I am a Landscaper or a Day Care Assistant or a Yoga Instructor or any other person who works as an Independent Contractor

SETS-Self Employed Tax Service

What is it about?

I am a Landscaper or a Day Care Assistant or a Yoga Instructor or any other person who works as an Independent Contractor. Amazingly in our country you are part of a group of over 30 million individuals.

App Store Description

I am a Landscaper or a Day Care Assistant or a Yoga Instructor or any other person who works as an Independent Contractor. Amazingly in our country you are part of a group of over 30 million individuals.

You are not an employee and as such not paid by an employer. As a result, the taxes that the employer would normally withhold and submit on your behalf is on your shoulders to take care of in a responsible and timely manner.

You may or may not know that your Tax obligations are due on a quarterly basis, you also in all likelihood may not know how to calculate all the different taxes you are responsible. You are not part of the minority, in fact over 95% of Independent Contractors do not know how to accurately calculate each of their Tax obligations.

What resources are available to you? In most cases you may not be able to afford an Accountant on a Quarterly basis on top of the dreaded (fear not really) annual Tax Return. While they can and will provide a great service in all likelihood you will be able to afford using an Accountant.

Well, fear not one innovative service is the SETS app combined with the free on-going Consultation services we offer all Independent Contractors regarding what their Tax obligations are.

Here is a simple example – you are a landscaper who has 5 clients who you service weekly each for $100.00. Each week you receive 5 checks each for $100.00 totaling $500.00. You aren’t paid by an employer so the taxes were not withheld, well searched and found our app SETS and downloaded it on your smart phone or Ipad.

First, well actually first deposit the 5 checks into your bank account or Credit Union account. Now you want to know how much to set aside from your total Income that you just deposited to pay for each Tax obligation that will due on the next Quarterly Due date.

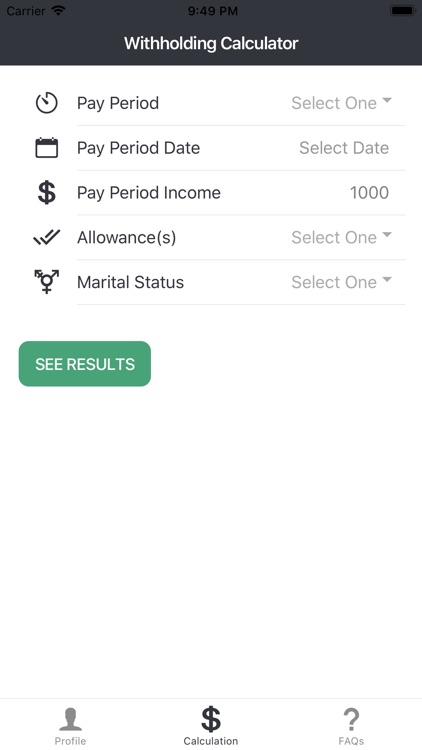

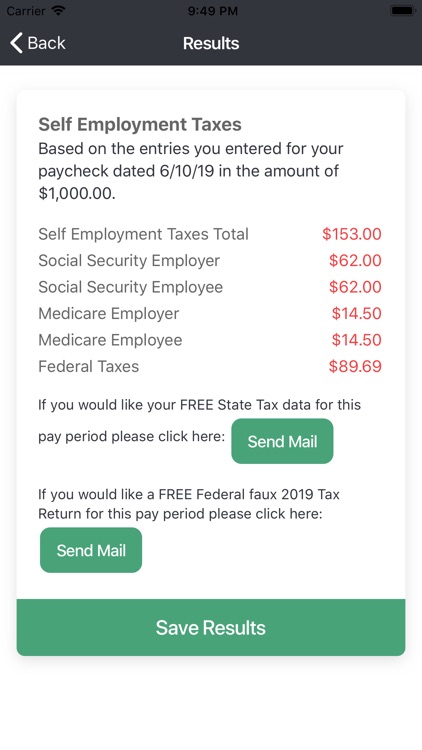

The app will ask you to enter 5 fields. Once you enter the 5 fields you will hit the “results” button. In seconds the app will Calculate the Federal Taxes you need to put aside for the 5 checks totaling $500.00.

But, you live in a state that wants their State Tax share, to obtain the State Tax calculation for the total income for this pay period Press the green button for a Free State Tax Calculation. SETS will receive a request from you for the State Tax Calculation. A report will be generated informing you of your Tax obligation for this pay period and emailed to you at the email in your profile.

Now you have both the Federal Tax and NY State Tax total that you need to set aside from this week’s Income.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.