What We Do

ReWise Financial

What is it about?

What We Do

App Screenshots

App Store Description

What We Do

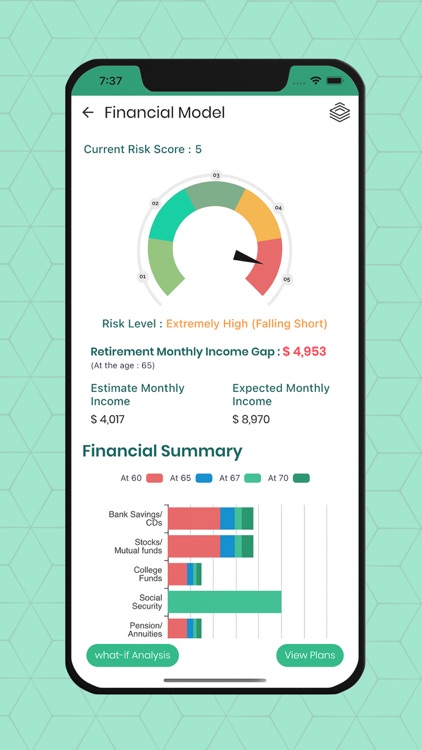

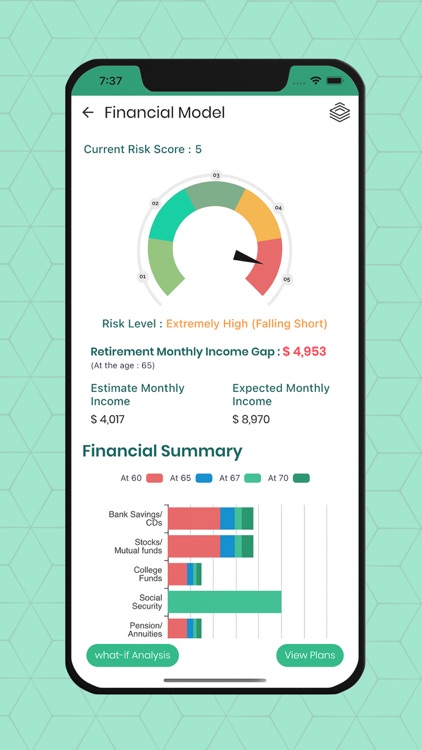

Financial & Retirement Planning

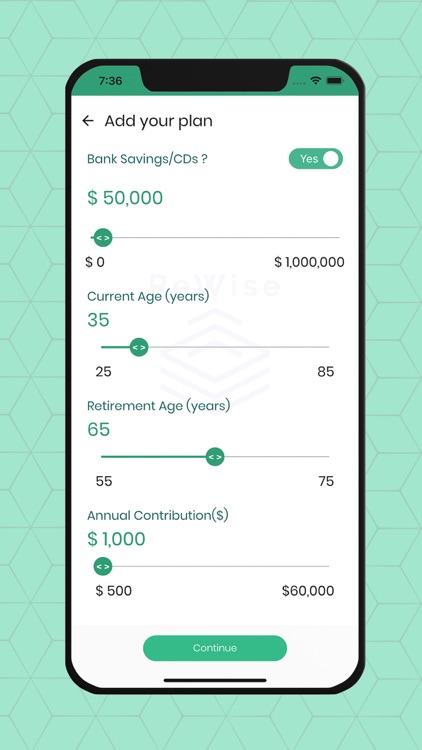

Our platform creates efficient ways to diversify portfolios by keeping financial protection and tax diversification in mind. ReWise calculates tax-deferred accumulation potential with financial reassurance to beneficiaries. We empower our clients to march towards financial freedom by educating and providing multiple options of supplemental income during the retirement period.

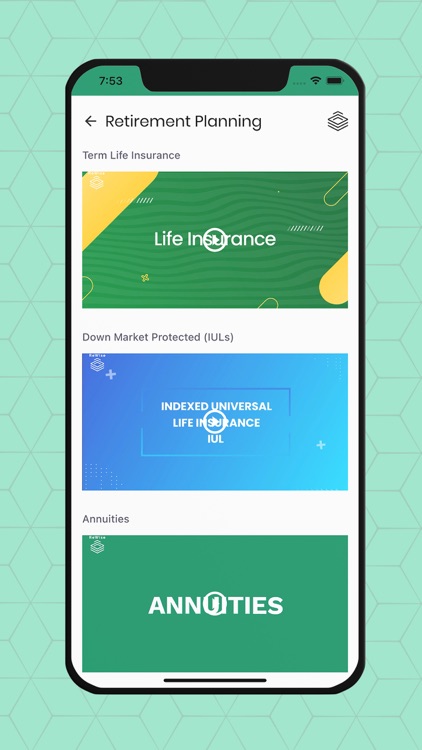

Term Life Insurance

ReWise provides a comparative analysis of different life insurance products from various carriers and suggests the best policy that suits the financial model and the risk score of its clients. Recommendations are designed by paying close attention to all eligible living benefits and other riders that are important to consider in a policy.

Down Market Protected Investments (IULs)

ReWise performs gap analysis between retirement savings and client's retirement goals to strategize and minimize market risks and exposures by investing in down market protected funds. We take into account market volatility, longevity, taxes, and inflation to design investment products that offer accumulation potential of the cash value without adding market risk.

Annuities

Our platform conducts a data-driven analysis of immediate and deferred annuities to identify its suitability for a given client's financial needs and goals. We design fixed annuities to address long-term financial goals, legacy transfer, and manage the required minimum distributions (RMDs) and avoid potential tax penalties.

Start Learning

Term life insurance may lose its value against the inflation rate over the next 20 or 30 years. Is having term life insurance good enough?

Ask ReWise professionals for alternatives and free financial analysis.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.