Max Life Insurance Mobile App

Max Life Insurance

What is it about?

Max Life Insurance Mobile App

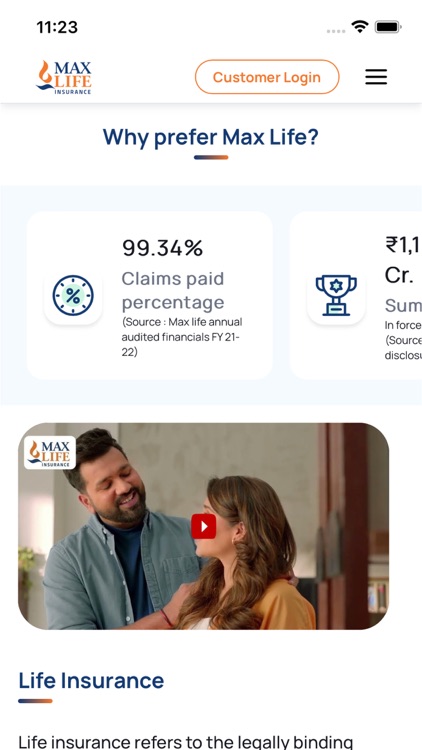

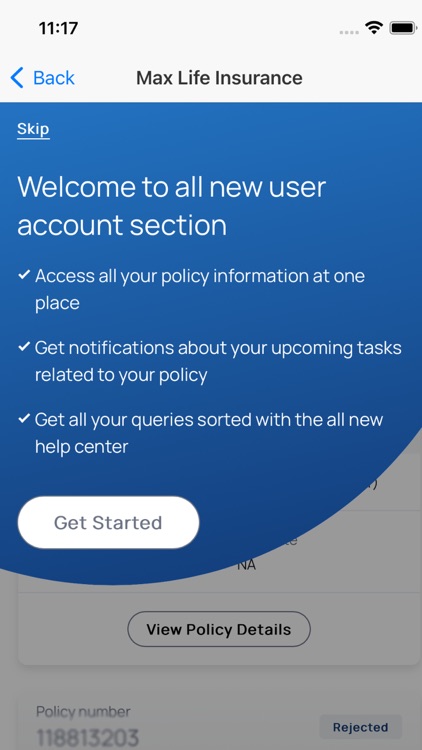

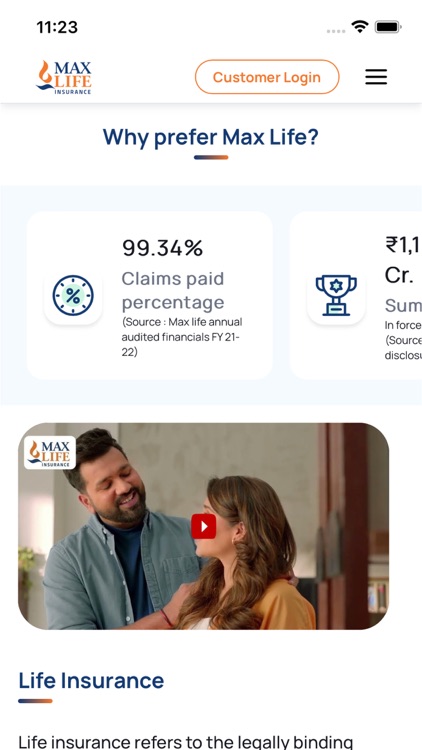

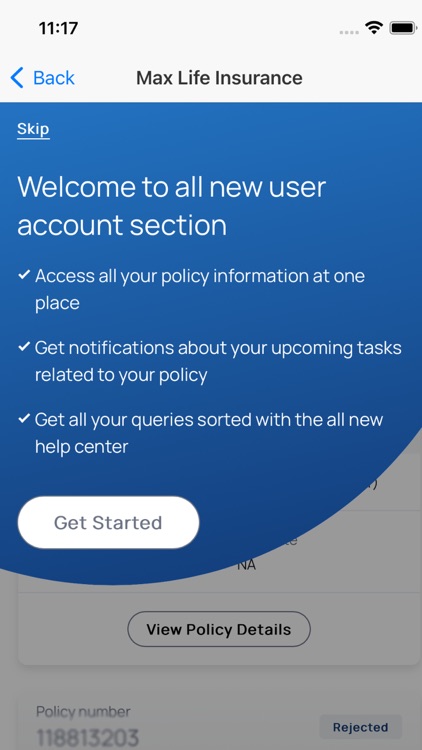

App Screenshots

App Store Description

Max Life Insurance Mobile App

About Us

We are the largest non-bank private-sector life insurer in India with 269 offices across the nation. We launched ourselves in the insurance world in the year of 2000 with an aim to simplify life insurance and make it accessible for one and all.

