Qcash makes it efficient for you to access credit anytime, anywhere

Qcash-QuickCredit

What is it about?

Qcash makes it efficient for you to access credit anytime, anywhere.

App Screenshots

App Store Description

Qcash makes it efficient for you to access credit anytime, anywhere.

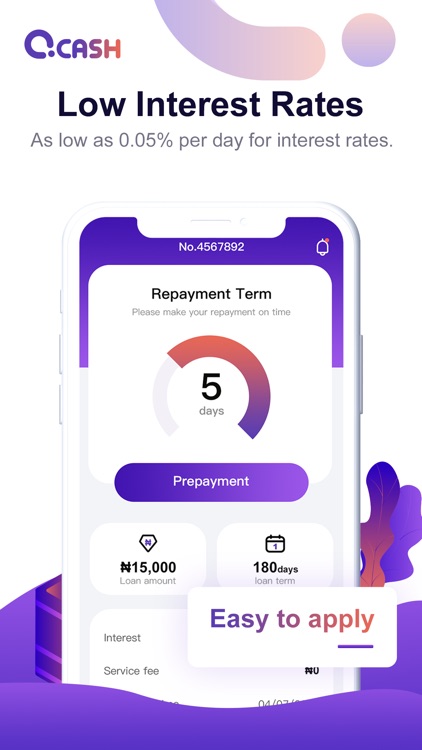

Loan Products:

Tenure: We will require your repayment from 91 days to 365 days*.

Loan Amount: from NGN 3,000 to NGN 500,000.

Interest Rate: With a minimum of 0.1% up to 1%

Our interest rate is calculated on a daily basis. Annual Percentage Rate(APR) from 36.5% to 360%.

Origination Fee: Range from NGN 1,229 – NGN 6,000 for a one-time charge

For example, 91-day loan payment terms have a processing fee of 41% and an interest of 9.1%. For the loan processed with a principal amount of NGN 3,000, the processing fee would be NGN 1,229, the interest would be NGN 273, the total amount due would be NGN 4,502.The total amount due in the first month would be N1,512, the processing fee would be N419, the interest would be N93, the total amount due in the second month would be N1,495, the processing fee would be N405, the interest would be N90, the total amount due in the third month would be N1,495, the processing fee would be N405, the interest would be N90.

Qcash is a Convenient Personal Loan Platform for Nigeria mobile users. Presented by Blue Ridge Microfinance Bank Limited. Qcash fulfills customers’ financial needs 7*24 completely online. The application process takes just a few steps with minimal documentation and the approved loan amount is transferred to the applicant’s bank account

Why Qcash?

1.You can apply a loan by your credit. Don't need any deposits or guarantees.

2. Up to NGN500,000. Disburse to your bank account.

3.Paperless and digital process on your mobile. All the steps can be done online.

4.We do not share your data with any third parties without your consent. Your data is totally safe with us.

5.Don't worry about forgetting repayment. We'll send messages to remind you.

How it works?

1. Install the Qcash APP from the Play Store.

2. Register an account.

3. Select the product you would like to apply for.

4. Fill out your basic information, then submit the application.

5. After the submission, you may receive a call for verification. The final application result will be shown in the APP and you will be informed by SMS if approved.

6. E-sign the loan agreement after the approval.

7. After the E-sign, the approved loan amount will be disbursed into your account shortly and a SMS notification will be sent.

Eligibility:

1. Nigeria Resident.

2. 20-55 years old.

3. Source of a monthly income.

Contact Us:

Customer Service Email: wangbaiwan668@gmail.com

Address: Room 302, Japaul House, Plot 8 Dr. Nurudeen Olowopopo Way, Central Business District, Ikeja, Lagos, Nigeria

*Please note we will give you several options for you to select when do you want to repay the loan.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.