Kyvu brings Financial Inclusion to salaried employees***

Kyvu

What is it about?

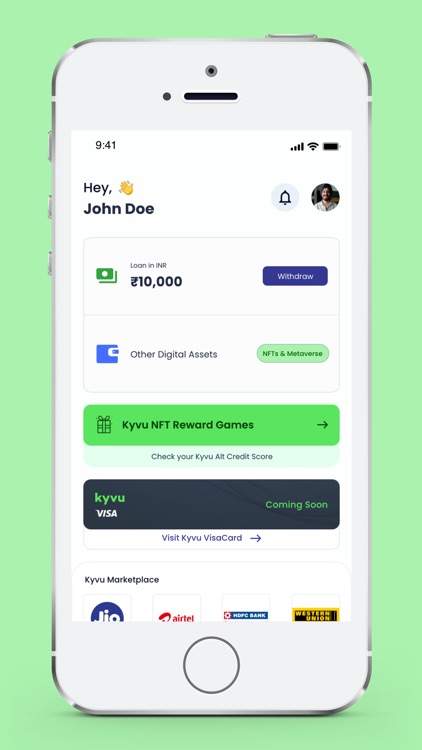

Kyvu brings Financial Inclusion to salaried employees***. We partner with third-party NBFCs (listed below), banks and other web 3.0 platforms to create and unlock the >$2 trn Digital Asset Universe via Ethical Loans, NFT Marketplace, Rewards, Kyvu Games, Kyvu Visa Cards, Credit Scores and much more!

App Store Description

Kyvu brings Financial Inclusion to salaried employees***. We partner with third-party NBFCs (listed below), banks and other web 3.0 platforms to create and unlock the >$2 trn Digital Asset Universe via Ethical Loans, NFT Marketplace, Rewards, Kyvu Games, Kyvu Visa Cards, Credit Scores and much more!

NBFC partner(s): Apollo Finvest India Limited

https://www.apollofinvest.com/list-of-lending-service-providers

***Note: If you are an employer or employee and want to learn more, please visit us at https://www.kyvuindia.com or email us at welcome@kyvuindia.com.

How it Works:

Kyvu offers you salary-driven and other loans at ethical rates, with the following key features:

- Loans range from INR 2,500 to INR 250,000

- Average Tenure: 95 days to 24 months

- 2% transaction fee plus interest rates ranging from 0% to 30%

- Minimal credit history is required

- Straightforward KYC including Aadhaar card, PAN card, selfie & salary slips

- Simply log-in to the Kyvu mobile app, complete the KYC process, select the loan amount and get the money in your bank account generally within 24 hours or less!

- The best part is as you use Kyvu, you get access to the Kyvu marketplace full of channel partners that focus on a variety of traditional and Web 3.0 products

Eligibility Criteria:

Indian citizen employed at a Kyvu-approved employer

Salaried individual with minimum take home pay of INR 25,000 per month

Above the age of 21

Possesses valid Aadhaar card, PAN card, Address ID proof, Salary Account bank statement and Proof of Employment (e.g., recent salary slips, etc.)

Security Standards: Ensuring employer and employee data security is our

highest priority. We follow robust information security protocols and

comply with all applicable security standards.

1. Minimum and maximum period for repayment

Minimum to Maximum Repayment Period: 95 days to 12 months.

2. Maximum Annual Percentage Rate (APR), which generally includes interest rate plus fees and other costs for a year, or similar other rate calculated consistently with local law

Maximum APR: 35%.

3. A representative example of the total cost of the loan, including the principal and all applicable fees

2% transaction fee plus interest rates ranging from 0% to 30%.

For Example:

If the loan amount is INR 10,000 & interest is 18% per annum with a tenure of 95 days, a processing fee of INR 200 would be charged, and the user would receive INR 9,800. The interest for 95 days would be INR 468. The EMI (due in 95 days) would be INR 10,468. This would result in an APR of 26%.

4. A privacy policy that comprehensively discloses the access, collection, use, and sharing of personal and sensitive user data

Privacy Policy located at https://www.kyvuindia.com/privacy-policy.

Please visit https://www.kyvuindia.com for more information.

Questions? Please email us at welcome@kyvuindia.com.

Prior to using the Kyvu app, please review our Terms & Conditions and

Privacy Policy located at https://www.kyvuindia.com/terms-conditions and

https://www.kyvuindia.com/privacy-policy.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.