How far we’ve come? We’ll let the numbers do the talk:

1. Claim settlement ratio – 99.51%

2. AUM - ₹1,22,857 Crores

3. Sum assured - ₹1,397,142 Crores

4. Offices – 269

Source:

1. Individual Death Claim Paid Ratio as per audited financials for FY 2022-2023

2. Max Life Public Disclosure, FY 2022-23

3. In force (individual) (Max Life Public Disclosure, FY 22-23)

4. As reported to IRDAI, FY 22-23

Some of the Products We Offer

Term Insurance Plans

A simple & pure life insurance product that offers financial coverage for a specific period of time – thus the name Term Plan. Max Life Smart Secure Plus, Return of Premium and Saral Jeevan are some couple of our top term plans.

• Saving & Investment Plans

An up from the basic term plan, an Max Life Insurance investment plans helps you multiply grow your money while providing life insurance. Max Whole Life Super, Assured Wealth, Savings Advantage are some of the top Max Life Insurance savings & investment plans plans.

• Unit Linked Insurance Plans (ULIPs)

One of the popular insurance plans, in which a part of the premium is used for life cover while the remaining portion is directed towards periodic fund investments. Online Savings Plan, Forever Young Pension Plan, Fast Track Super & Shiksha Plus Super are some of the ULIPs offered by us.

• Health Insurance

We provide critical illness cover against 64 listed critical illnesses (can be coupled with your Max life insurance policy) – helping you when you’re at your low. Top Online Life Insurance Plans offered by Max Life

• Max Life Smart Secure Plus Plan

It’s a non-linked pure risk life insurance plan that offers term insurance cover and terminal illness coverage (up to 64 critical illnesses covered) at no extra cost.

• Max Life Critical Illness & Disability Rider

Provides financial coverage when the customer is diagnosed with any of the 64 listed critical illness (like cancer, stroke & kidney failure, etc.). This rider can be added to your existing Max Life term plans and ULIPs as well.

• Max Life SFRD

This life insurance plan offers you with guaranteed tax-free returns along with life coverage, thus securing your future while adding to your savings significantly (up to 0.5% additional

maturity benefit for women).

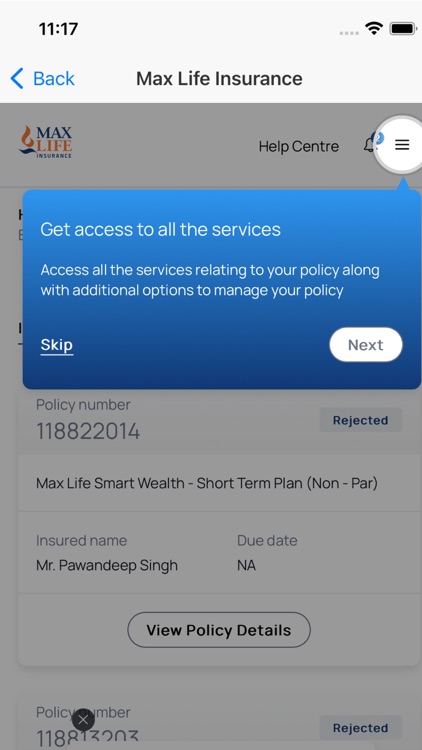

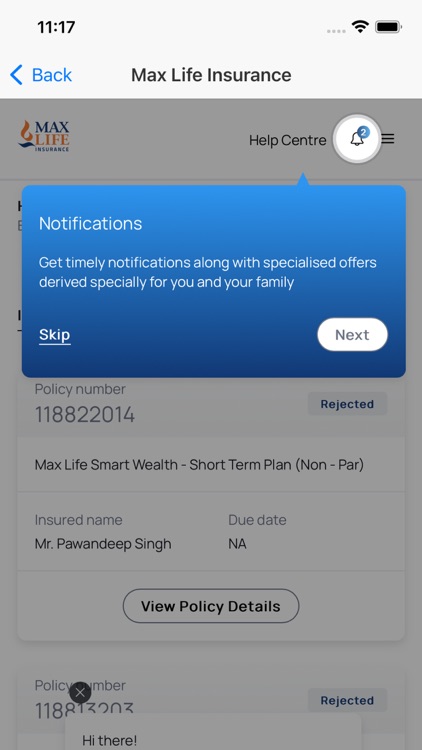

About this app-

Max Life Insurance app – we are where you are!

With this app, you can buy and manage your Max Life policies- Term Insurance, Savings, Investment and

Health, pay premium, update details, get premium quotes and apply for claims, etc. easily.

Features of the App:

• Check & buy new insurance policies

• Browse through our range of life insurance policies

• Get free premium quote

• Upload documents

• Schedule medical tests

• Track policy application status

• Update address details

• Set personalized reminders for premium payment

• Know about our newly launched products and more – much more!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.