LOG MILEAGE, EXPENSES and ESTIMATE SE TAX

Mileaged Mileage & Tax Tracker

What is it about?

LOG MILEAGE, EXPENSES and ESTIMATE SE TAX. SAVE up to $20,000 in tax exemption each year with Mileaged - Mileage and Tax Tracker. A full-time Uber/Lyft driver can drive up to 36,000 miles a year. You will never miss a mile with Mileaged.

App Screenshots

App Store Description

LOG MILEAGE, EXPENSES and ESTIMATE SE TAX. SAVE up to $20,000 in tax exemption each year with Mileaged - Mileage and Tax Tracker. A full-time Uber/Lyft driver can drive up to 36,000 miles a year. You will never miss a mile with Mileaged.

Mileaged stands out from MileIQ, Everlance, Driversnote with innovative features developed based on thousands of user reviews on Appstore. Mileaged helps you get rid of your paper trail, therefore, have more time for taking business drives.

SMART TRACKING

Customize rules for auto detecting and classifying your drives:

> Create a new drive for every passenger dropoff

> Continue current drive if you stop the car for gas refill or shopping

> Auto classify commute drives as personal

> Discover more rules in SMART TRACKING setitngs

DASHBOARD FOR QUICK ACTIONS

Take quick actions from important highlights on homepage:

> Add drives manually in one tap

> Act on unclassified drives while they are still fresh

> Review summaries of up-to-date mileage, income, expenses and self-employed tax

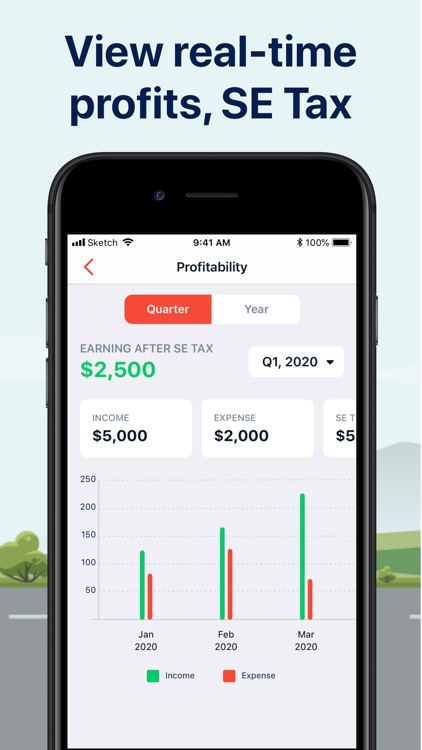

PERFORMANCE REPORTS

Read real-time user-friendly reports for constantly monitoring driving performance:

> View weekly, quarterly and yearly reports

> View most important drives by purposes

> Export each vehicle's mileage log for IRS to pdf or sent to e-mail

START NOW FOR GREATER TAX DEDUCTIONS!

> STANDARD PACKAGE: 1.500 business mileage limit, Auto mileage logging, Real-time report & export

| Monthly $9.99

| Yearly $39.99

> PREMIUM PACKAGE: All Standard Package benefits and including Unlimited business mileage, Income/Expense Logging, Self-employment tax estimation, Real-time profitability report

| Monthly $19.99

| Yearly $59.99

Information about the auto-renewal of subscription:

Payment will be charged to iTunes Account at confirmation of purchase.

Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period.

Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal. The cost depends on the selected plan.

Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user's Account Settings after purchase.

Any unused portion of the free trial will be forfeited when the user purchases a subscription.

Privacy Policy: http://apponfire.co/privacy-policy.html

Terms of Use: http://apponfire.co/terms.html

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.