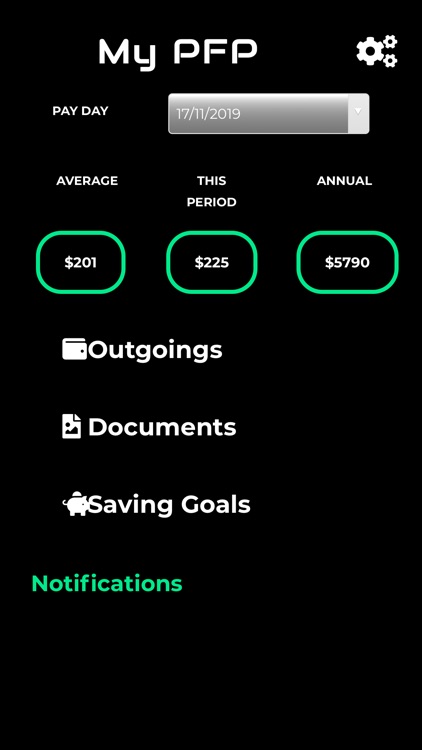

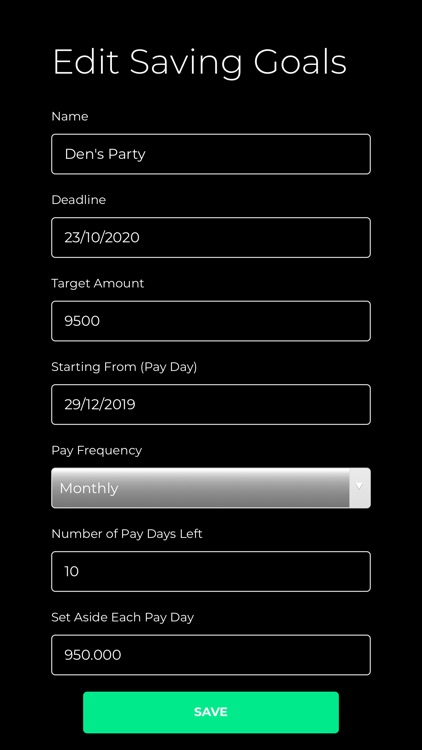

My PFP integrates the specific dates your outgoings fall due along with your pay frequency (how often you receive income; weekly, bi-weekly, 4-weekly or monthly) and determines exactly how much money you need to set aside from each paycheque to cover your outgoings

MyPFP

What is it about?

My PFP integrates the specific dates your outgoings fall due along with your pay frequency (how often you receive income; weekly, bi-weekly, 4-weekly or monthly) and determines exactly how much money you need to set aside from each paycheque to cover your outgoings.

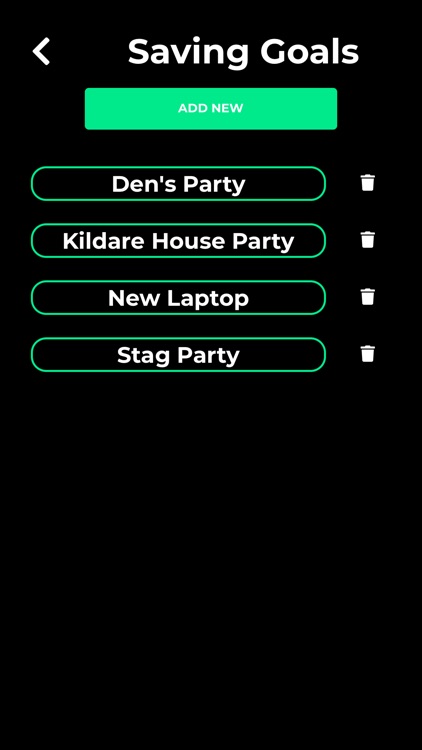

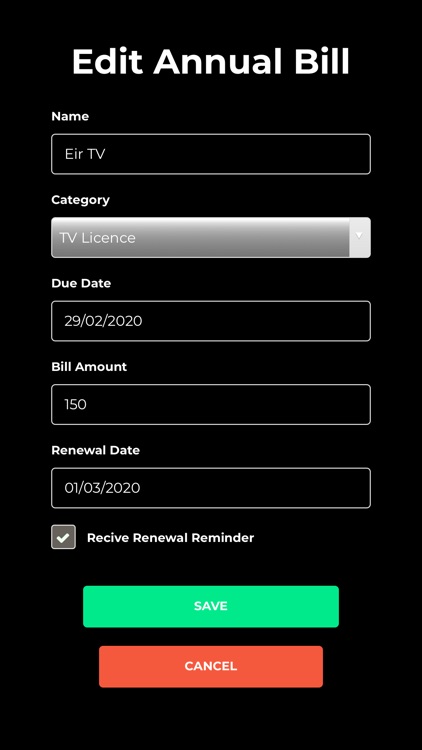

App Screenshots

App Store Description

My PFP integrates the specific dates your outgoings fall due along with your pay frequency (how often you receive income; weekly, bi-weekly, 4-weekly or monthly) and determines exactly how much money you need to set aside from each paycheque to cover your outgoings.

My PFP is different from most traditional personal finance/budgeting apps on the market in that it focuses on upcoming expenditure as opposed to past expenditure.

My PFP is the new innovative way to manage all of your personal finances from one platform.

Use My PFP to manage your entire finances from one platform.

My PFP will:

Determine what your outgoings are costing you per paycheque

Identify what bills and expenses are falling due between pay cheques and establish how much you need to set aside to cover these

Send you reminders of policies that are falling due for renewal 30 days in advance of the renewal date

Store your policy documents that are easily accessible

Send you notifications of bills falling due 7 days in advance of them falling due

Illustrate your key financial information in a graph form that is easy to view

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.