PointCard™ Neon is the premier debit card and mobile banking experience, with unlimited cash-back and benefits

PointCard™ Neon

What is it about?

PointCard™ Neon is the premier debit card and mobile banking experience, with unlimited cash-back and benefits.

App Screenshots

App Store Description

PointCard™ Neon is the premier debit card and mobile banking experience, with unlimited cash-back and benefits.

FDIC insured.* No credit check required.

Learn more at: www.point.app

WHAT YOU GET

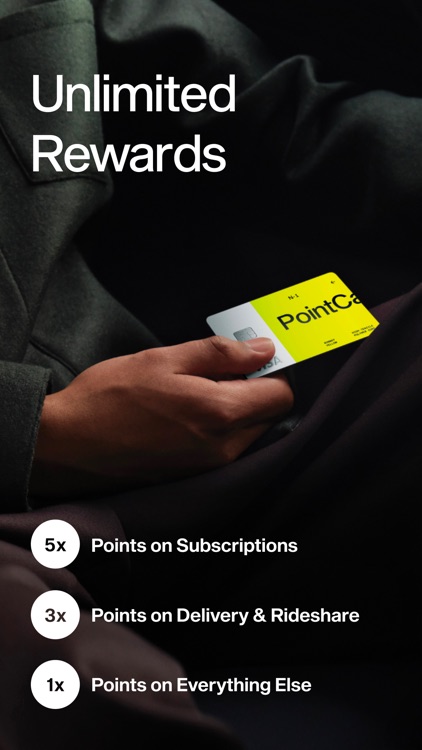

• Card — A debit card designed for unlimited cash-back, exclusive rewards, and comprehensive benefits.

• App — Engineered for clarity and speed, to take your everyday spending and mobile banking experience to the next level.

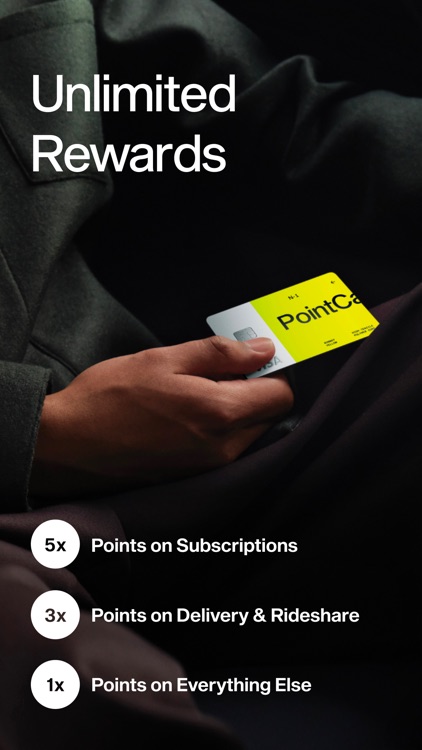

• 5x points on subscriptions like Netflix, Spotify, and more.¹

• 3x points on food delivery and rideshare like DoorDash, Postmates, Uber, Lyft, and more.²

• 1x points on everything else.³

• Phone Insurance — Get reimbursed up to $1,000 per year if your phone is lost or damaged when you pay your phone bill with your PointCard.⁴

• New Purchase Insurance — We’ll reimburse you up to a $1,000 if a new item bought with your PointCard is damaged or lost within 90 days of the purchase.⁵

• Trip Cancellation Insurance — PointCard covers up to $1,500 for any out-of-pocket expenses you incur if your trip is cancelled or delayed.⁶

• Car Rental Insurance — When you pay with your PointCard, you're automatically covered for any physical damage or theft to your rental car.⁷

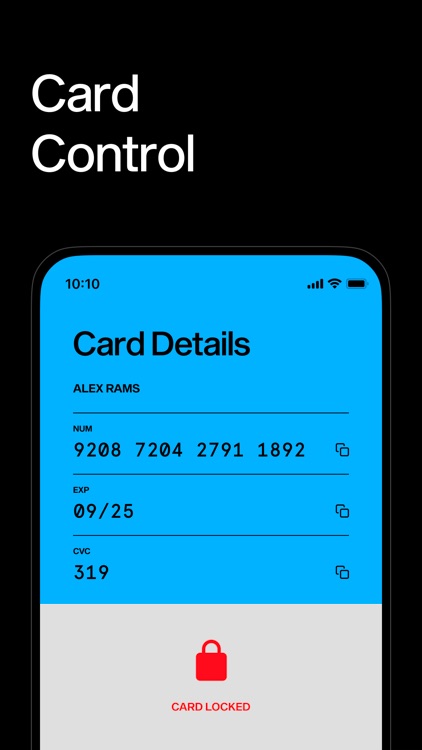

• Virtual Card —An all-digital card designed for online and in-store shopping, virtual card enables you to start spending and earning instantly.

• Card Control — With Point, you’re in complete control. Get notifications the instant your card is charged, change your PIN, and lock your card — anywhere, anytime.

• No international travel fees.⁹

• And much more.

For member support, please email help@point.app or text (650) 539-2701.

1. 5x points on subscriptions is applicable on the following services: Netflix, Hulu, HBO Max, YouTube Premium, Spotify, Pandora, Feather, and Headspace.

2. 3x points on food delivery and rideshare services is applicable on the following services: DoorDash, Uber Eats, Postmates, Caviar, GrubHub, Seamless, Instacart, Good Eggs, Uber, Lyft, and Lime.

3. Purchasing goods and services with your Point card, in most cases, will earn points, excluding balance transfers, cash-like transactions, digital currency purchases, certain gift card purchases and all other forms of manufactured spending.

4. Provides coverage when you charge your monthly phone bill to your Point card and in the event your phone is stolen or damaged (inc. cracked screens), up to $600 per incident, $50 deductible per loss. A maximum of $1,000 per 12 months.

5. Provides coverage for most new items purchased with your Point card that are damaged or stolen within 90 days of purchase, up to $1,000 per loss. A maximum of $25,000 per 12 months.

6. Protects you against forfeited, non-refundable, unused payments if a trip is cancelled or interrupted for covered reasons, up to $1,500 per incident. Coverage applies to common carrier airfare.

7. Pays for physical damage and theft to most rental vehicles when you pay for the entire rental transaction with your Point card and decline the Collision Damage/Loss Damage Waiver coverage offered by the car rental company.

8. Incoming bank transfers typically arrive within 1-3 business days (M-F excluding public holidays) when initiated inside Point app.

9. Covers foreign merchant transaction fees at Visa locations outside the United States.

*Banking services are provided by Column N.A., member FDIC. “Column” is a registered trademark of Column National Association. Point Up Inc. © 2022 All Rights Reserved. Benefits are subject to terms, conditions and limitations, including limitations on the amount of coverage. Please refer to terms for additional details.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.