Moneylab provides the tools to help you make better decisions about your money

Moneylab App

What is it about?

Moneylab provides the tools to help you make better decisions about your money. It’s like a personal financial assistant that never stops working for you – you’re the boss, but we’ve got your back.

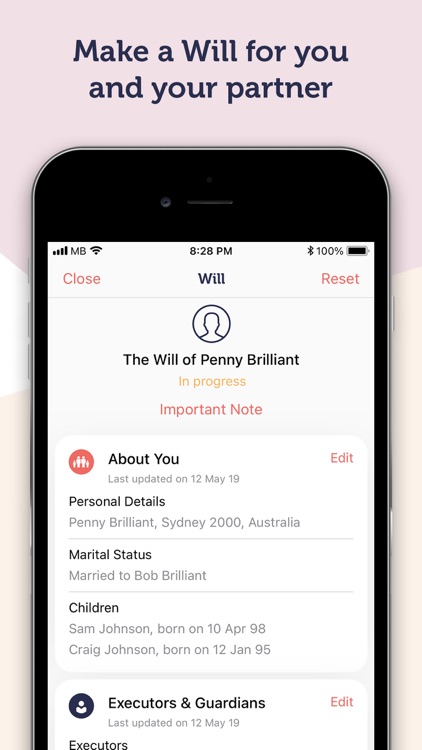

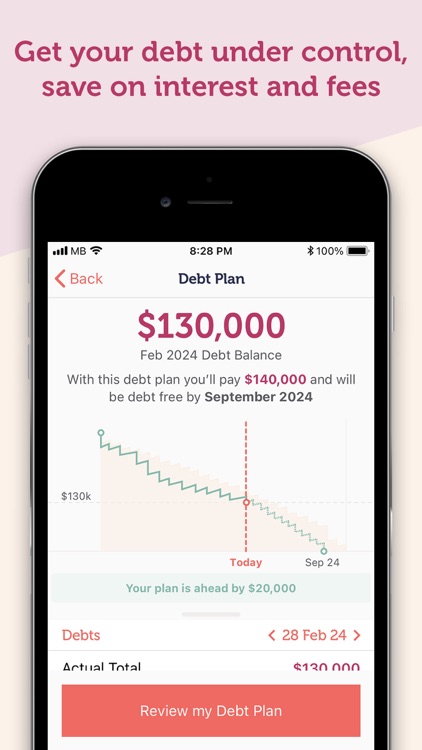

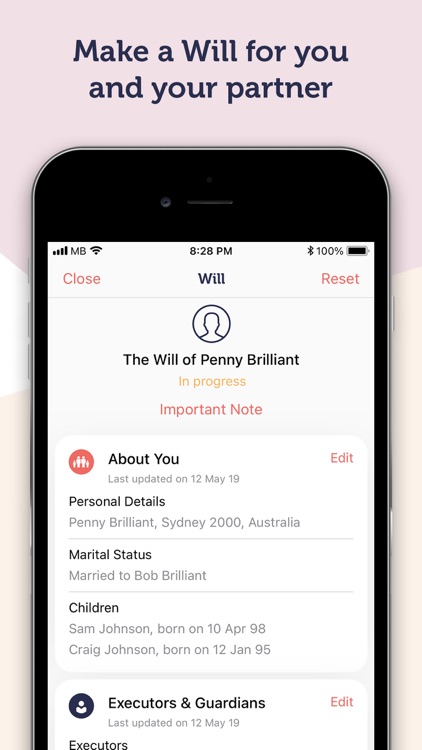

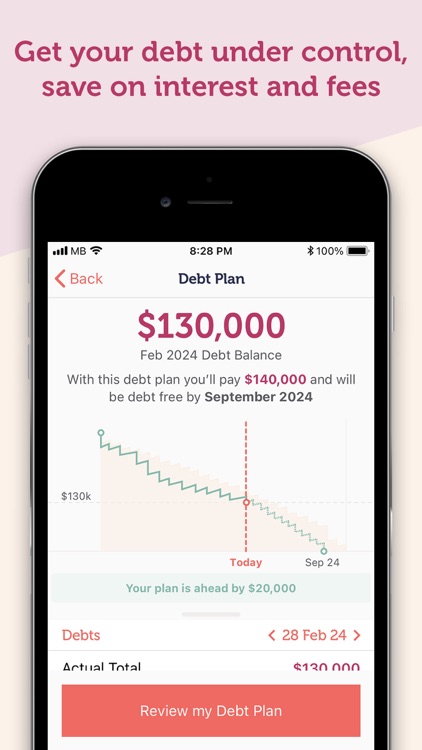

App Screenshots

App Store Description

Moneylab provides the tools to help you make better decisions about your money. It’s like a personal financial assistant that never stops working for you – you’re the boss, but we’ve got your back.

Moneylab is based on the MoneyBrilliant app platform – one of Australia’s best and most widely used personal financial management tools.

