Moneybox is the simple way to save and invest towards your child’s future

Moneybox Junior ISA

What is it about?

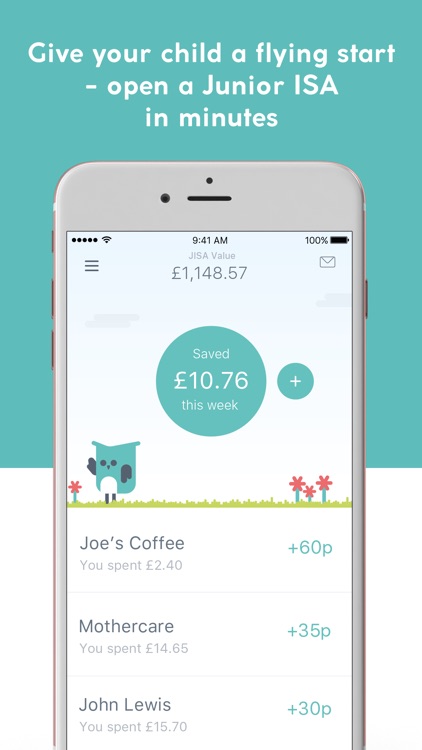

Moneybox is the simple way to save and invest towards your child’s future. Round up your card purchases to the nearest pound and invest the spare change into thousands of leading companies via tracker funds within a Junior Stocks & Shares ISA. Sign up in minutes and get started with as little as £1.

App Screenshots

App Store Description

Moneybox is the simple way to save and invest towards your child’s future. Round up your card purchases to the nearest pound and invest the spare change into thousands of leading companies via tracker funds within a Junior Stocks & Shares ISA. Sign up in minutes and get started with as little as £1.

Save towards your child’s future every time you spend

• Moneybox helps you to save as you spend by enabling you to round up your everyday card purchases to the nearest pound e.g. when you buy a coffee for £1.80, you can choose to ‘round up’ to £2 and set aside the 20p to invest.

• You can also set up regular weekly deposits and make one-off deposits.

• However you choose to set money aside, your savings will be collected once a week via Direct Debit and invested into your child’s Junior Stocks & Shares ISA a few days later.

• Please note that the money held within the Junior Stocks & Shares ISA belongs to your child. Any contributions will be considered a gift and, as such, cannot be repaid.

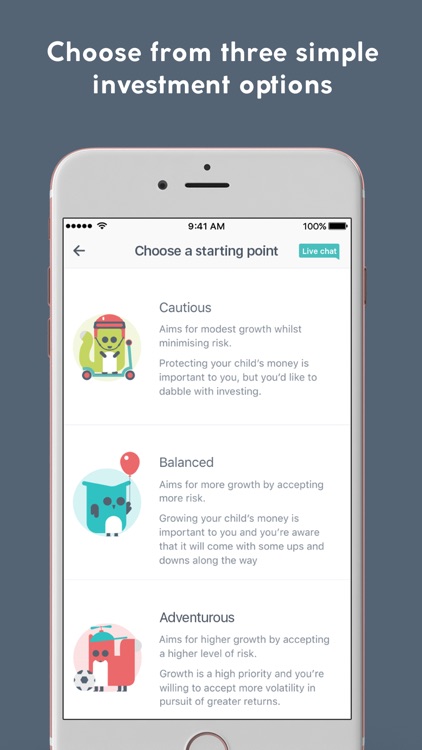

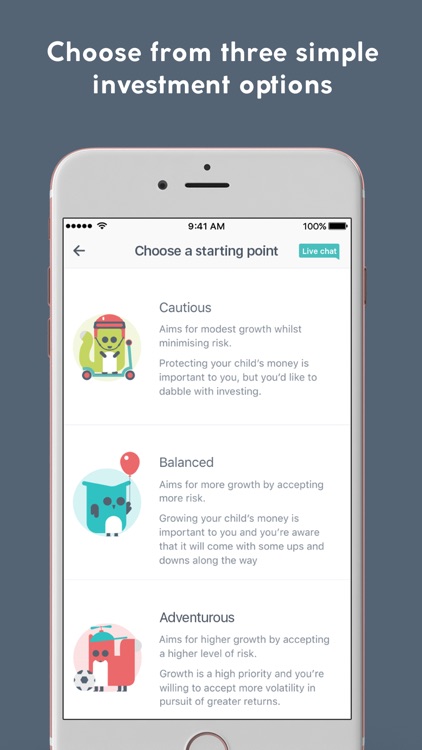

Making investing as easy as 1,2,3

• Investing can be a great way to grow your child’s savings over the long term.

• We've worked with experts to put together three simple starting options – cautious, balanced and adventurous. All you need to do is pick one!

• The option you choose determines how your child’s investments are split between three tracker funds – a cash fund, a global shares fund and a property shares fund. Via these funds, you can invest on your child’s behalf into thousands of leading companies from around the world such as Apple, Netflix and Disney.

• Your child’s investments are held within a Junior Stocks & Shares ISA. At the age of 18, the child will take control of the Junior Stocks & Shares ISA and will be able to withdraw any amount at that point.

It is important to bear in mind that there is risk involved in investing. The value of your child’s investments will rise and fall at times and they could get back less than the amount invested.

Fees

• Our fees are structured to make it possible for you to invest for your child little and often.

• We charge a monthly subscription fee of £1 and an annual platform fee of 0.45% of the value of your child’s investments per year. To help your child get started, we do not charge the £1 subscription fee for the first three months.

Peace of mind

• Moneybox is authorised and regulated by the Financial Conduct Authority with reference number 712935.

• Your child’s investments are covered by the UK government’s Financial Services Compensation Scheme in the unlikely event that a fund provider is declared bankrupt.

• We use bank level 256-bit TLS encryption for all personal information.

Ready to get started? Install Moneybox for free today.

If you have any questions or would like to find out more, please get in touch using support@moneyboxapp.com - we’d love to hear from you!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.