Create a 'whole life' model of future financial well-being

PersonalProjexion

What is it about?

Create a 'whole life' model of future financial well-being. You chose how far ahead you want to look.

App Screenshots

App Store Description

Create a 'whole life' model of future financial well-being. You chose how far ahead you want to look.

Answer those important questions - how and when...

- Can we afford that house, that car, those school fees, our retirement?

- Can I stop work early, take a sabbatical, go part-time?

- .... and those other important things to live life to the full.

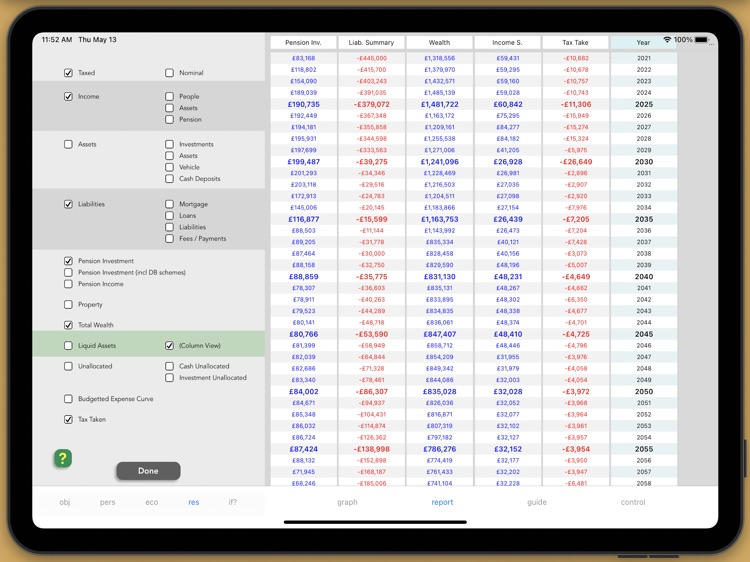

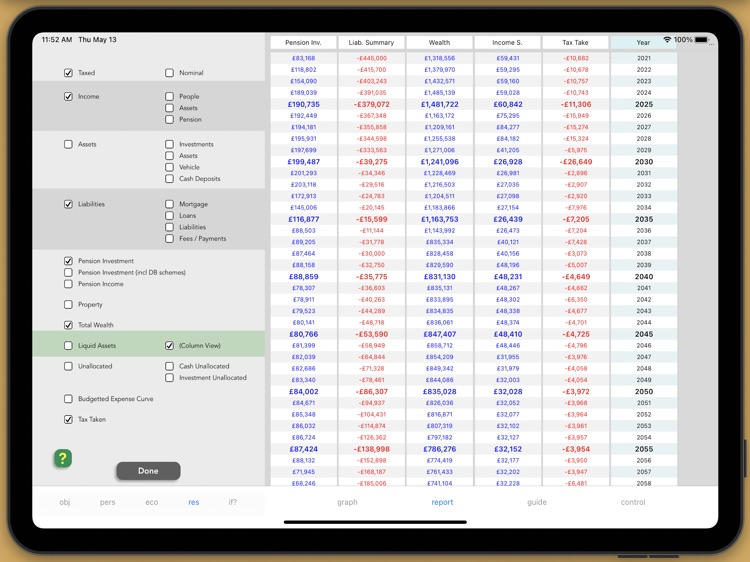

Create a simple to use but sophisticated model of your income, outgoings, assets and costs and see how they change over the years.

Play with different options to understand how your choices are affected. What-if this happens, what-if that changes. Model it and see.

With PersonalProjexion you can show, share and understand ideas and plans about today, tomorrow and your future.

PersonalProjexion Provides:

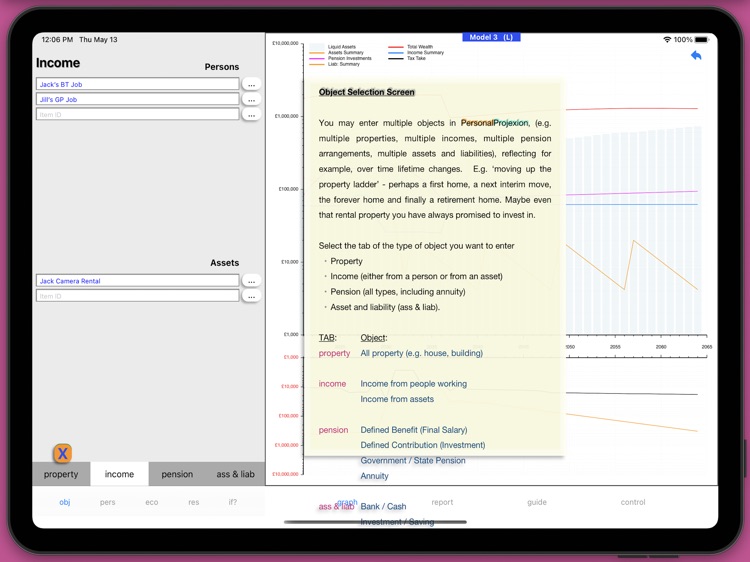

Simplified Lifetime Modelling: Model what you have today and what you plan to have in the years ahead. Tools provided to speed up and simplify the process.

Straight Forward: Simple and easy interface (both graphic and numeric) provides clever and sophisticated information analysis. Optional summary and detailed levels of reporting.

Multiple Models: Create, hold and modify up to five independent models to support different life-time scenarios.

'Auto-Solve': A dynamic and flexible feature to re-allocate resources and demonstrate future solvency. Where PersonalProjexion identifies a resource shortfall to cover your expenses a prioritised re-allocation of resources will try to keep you 'in the black'.

'Auto-Investment': Another dynamic and flexible feature to manage surplus or shortfalls. As in the real-world, unallocated 'cash' (amounts in excess of, or through a shortfall of) planned income and expenditure become subject to maintainable cash, investment or loan rates of interest.

What-If Analysis. Dynamically change key elements of the model (e.g. pension performed better/worse than expected, house prices did/didn't rise as anticipated, income grew faster/slower than believed and others) and see how your future choices will change.

Multiple Annual Expenditure Levels. In the real world, your annual expenditure will change with your stage of life and the events around you. PersonalProjexion allows the maintenance of multiple stages / levels of annual expenditure over the model lifetime.

Types of Entry: All key classes of income, outgoings, assets and costs catered for so your model can be as comprehensive as you choose.

Tax: Choose to have PersonalProjexion work on a gross or net of tax basis.

Real and Nominal View: You choose how you want to see the future. As it will look or based at today's prices.

One or Two People: Models can be for one person or a couple.

Your Privacy: No account required; the application and the data sit in your own data-store.

Help: Extensive help, with context sensitive guidance.

Security: Password security built in.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.