Chances are you're tired of the traditional loan process with its long lines and heaps of paperwork

Payday & Cash Advance Loan App

What is it about?

Chances are you're tired of the traditional loan process with its long lines and heaps of paperwork. Fortunately, we've got the perfect solution for you. By downloading our payday cash advance app today, you can simplify your borrowing experience. Our payday cash advance app is optimally designed to make your loan requests a piece of cake. Now, you can get the necessary funds to upgrade your car, pay for your child's education, or take a dream vacation without fussing over needless features.

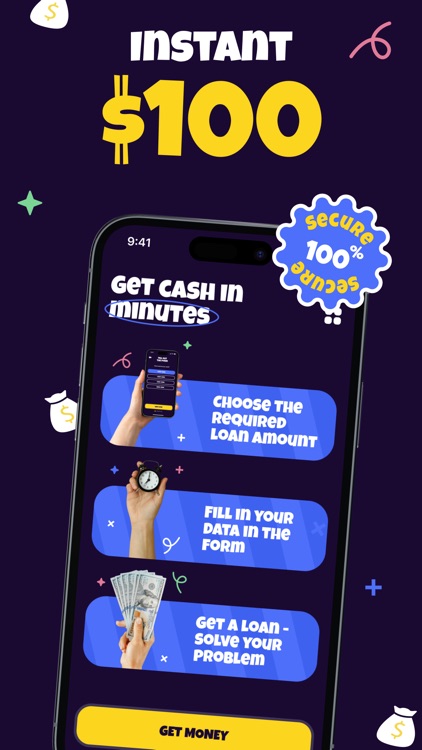

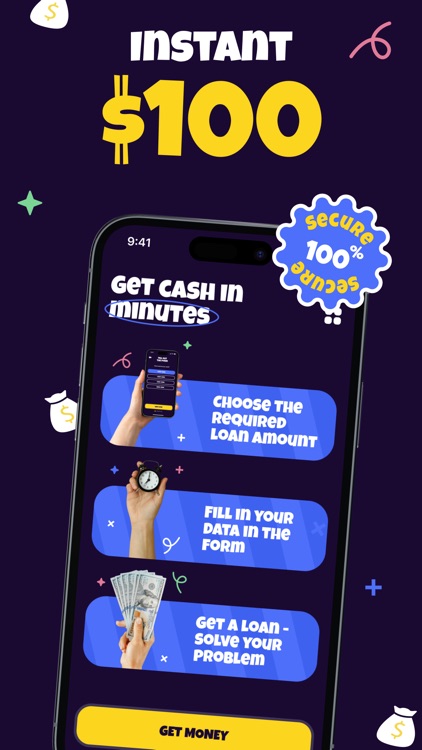

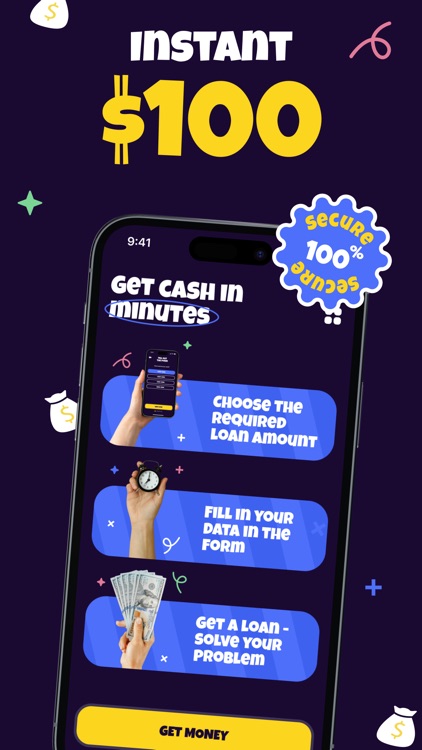

App Screenshots

App Store Description

Chances are you're tired of the traditional loan process with its long lines and heaps of paperwork. Fortunately, we've got the perfect solution for you. By downloading our payday cash advance app today, you can simplify your borrowing experience. Our payday cash advance app is optimally designed to make your loan requests a piece of cake. Now, you can get the necessary funds to upgrade your car, pay for your child's education, or take a dream vacation without fussing over needless features.

With our cash advance loan app, there's no need to stress about complicated forms or waste hours at the bank. You'll have quick access to loan funds and a simple application process. Imagine getting the money you need without leaving your couch – nothing tops that! Did we mention there are no hidden fees or obscure jargon to contend with?

Unlike traditional money lenders, we do not charge for submitting an application. Plus, you can send your loan request 24/7, anytime you need it. So why bother your friends or family when you can handle it with a few taps on your phone? Download our payday cash advance app today and say goodbye to financial hassles forever.

SIMPLE ELIGIBILITY CRITERIA

To use our cash advance loan app, you just need to meet a few requirements. First, you must be at least 18 years old. Second, you need to have a steady source of income, like a part-time job or business. Lastly, you'll need to show a valid ID, like a government-issued ID. For example, if you are 16 years old or don't have any income yet, you may not be eligible. But don't worry, when you're older and earning money, you can apply.

TRANSPARENT TERMS AND CONDITIONS

In our cash advance loan app, we keep things crystal clear terms. First, there are no fees for using our payday cash advance app - zero extra charges! As for loan verification, it's just a simple process to confirm your info. Now, let's talk numbers. Interest rates can vary from 5.99% to 35.99%.

For example, if you borrow $1,000, you might pay back $1,059.80 at an interest rate of 10%. Before you commit, we want to be upfront about everything, so we disclose all loan interest charges, associated fees, and repayment terms. No confusing stuff, just plain language to help you make informed decisions.

ANNUAL PERCENTAGE RATE

Keep track of the attached APR to your loan as it shows the total actual loan cost. Different factors affect the APR, helping borrowers like yourself make smarter choices. Credit scores matter; higher scores mean lower APRs as lenders trust you more. Loan term matters too; longer terms often mean higher APRs due to higher risks. Also, the loan amount can impact the APR; bigger loans might get better terms or lower interest rates from lenders.

MATERIAL DISCLOSURE

When it comes to repaying our small loans, the minimum period is usually 65 days, and the maximum can go up to 2 years. Your loan's APR decides how we calculate the overall cost of borrowing. The APR for our loans can range from 5.99% to 35.99%. It includes not only the loan interest rate but also any additional fees and charges that come with the loan.

Basically, it gives you an idea of how much you'll be paying back in total. For example, if you borrow $1,000 with an APR of 10%, you'll end up repaying $1,100 in total. Keep the APR in mind when considering our payday cash advance app options.

REPRESENTATIVE EXAMPLE

Here's a representative example of the total loan cost:

- Loan amount - $900; loan term - 6 months; APR - 12%. Your monthly repayment is $155,29.

- The total amount payable is $931,76.

- The total interest is $31,76.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.