PayroPH is designed to help Filipino employees to easily compute their net income, government mandated benefits, other deductions and withholding tax based on the Tax Reform for Acceleration and Inclusion (TRAIN) law and applied the new Philhealth circular no

PayroPH

What is it about?

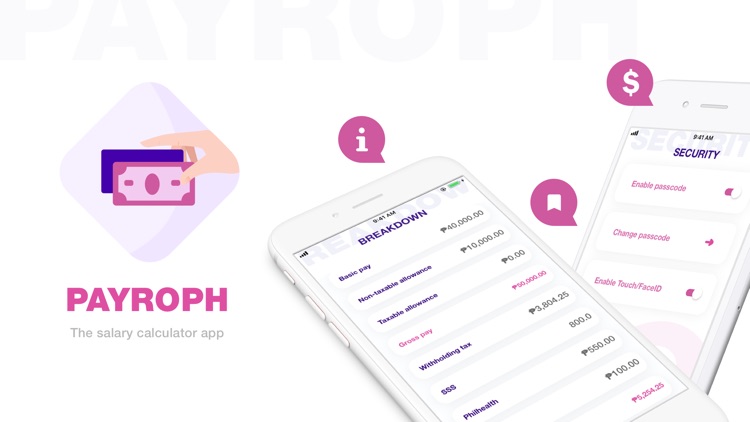

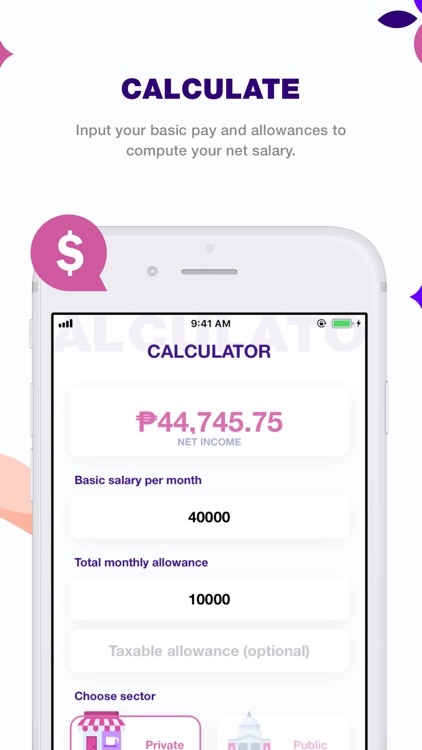

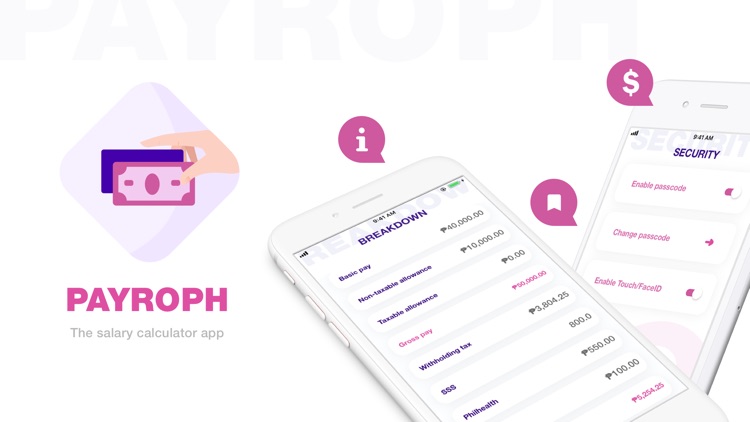

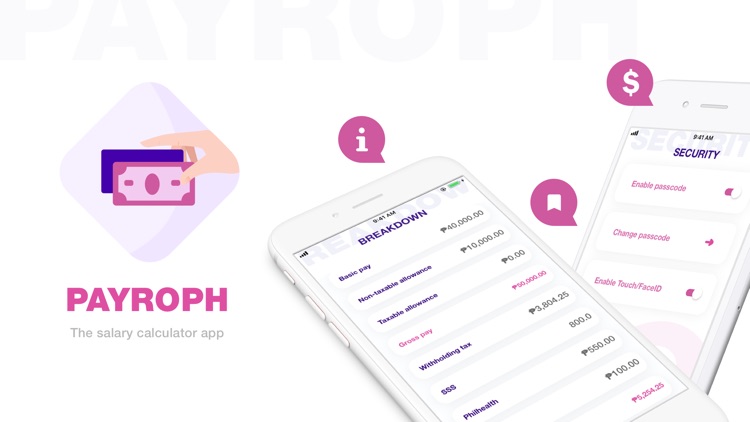

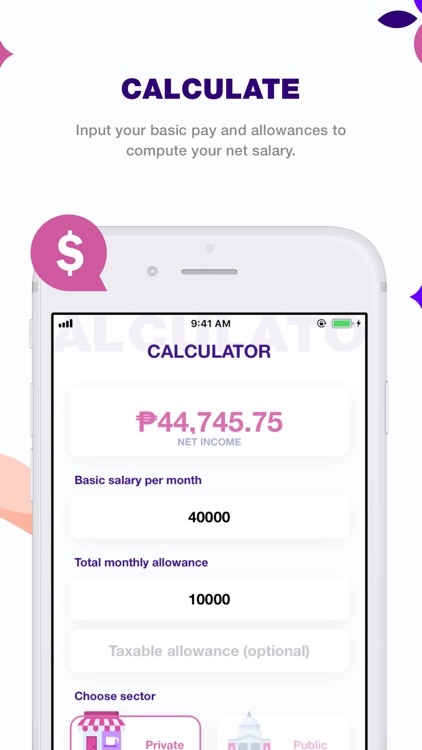

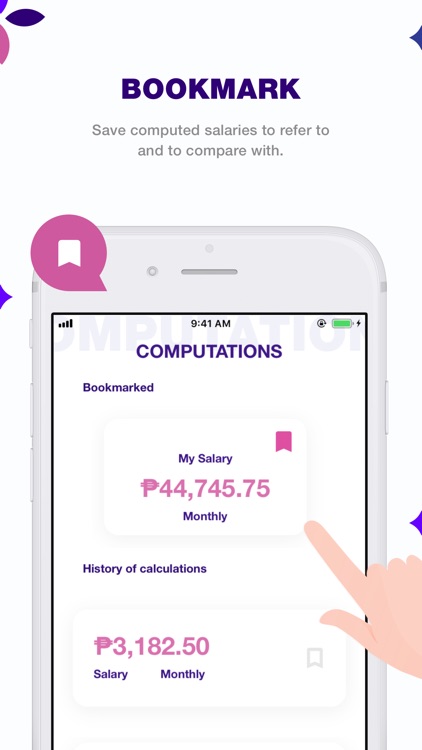

PayroPH is designed to help Filipino employees to easily compute their net income, government mandated benefits, other deductions and withholding tax based on the Tax Reform for Acceleration and Inclusion (TRAIN) law and applied the new Philhealth circular no. 2017-0024.Here are the steps. 1. Categorize your salary based on its frequency - yearly, monthly or semi-monthly. You also get to indicate whether it's from the private or public sector. 2. Input your basic pay and non-taxable allowance, if any. This will determine your gross salary. 3. Enter your deductions such as withholding tax, SSS, PhilHealth, PAG-IBIG, etc. 4. Know your net income! That's it! It's that simple! You even get to bookmark salary computations to serve as reference or for comparison purposes, especially when you're job hunting. Oh, you don't have to worry about security since you can enter your passcode. Download the app now!Disclaimer:PayroPH uses the standard computation and prescribed formula only as of the moment. Results may vary depending on your employer's discretion or some salary customization. This is for personal use only.

