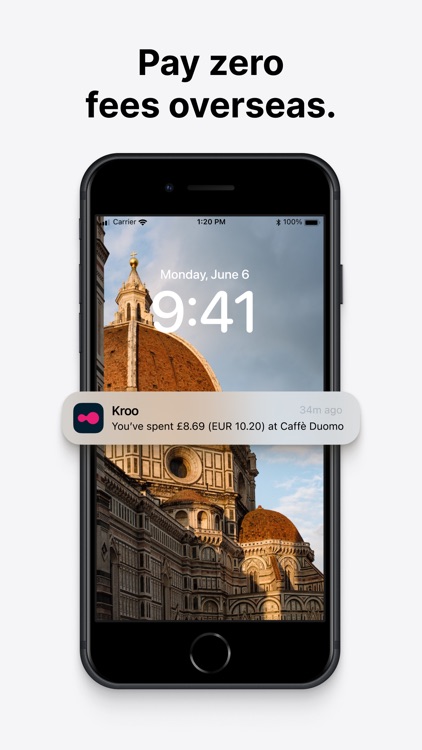

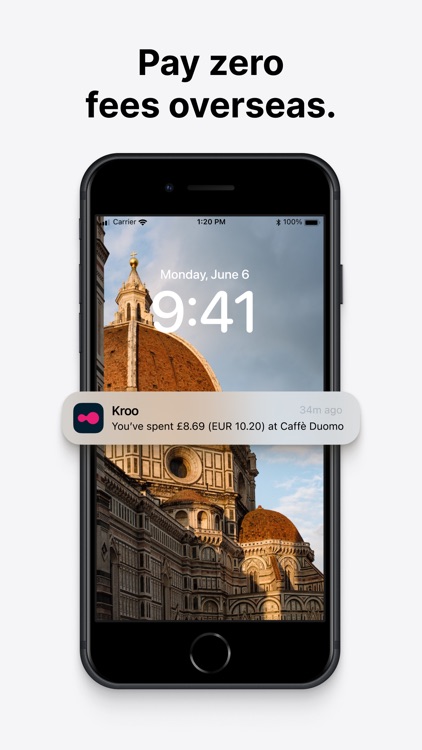

ZERO FEES OVERSEAS

Spend using your Kroo debit card at home and abroad, where Visa is accepted, with zero fees.

PEACE OF MIND

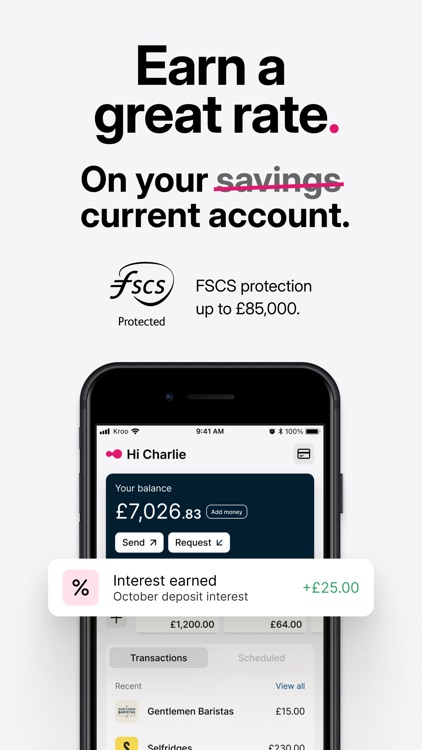

FSCS deposit protection up to £85,000 per customer

Face ID. Touch ID

Multi-factor authentication

UK-based customer support

Freeze and unfreeze your card.

KROO & APPLE PAY

Enjoy all the benefits of your Kroo card using Apple Pay. It’s an easy, secure, and private way to pay.

INTEREST FOR YOU

With a Kroo current account, you’ll earn interest at 0.9% below the Bank of England base rate on your current account balance up to £500,000. And it’s paid into your account monthly.

AER means annual equivalent rate. It shows you the yearly rate if we paid interest on top of interest. Gross interest is the contractual rate of interest.

KROO PERSONAL LOANS

Kroo loans are now available through the app. Applications for a loan are by invitation only for Kroo current account holders.

The loan repayment periods are from 12 to 60 months, with a Maximum Annual Percentage Rate (APR) of 23.6%

A representative example is £5,000.00 over 5 years, with APR (fixed) of 8.2%. This would have 60 monthly repayments of £101.16. The total repayment would be £6,069.60, and the cost of credit would be £1,069.60

Our customer privacy policy can be viewed here: https://www.kroo.com/customer-privacy-notice

OUR MISSION

Our goal is to be trusted and loved by our customers because we have their backs.

We are a fully licensed UK bank, authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority and the PRA. Our Firm Registration number is 953772.

Head to kroo.com to find out more. Current account applications and account management are via the app only.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.