BullLabs

Stock Market Sector Indexes

What is it about?

BullLabs.com publishes sector and industry specific stock market indexes. These are market capitalization weighted stock market price indexes of companies from specific sectors or industries. This App provides publication of US stock market indexes based on the industry classification containing indexes from 11 sectors, 69 industries of over 600 public companies with stocks traded on the NYSE, NASDAQ, AMEX exchanges and the OTCBB (Over-the-counter Bulletin Board). Index data are calculated and updated on a daily basis with periodically allocation adjustments based on the market capitalization of each individual component.

App Screenshots

App Store Description

BullLabs.com publishes sector and industry specific stock market indexes. These are market capitalization weighted stock market price indexes of companies from specific sectors or industries. This App provides publication of US stock market indexes based on the industry classification containing indexes from 11 sectors, 69 industries of over 600 public companies with stocks traded on the NYSE, NASDAQ, AMEX exchanges and the OTCBB (Over-the-counter Bulletin Board). Index data are calculated and updated on a daily basis with periodically allocation adjustments based on the market capitalization of each individual component.

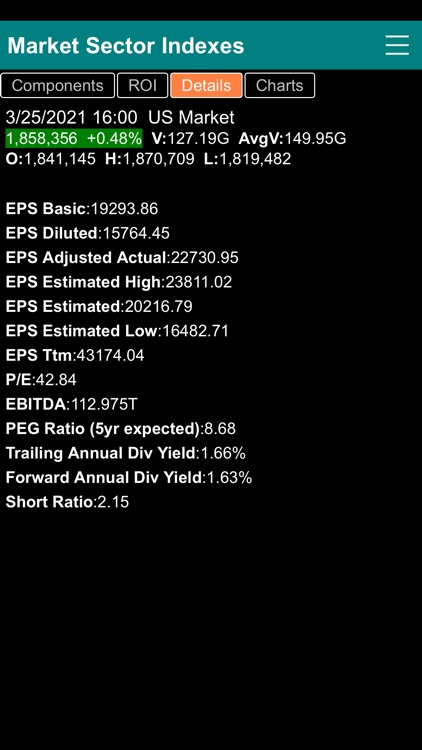

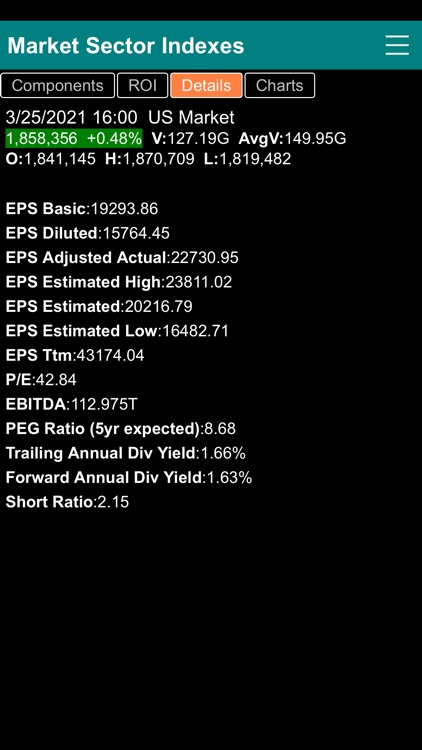

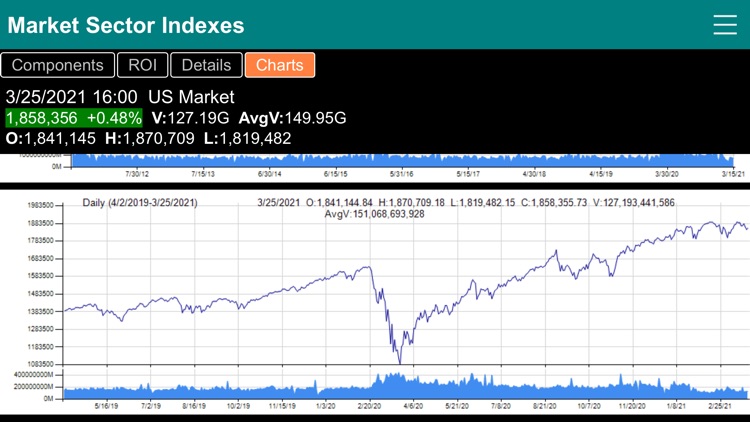

The app includes four types of information for each sector or industry index. The Components screen gives a list of underlying components of the index with daily prices and gains/losses. The Performance screen shows the list of components of the index with performance data from daily, weekly, monthly, 3-month, 6-month and one year periods. The Details screen gives specific information of each index, including the daily trading volume, the 52-week average volume, the allocation percentage of the industry within the sector, earning per share (EPS ttm) of the index and the Price to Earning (P/E ttm) of the index. The Graph screen gives the monthly, weekly and daily price chart of the index.

Sector and Industry specific indexes allow investors to benchmark the performance of investment based on specific stock market sectors or industries. Just as all stocks tend to move based on the underlying factors that drive the overall market, stocks in a similar industry tend to move based on underlying factors that affect the industry. One of the most basic methods for understanding the risk of an investment portfolio is to determine its sector breakdown. Is the portfolio spread across different industrial sectors or is it concentrated in just a few? This provides a good indication of how an investment portfolio will respond to macroeconomic factors or industry trends.

Market sector and industry indexes are also essential tools for the Sector Rotation Investment Strategy. A rotation strategy is very similar in approach to tactical asset allocation, but rather than asset classes, the investor will allocate his funds to specific sectors or industries depending on the short-term view. The investor will overweight the sectors or industries that he or she believes will outperform and underweight those expected to underperform.

Sector and industry information are very important not only for the underlying research that drives the rotation strategy but also in its implementation. Companies in the same or similar industries are analyzed in a similar fashion. Understanding the industry is very helpful when valuing companies because different industries might have more useful valuation metrics than others. In some industries, cash flow or EBITDA might be more relevant than earnings in stock valuation. As such, comparing companies from the same industry is easier - it is not a coincidence that equity research analysts generally cover companies that are in the same industry.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.