Get credit that’s easy, instant and stress-free

LazyPay: Loan App & Pay Later

What is it about?

Get credit that’s easy, instant and stress-free. With LazyPay, you get a free credit limit upto Rs.10,000 that you can use across 45,000+ online stores and merchants! Just repay the total every 15 or 30 days, interest-free.

App Screenshots

App Store Description

Get credit that’s easy, instant and stress-free. With LazyPay, you get a free credit limit upto Rs.10,000 that you can use across 45,000+ online stores and merchants! Just repay the total every 15 or 30 days, interest-free.

Here’s what you can do on LazyPay:

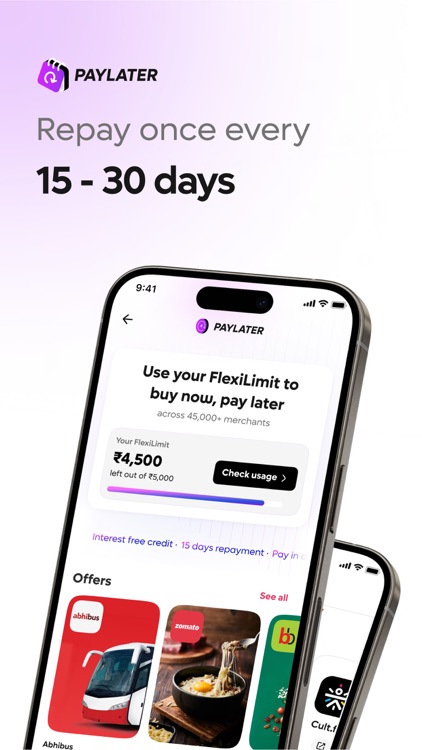

PayLater

Checkout on your favourite merchants in just one-tap! It’s completely free. No extra charges, no hidden fees. Shop, buy, spend from your credit limit and pay just one single bill every 15 days.

• One-tap payments

• No OTPs, CVVs or PINs

• Repay just once every 15 days

• No interest and no hidden charges

◆ Get attractive discounts and offers on various merchants like Swiggy, Zomato, Myntra, Zepto and more.

◆ A quick, simple KYC makes your experience a lot smoother. If you complete your KYC with us, you can increase your credit limit (upto as much as Rs. 5 lakhs), and get 30 days to repay your dues (that’s double the normal billing period!). In case you’re unable to pay your bill, you’ll also have options to repay your dues in EMIs.

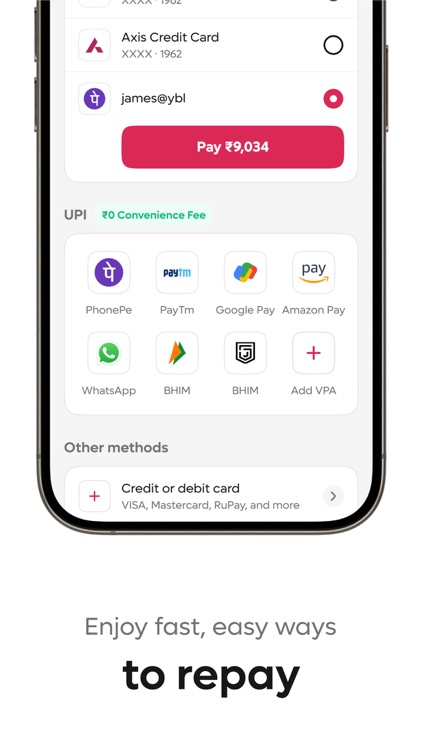

BillPay: Pay Utility Bills

With over 20,000+ supported billers, LazyPay allows you to pay utility bills with your credit limit. Pay electricity, gas, water bills in one-click; recharge FASTag, mobile postpaid, mobile prepaid, landline, DTH and more. Repay in one shot, along with your LazyPay dues, every 15 or 30 days.

Auto360

Your all-in-one vehicle management hub. Now you can add your vehicle, track challans, stay ahead of PUC and insurance expiries. Also, renew your vehicle insurance seamlessly—all in one place.

GiftCards

Now you can purchase vouchers of over 200+ brands like Amazon, Myntra, Flipkart and more on the LazyPay app. Use them to avail discounts ranging upto 30% on your purchases, or share them with your loved ones!

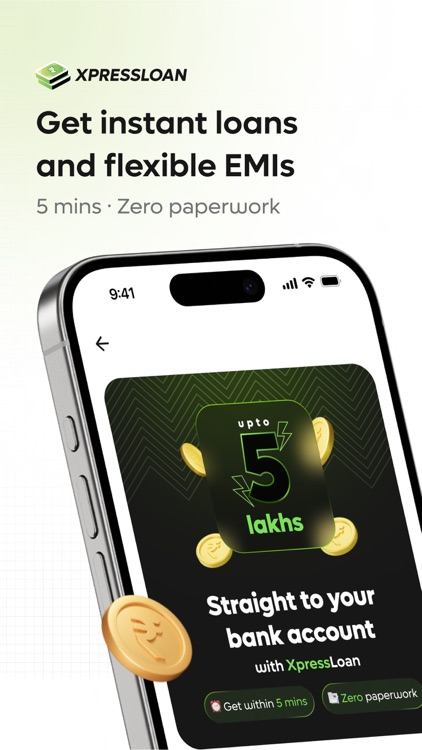

XpressLoans: Instant Personal Loans

LazyPay offers instant personal loans for all your needs, big or small. Get online loans within minutes and use it for anything you want - no questions asked. Our instant personal loans are cash loans where the lump sum amount is transferred to your bank account. The entire process is paperless and 100% digital, for your convenience.

Personal loan interest rates range from 12% to 36% p.a. with EMI tenures from 3 months upto 60 months.

XpressLoans range from Rs. 3,000 to Rs. 5 lakh with an Annual Repayment Period (APR) from 3 to 60 months. Percentage rate (APR) between 12% - 36% on a reducing balance basis.

◆Sample EMI Calculation◆

For a loan amount = Rs 10,000 | Tenure = 6 months @ interest rate of 18%* p.a.

EMI will be = Rs 1,755/- p.m.

Processing fee = Rs. 200

Total Payment = Rs. 10,730

*Interest rate and processing fee may vary.

◆ Join over 20 lakh fellow Indians using the LazyPay app everyday to get instant personal loans, and make payments easily.

◆ We believe in total transparency and data safety and security. All your information is safe with us.

◆ Have questions? Reach out to us anytime at wecare@lazypay.in

----------

Revolve rates - 36% to 42%. For Revolve there is no period for repayment. It's a monthly rolling feature.

Convert to EMI - 3 month 24% | 6 month 26% Tenure basis - 3 to 6 months.

Declaration

LazyPay is a platform that only facilitates money lending to duly registered NBFCs to users and complies with all applicable laws including RBI’s Fair Practices code. The details of the registered NBFCs who are partnered with us are mentioned below.

• PayU Finance India Private Limited (“PayU Finance”)

https://www.payufin.in/

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.