In a crowded, commoditized market with ads filling our mailboxes offering appeals for a significant percentage of your savings, we decided to break the mold

Residential Tax Appeal

What is it about?

In a crowded, commoditized market with ads filling our mailboxes offering appeals for a significant percentage of your savings, we decided to break the mold. RTA offers the most affordable property tax appeal service on the market for residents of Cook County Illinois!

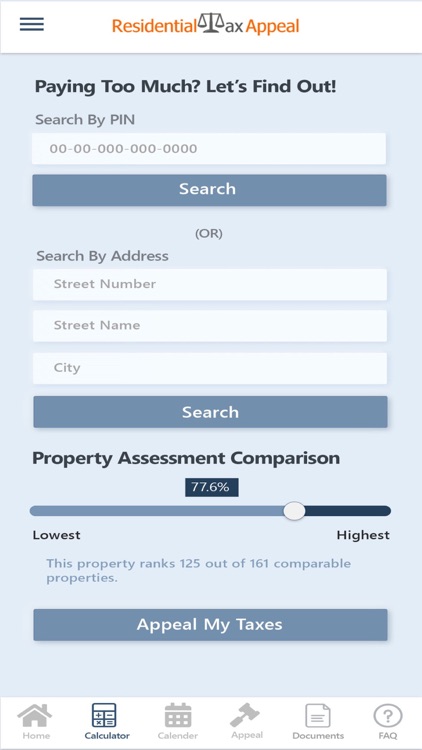

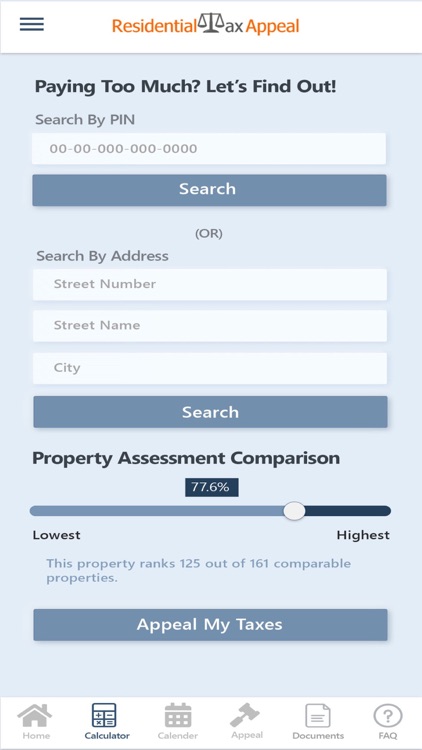

App Screenshots

App Store Description

In a crowded, commoditized market with ads filling our mailboxes offering appeals for a significant percentage of your savings, we decided to break the mold. RTA offers the most affordable property tax appeal service on the market for residents of Cook County Illinois!

The RTA App offers homeowners the ability to:

* See how your assessed value ranks to comparable properties.

* Keep a real-time view of the appeal calendar so you don't miss your township's deadline.

* Stay up to date with the latest topics affecting property taxes in Cook County IL.

* Sign up for the affordable, fixed-fee RTA Appeal Service.

The RTA Difference

Any Device, Any Time: Do you prefer a computer over your mobile device? Are you always on the move and rely on your tablet or mobile phone? RTA has you covered with the first and only platform to appeal your residential property taxes using any device.

Don't Break the Bank: We use the same data as others that charge a percent of your savings. Why pay more? RTA helps Cook County residents lower their property tax assessments for a one-time, budget friendly cost. The more you save, the more YOU save!

If at first you don't succeed: We monitor the appeal calendar to ensure you file on time. If your initial appeal is unsuccessful, we’ll prepare everything you need to file a re-review. If that doesn’t work, the third time is often a charm with the Board of Review appeal. All three for the price of one!

Learn More

Cook County IL homeowners have seen the assessed values on their property climb over many years, and some residents are paying far more property taxes than they should.

The Cook County’s Assessor’s Office is responsible for valuing the more than 1.8 million parcels in Cook County, and though they are doing their best to keep assessments fair and accurate, it doesn't always work out. Homeowners are encouraged to appeal their assessments each year if they believe theirs is too high, but the reality is that less than 20% of homeowners file an annual appeal.

Do I need the help of an attorney? The short answer is no. Cook County allows homeowners and property tax services like ours to have the same access that lawyers have to the public records and required documentation. Recent statistics show that most homeowners appealing to the Assessor’s Office do not use an attorney.

So why can't I just do this myself? You can! The question you need to consider is “Do I want to spend the time to learn the process, search for comparables, identify the best candidates to use, and file the appeal?“. If you have the time and desire, by all means go for it. Many people do. If you would rather have help at an affordable price and spend just a few minutes of your time, we’re here to assist.

What are you waiting for? Download the FREE RTA app today!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.