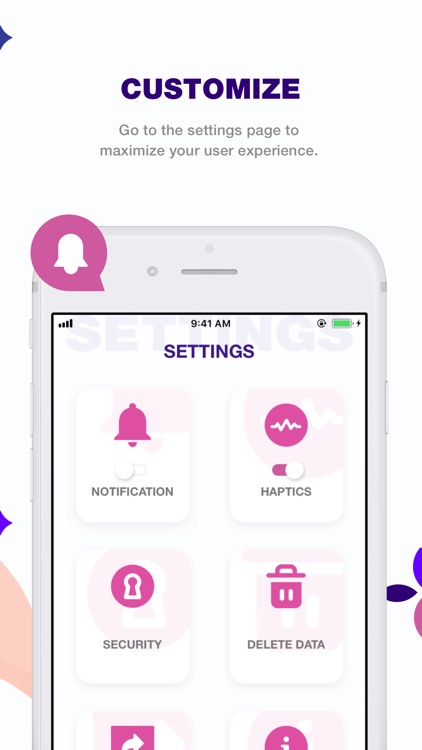

App Screenshots

App Store Description

PayroPH is designed to help Filipino employees to easily compute their net income, government mandated benefits, other deductions and withholding tax based on the Tax Reform for Acceleration and Inclusion (TRAIN) law and applied the new Philhealth circular no. 2017-0024.Here are the steps. 1. Categorize your salary based on its frequency - yearly, monthly or semi-monthly. You also get to indicate whether it's from the private or public sector. 2. Input your basic pay and non-taxable allowance, if any. This will determine your gross salary. 3. Enter your deductions such as withholding tax, SSS, PhilHealth, PAG-IBIG, etc. 4. Know your net income! That's it! It's that simple! You even get to bookmark salary computations to serve as reference or for comparison purposes, especially when you're job hunting. Oh, you don't have to worry about security since you can enter your passcode. Download the app now!Disclaimer:PayroPH uses the standard computation and prescribed formula only as of the moment. Results may vary depending on your employer's discretion or some salary customization. This is for personal use only.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.