Features

--------

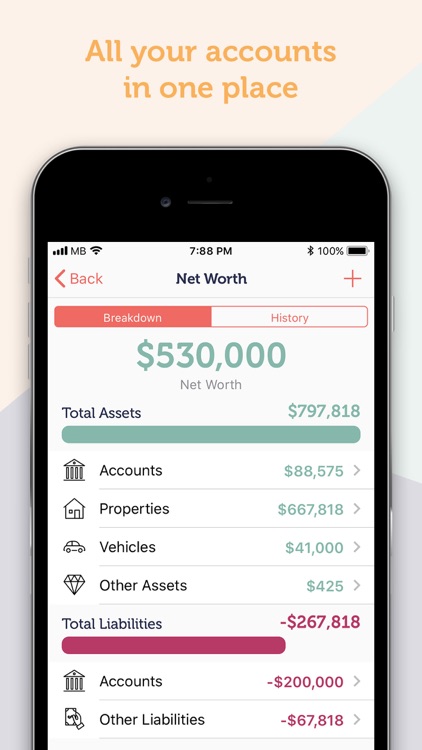

1. Connect all your accounts to see a complete picture

You can connect all your financial accounts and see all the details on whatever device you choose – your phone, tablet or computer. We connect to more institutions than anyone else

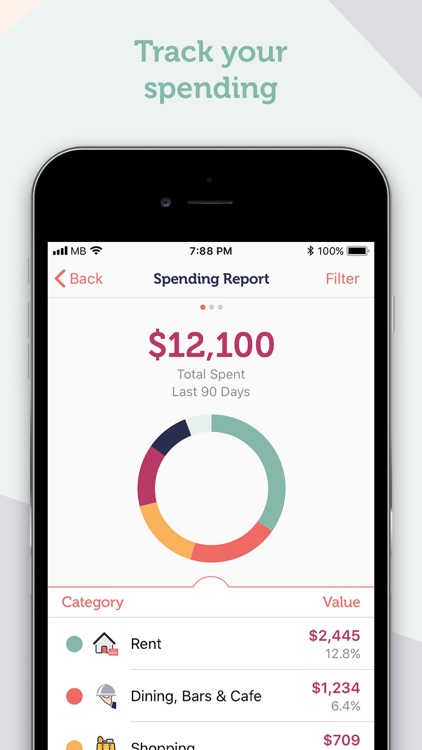

2. Understand your spending – so you can change it

Use our connections, intelligent transaction categorisation and spending reports to understand how you spend your money and find opportunities to spend less

3. Manage your bills

Identify your bills, view your upcoming bills calendar, track your spending by biller and set alerts for upcoming, due and missed bills

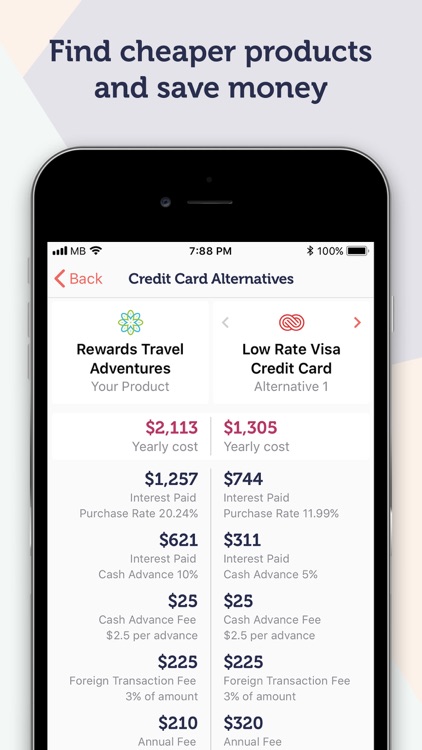

4. Get better deals on bills

Automatically find the cheapest gas and electricity deals based on your bills and energy usage data. We will regularly check the market to make sure you are on the best plans

5. Create a budget and track your progress

Automatically create a budget based on your historical income and spending, adjust your budgeted income and spending to achieve your goals and we will automatically track and report your progress - with no boring data entry

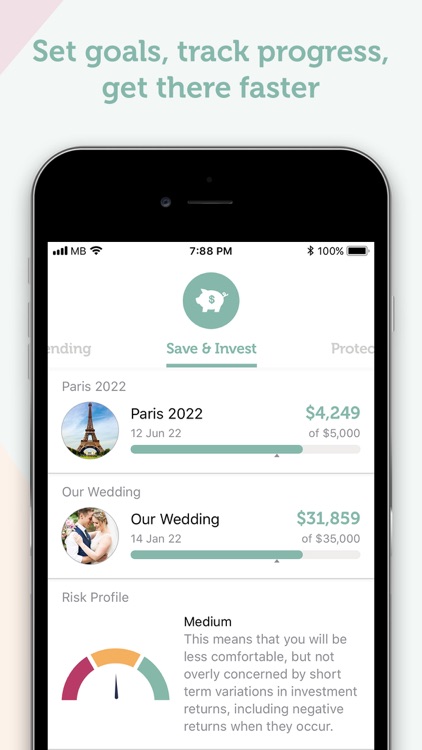

6. Set savings goals to achieve the important things

Use our Save and Invest tool to set savings goals for the things that really matter – calculate how much you need to save each month, whether you can afford it, and link your goals to specific accounts to automatically track your progress

7. Track your tax deductible expenses

Never forget to claim an allowable tax deduction again by automatically identifying possible tax deductible expenses and capturing receipts. At the end of year send a summary report to your tax accountant or adviser

8. Sort out your banking and bank efficiently

Get suggestions on how to improve your banking structure and habits to simplify your banking and bank more efficiently

9. Compare your income and spending to others

Use People Like Me to compare your spending and income to people like you – people with the same income, same net worth, live in the same area or have the same occupation

10. Manage your Insurance details

Keep details of the important insurance policies for you and your family in one place

11. Own a home or investment property sooner

Build a plan to buy a home or an investment property. See what concessions you will be entitled to, maximise your saving and borrowing capacity and let us help you stay on track

12. Plan your Retirement

Connect your super fund and plan your retirement using an estimate of what you’ll save

13. Get your debt under control

Get your debt under control by selecting a debt strategy and building a plan. We’ll automatically help keep you on track

14. Regular tips and insights

Get regular insights and tips on how to save money in the Activity Feed

Terms of Use

https://help.moneylab.com.au/terms-of-access/

Privacy Policy

https://help.moneylab.com.au/privacy-policy/

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.