Why choose an Oakam loan

Oakam

What is it about?

Why choose an Oakam loan?

App Screenshots

App Store Description

Why choose an Oakam loan?

• We strive to break down financial barriers and provide access, which means we’ll listen to your story if you are on benefits, have a bad credit history or just arrived to the UK.

• Money is a private matter and we keep it that way. That’s why we’ll never knock on your door, and you can reach us online or over the phone if you need us.

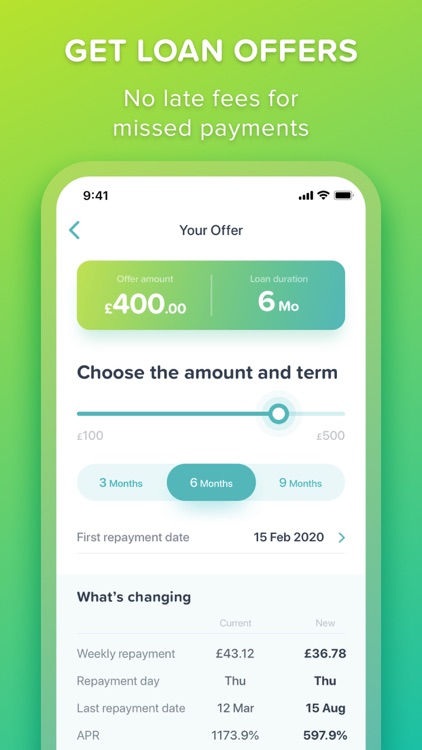

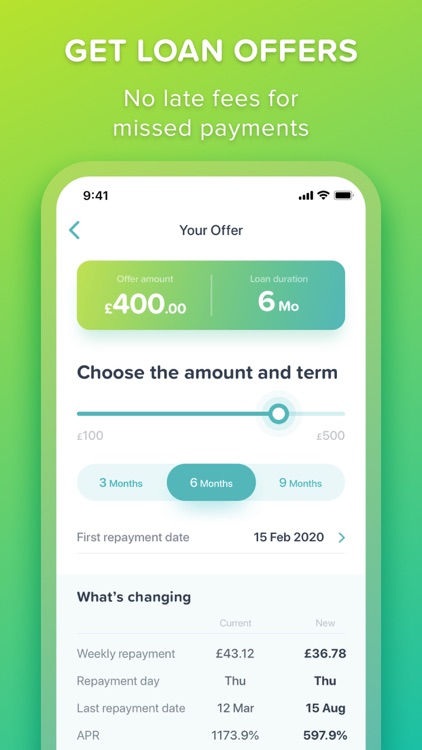

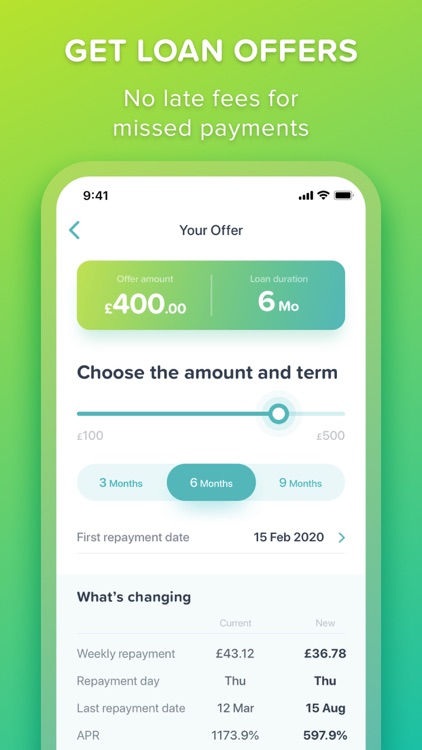

• At Oakam you’re always in control, which is why you can choose from weekly or 2-weekly payment plans.

• Our products are simple and transparent. We don’t charge late fees or penalise you for settling early.

• We give you the tools to build a brighter financial future. With good repayment behaviour, you could have the flexibility to top-up your loan at a lower price or borrow up to £5,000 for a large purchase.

What do our customers think?

"Really easy to use app to pay bills with great customer service. I have bad credit and got a 2nd chance to rebuild my credit with this loan. Amazing service and happy customer" - Penny (Feb 2020)

"So easy to go through the application process, app is very easy to use and you can see the history of your account, payments made and when the next payment is due. Would highly recommend Oakam." - Jane (Feb 2020)

"Fast and simple and I love the fact I can keep track using the app" - Nick (Feb 2020)

See more of our reviews on Trustpilot!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.