In a recent study by Forbes, 56 percent of Americans have less than $1000 in their checking or savings account

SuSu Money

What is it about?

In a recent study by Forbes, 56 percent of Americans have less than $1000 in their checking or savings account. These numbers are much lower in emerging economies. This basically means that more than half of the population is living paycheck-to-paycheck.

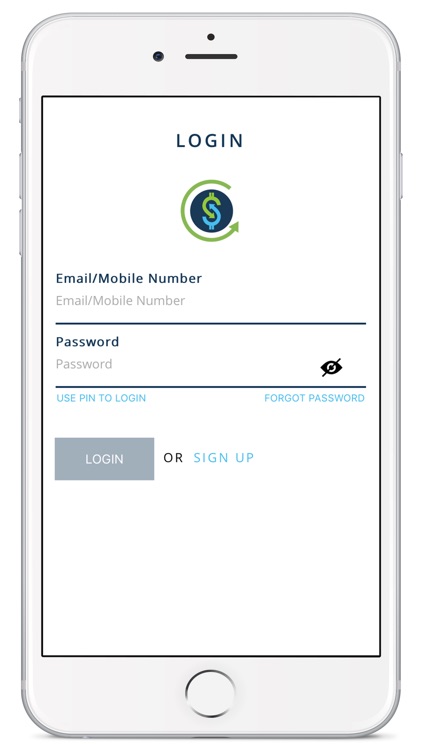

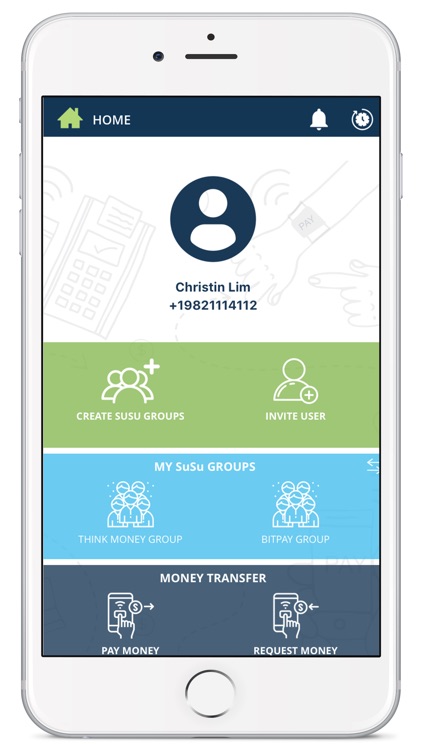

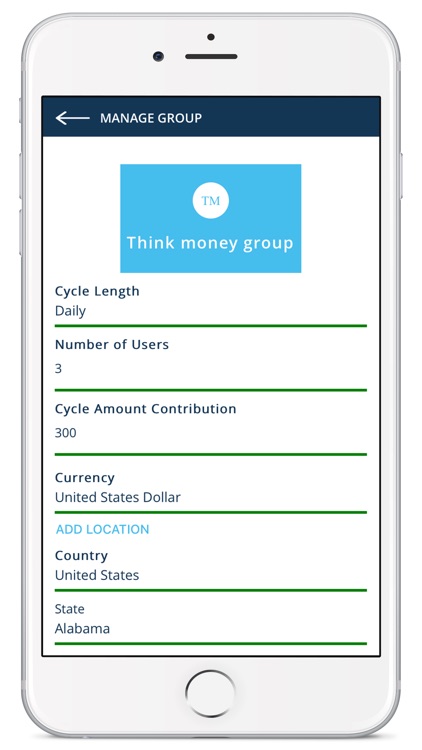

App Screenshots

App Store Description

In a recent study by Forbes, 56 percent of Americans have less than $1000 in their checking or savings account. These numbers are much lower in emerging economies. This basically means that more than half of the population is living paycheck-to-paycheck.

Traditionally, cash strapped individuals and entrepreneurs have been solely dependent on IRAs or short term Loan products which have its restrictions.

Formal sector credit is often out of reach due to high interest rates. Banks also demand collaterals that many informal entrepreneurs cannot provide and widely ruling un-regulated banking practices may imply additional costs to facilitate the application process. The traditional process takes time and can be very costly while the Susu Money App provides access to credit that would otherwise not be available.

SuSu is based on this premise—saving money with fewer restrictions with people you are familiar with (or share a similar financial goal) and get the money when you want. Also, you are essentially getting loan at 0% interest. This eliminates the need for short term costly traditional banking products saving. This idea has been around for hundreds of years in most African and Caribbean countries and is now available on your phone with the Susu Money Turn App.

