You are using an outdated browser. Please

upgrade your browser to improve your experience.

The Research and development (R&D) tax incentive encourages companies to engage in R&D benefiting Australia, by providing a tax offset for eligible R&D activities

R&DTAX

by DIY GRANTS ONLINE PTY LTD

What is it about?

The Research and development (R&D) tax incentive encourages companies to engage in R&D benefiting Australia, by providing a tax offset for eligible R&D activities. It has two core components:

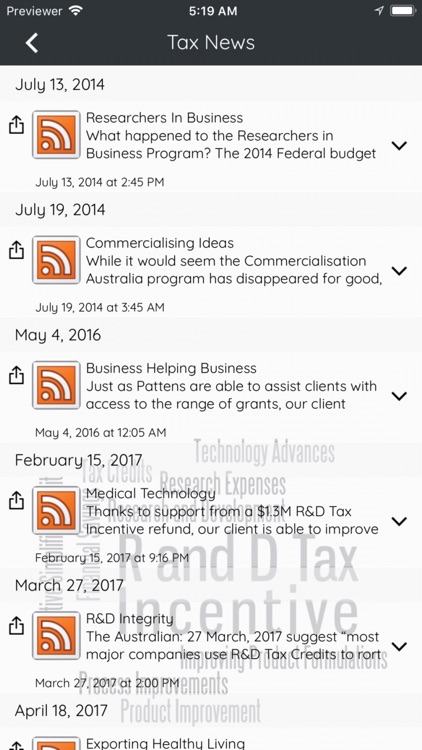

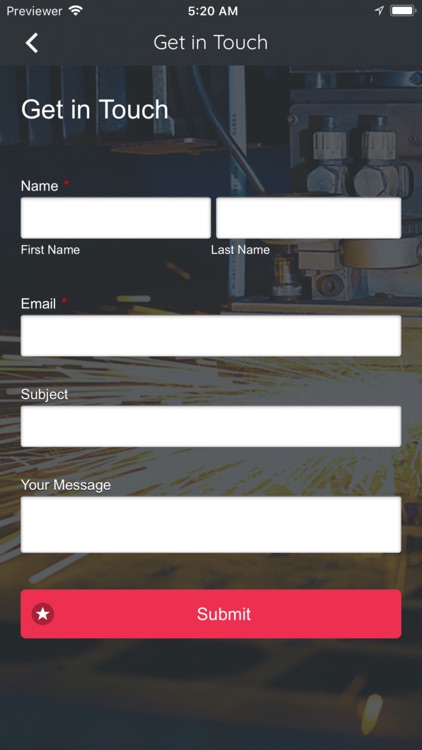

App Screenshots

App Store Description

The Research and development (R&D) tax incentive encourages companies to engage in R&D benefiting Australia, by providing a tax offset for eligible R&D activities. It has two core components:

- a refundable tax offset for certain eligible entities whose aggregated turnover is less than $20 million

- a non-refundable tax offset for all other eligible entities.

The R&D tax incentive replaced the R&D tax concession from 1 July 2011, and applies differently from the concession.

Disclaimer:

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.