Access your Mariner Finance Customer Account Center on the go

Mariner Finance

What is it about?

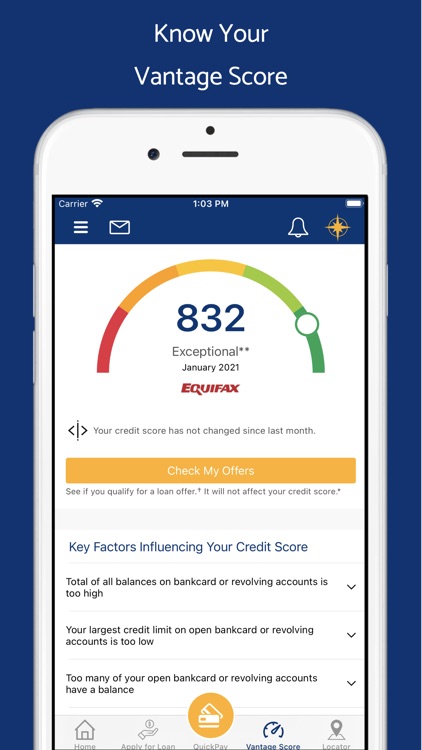

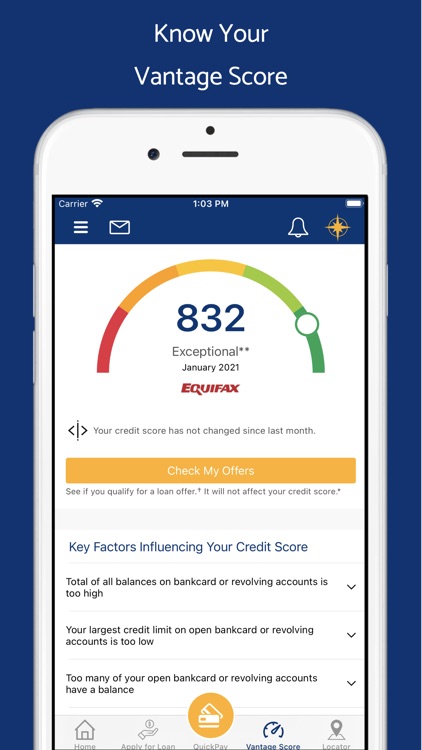

Access your Mariner Finance Customer Account Center on the go. With the Mariner Finance mobile app, you can:

App Screenshots

App Store Description

Access your Mariner Finance Customer Account Center on the go. With the Mariner Finance mobile app, you can:

• Monitor your account activity;

• Set up auto pay to never miss a payment;

• Make a monthly payment on your existing loan;

• Apply for a new loan;

• See your current offers;

• Locate a branch near you;

• And more!

The Mariner Finance mobile app is designed for Mariner Finance customers and requires a loan account in order to log into the app. Mariner Finance, LLC is a Non Bank Financial Company and is a Loan Processor offering Personal Consumer Loans. Mariner Finance utilizes Bank of America as our main registered bank ACH processor.

A personal loan from Mariner Finance can meet a variety of needs, including home improvement projects, vacations, weddings, debt consolidation, and unplanned expenses. We offer personal loans from $1,000 to $25,000, with loans terms from 12 to 60 months. APR's range from 20.99% to 35.99%. Minimum and maximum amounts dependent on an applicant’s state of residence and the underwriting of the loan.

The stated APR represents the cost of credit as a yearly rate and will be determined based upon the applicant’s credit at the time of application, subject to state law limits. The stated APR represents the range of APR’s that may be applicable, subject to state law limits and individual underwriting. Not all applicants will qualify for a lower rate. APR’s are generally higher on loans not secured by a vehicle, and the lowest rates typically apply to the most creditworthy borrowers. All terms and conditions of a loan offer, including the APR, will be disclosed during the application process. As an example, with an amount financed of $5,000.00 the borrower receives $5,000.00 at an APR of 31.99% and an interest rate of 30.76% which includes a finance charge of $3,922.72. Under these terms, the borrower would make 48 monthly payments of $185.89, for a total of payments of $8,922.72. The amount financed may not be the net proceeds paid if charges other than interest are included in the loan.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.