Core Features

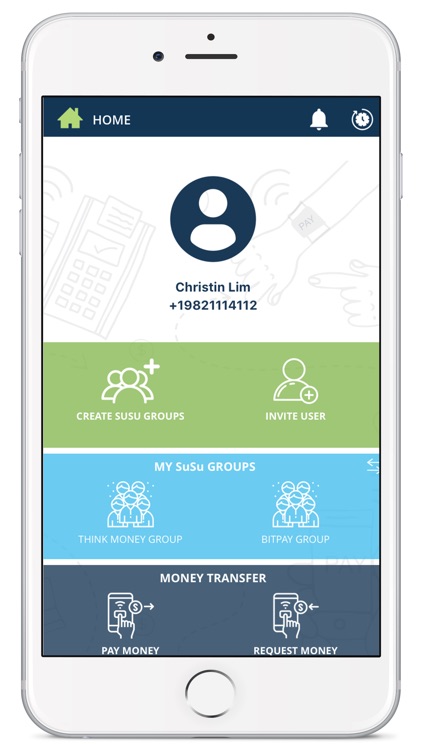

-Create SuSu groups (Money pools)

-Add users to your SuSu group(s).

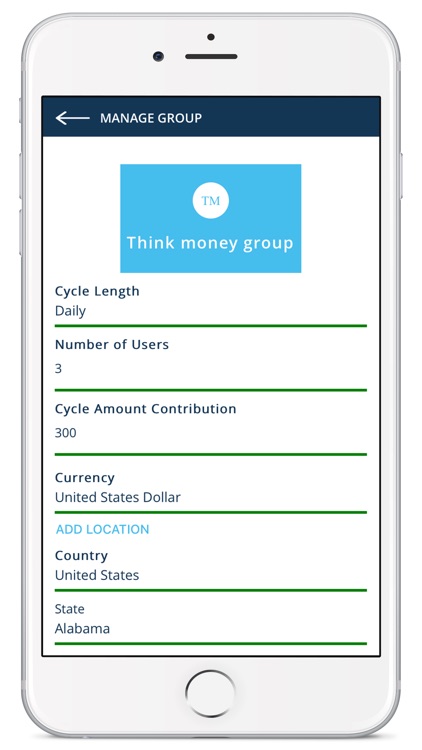

-Manage Group settings

-View Groups you have joined.

-View group transactions.

-Request one-time payment from friends.

-Make one time payment to friends back account

-Invite friends to join SuSu Money App

FAQs

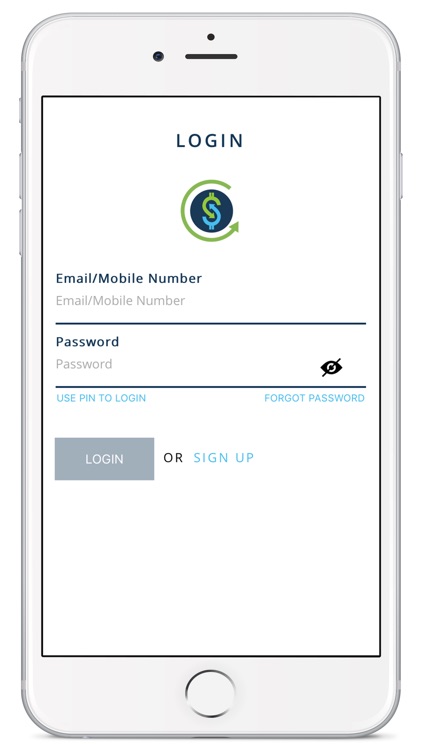

1. How can I Sign up?

To sign up, simply download the app from the Apple store and follow easy steps to create a profile and add funding source (bank account).

2.How Can I Join a group?

There are two ways someone can join a group; via invitation or start your own group. If you get an invite to join the group, you will need to sign up and accept the invitation request. If you want to start your own group, simply follow steps for creating groups.

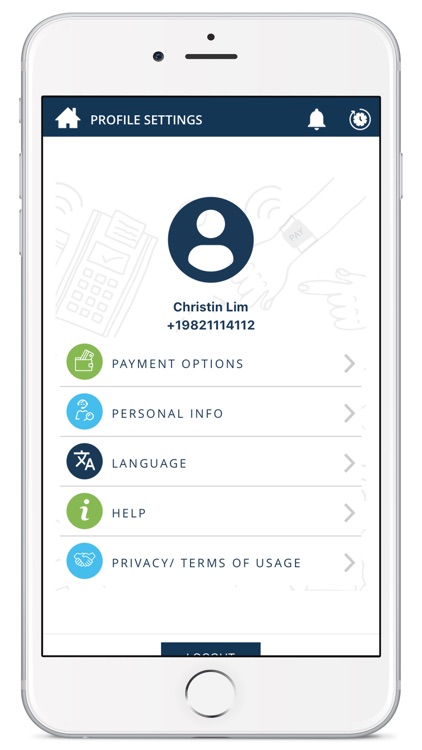

3. Is the SuSu MoneyTurn app secure?

We built this app with user security as a top priority. We have used state of the art security technologies to ensure you have a peace of mind.

4. How much does the SuSu MoneyTurn app cost?

The SuSu MoneyTurn app comes at no cost to you. You can download at the Apple Store. However, you will be charged 1% of total group transactions.

5. Does using the SuSu MoneyTurn App have any effect on my credit rating?

No, SuSu MoneTurn App does not have any effect on your credit.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.