Raiffeisen mobilno Bankarstvo – R'm'B - za život u pokretu

Raiffeisen mobilno bankarstvo

What is it about?

Raiffeisen mobilno Bankarstvo – R'm'B - za život u pokretu

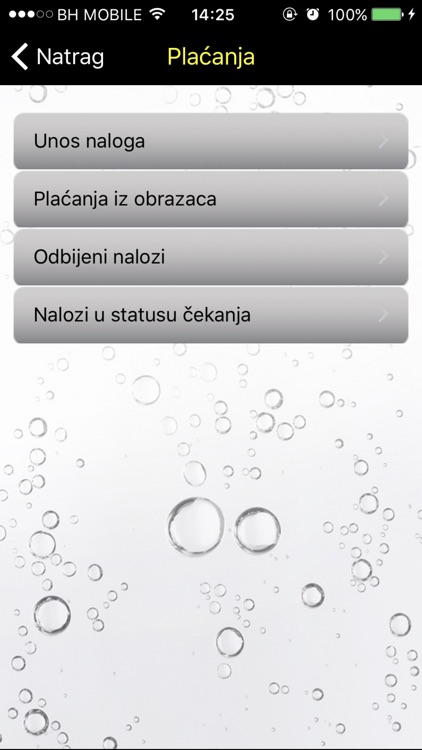

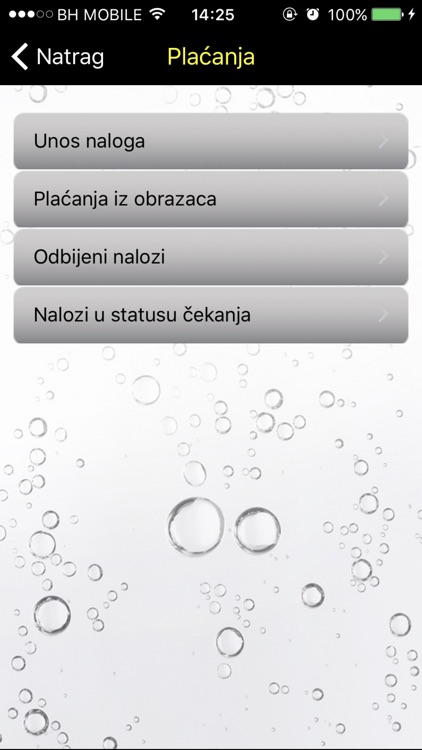

App Screenshots

App Store Description

Raiffeisen mobilno Bankarstvo – R'm'B - za život u pokretu

Šta je Raiffeisen mobilno bankarstvo – R'm'B?

Raiffeisen mobilno bankarstvo je usluga koja Vam omogućava da, putem Vašeg mobilnog telefona, u svakom trenutku, imate brz i jednostavan pristup Vašim računima i ostalim informacijama vezanim za poslovanje sa Raiffeisen bankom, uz mogućnost vršenja finansijskih transakcija.

Koji su preduslovi za korištenje R'm'B usluge?

Korisnik usluge Raiffeisen mobilno bankarstvo može biti svaki klijent Banke, domaće i strano fizičko lice, koji je vlasnik debitne kartice/tekućeg računa i mobilnog telefona sa mogućnošću pristupa Internetu.

Šta omogućava R'm'B?

Usluga Raiffeisen mobilno bankarstvo omogućava:

•Pregled stanja i detalja računa,

•Pregled prometa po računima,

•Obavljanje transakcija između vlastitih računa i računa fizičkih i pravnih lica u Raiffeisen banci,

•Obavljanje transakcija na račune fizičkih i pravnih lica u drugim bankama u BiH

•Konverziju deviza

Koje su prednosti korištenja Raiffeisen mobilnog bankarstva?

Prednosti korištenja usluge R'm'B su:

•Dostupnost 24 sata bez obzira na radno vrijeme Banke,

•Povoljnije naknade za realizaciju naloga,

•Korištenje usluge gdje god je omogućen pristup Internetu,

•Maksimalna sigurnost i diskrecija uz primjenu najsavremenijih sigurnosnih tehnologija,

•Praćenje svjetskih trendova i ušteda vremena.

Koliko je sigurno koristiti Raiffeisen mobilno bankarstvo?

Raiffeisen banka koristi najsavremenije tehnologije zaštite i sigurnosti. Pristup aplikaciji Raiffeisen mobilnog bankarstva zaštićen je jedinstvenim PIN-om kojeg klijent samostalno generiše prilikom prve prijave što garantuje zaštitu i privatnost finansijskih transakcija. Dodatnu sigurnost predstavlja softverski token koji se automatski, zajedno sa aplikacijom, instalira na mobilni uređaj.

Raiffeisen Mobile Banking - RmB - For a life on the trot!

What is Raiffeisen Mobile Banking – R'm'B?

Raiffeisen Mobile Banking is a service that provides you with quick and simple access to your accounts and other details related to your business with Raiffeisen Bank and to make financial transactions, anytime via your mobile phone.

What criteria have to be met for the R'm'B service?

Any customer of our bank, resident or non-residents who has a debit card/current account and a mobile phone with internet access can register to the service.

What can you do with R'm'B?

Raiffeisen Mobile Banking allows you to:

•Check your account balance and details;

•Check your account movements;

•Transfer funds to your personal accounts and other private and corporate customers' accounts with Raiffeisen Bank;

•Transfer funds to private and corporate customers’ accounts with other banks in the country;

•Make foreign currency conversions;

What are the benefits of Raiffeisen Mobile Banking?

R'm'B has these benefits:

•Available 24 hours a day - regardless of our opening hours;

•Favourable fees for execution of orders;

•Usable anywhere with internet access;

•Maximum security and confidentiality thanks to state-of-the-art security technologies;

•If follows global trends and saves you time.

How safe is Raiffeisen Mobile Banking?

Raiffeisen Bank implements state-of-the art security and safety technologies. Access to the Raiffeisen Mobile Banking application is protected by a user-specific PIN which the customer generates on his own during the first registration and which guarantees protection and privacy of his financial transaction. Additional security is provided by a software token which is automatically installed to the mobile phone, together with the application.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.