Money Forecast allows you to track your finances with litte data input only

Money Forecast: CashFlow

What is it about?

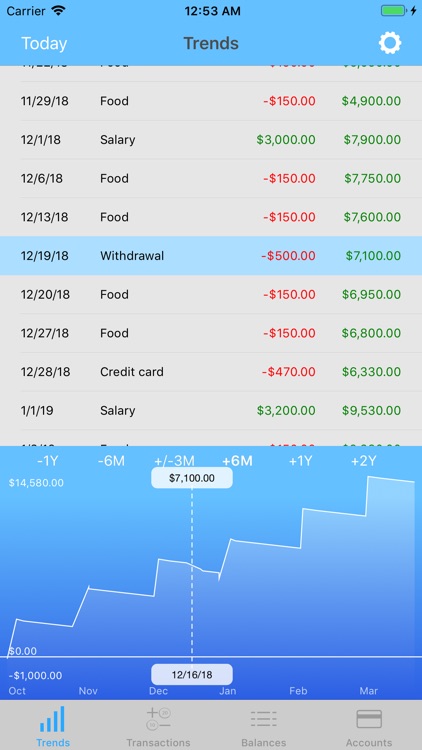

Money Forecast allows you to track your finances with litte data input only! Simply enter your current account balance as well as (recurrent) transactions (e.g., salary and expenses) and see how your balance will develop over the next few weeks and months. If the prediction was wrong, simply correct it by specifying the actual balance at a specific date, which is used as new basis for further predictions then.

App Screenshots

App Store Description

Money Forecast allows you to track your finances with litte data input only! Simply enter your current account balance as well as (recurrent) transactions (e.g., salary and expenses) and see how your balance will develop over the next few weeks and months. If the prediction was wrong, simply correct it by specifying the actual balance at a specific date, which is used as new basis for further predictions then.

This way it helps you to plan your financial situation, and also to decide if an investment should be made now or better later, for example. Also, this app allows you to avoid situations where you forgot about some outgoing transactions and end up with an overdrawn account balance.

The best thing about Money Forecast, however, is that you do not need to constantly add new micro transactions - just enter the balance on a particular date, create estimated recurring income/expenses and correct either the balance or actual payments later (for a particular date).

First use instructions:

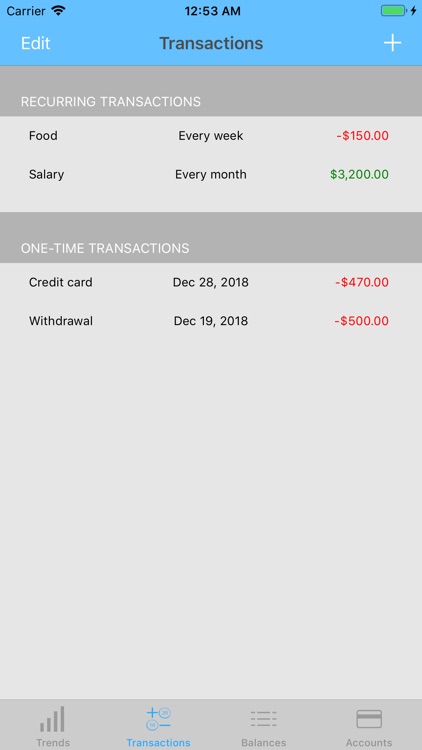

1) Enter the current balance.

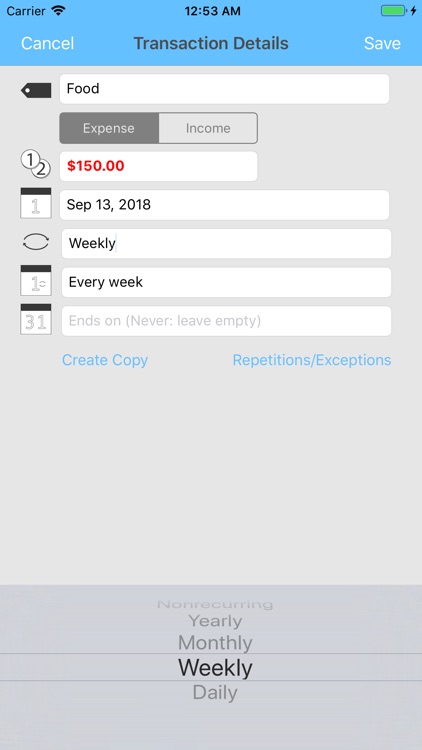

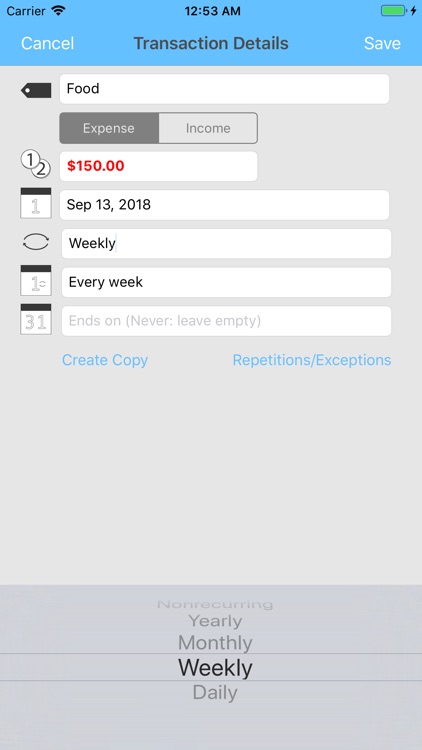

2) Add recurrent or one-time transactions (i.e., income and expenses).

3) See how your finances will develop over the next few weeks, months, and years!

4) Adjust the actual account balance for specific (future) dates. This will correct wrong estimations.

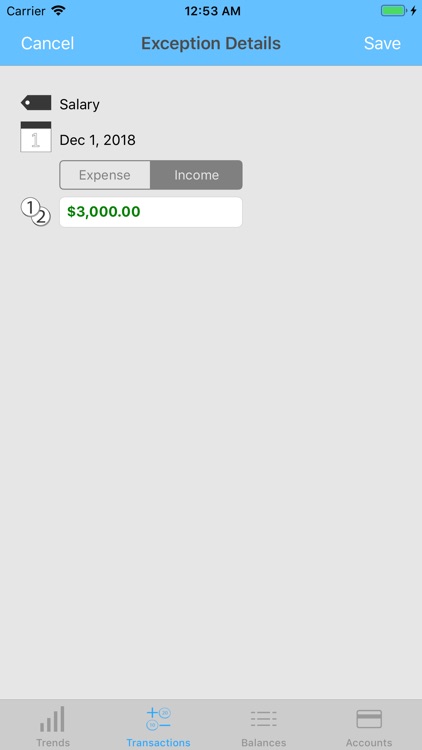

5) Adjust the actual value of a recurrent transaction for specific dates only. Simply double-tap the recurring entry in the trends view to adjust (by creating a 'Transaction Exception')!

You can manage several accounts with this app (e.g., for several people in your family) and you can also use a PIN (or Touch ID / Face ID) to protect your data! Since the app synchronizes via iCloud, you can also see/edit the data from several devices and restore your data after a complete re-install.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.