"Tax Calculator - Simple Edition" is an easy-to-use application for understanding the price of new products

Tax Calculator - Simple Editio

What is it about?

"Tax Calculator - Simple Edition" is an easy-to-use application for understanding the price of new products. You may have realized that the Indian government has revolutionized the tax system by eliminating all unnecessary tax systems and implementing simple tax product and service taxes. As

App Store Description

"Tax Calculator - Simple Edition" is an easy-to-use application for understanding the price of new products. You may have realized that the Indian government has revolutionized the tax system by eliminating all unnecessary tax systems and implementing simple tax product and service taxes. As

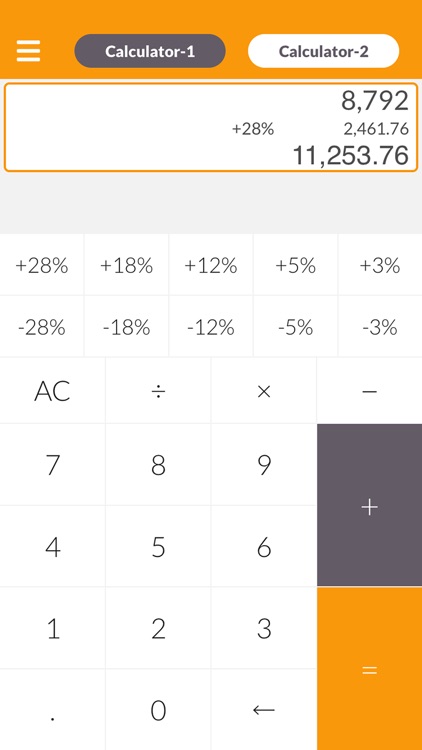

Enter the base amount of the product. Select the tax level in which the product is located. You will receive the net price of the product immediately, including the consumption tax.

For example, the basic amount you enter is 100 rupees and you choose a tax rate of 18%. You will automatically receive a net amount of Rs 118.

You can also use the reverse method. You can enter the net price of the product and choose a tax rate. It will automatically remove the tax from the net price and you will be able to get the base price.

For example, the net amount you enter is 100 rupees and you choose a tax rate of 18%. You will automatically get a reply of 84.75

According to the GST Committee India, there are currently six tax levels, as follows: 0%, 3%, 5%, 12%, 18% and 28%.

The Goods and Services Tax Calculator application works offline, so you can use it whenever you don't have an Internet. This is not an official app, but we use the most reliable data provided by the tax department.

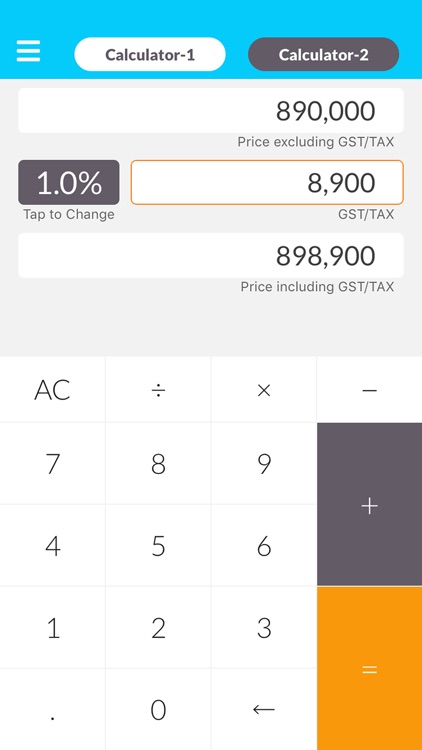

Enter the base amount of the product. Select the tax level in which the product is located. You will receive the net price of the product immediately, including the consumption tax.

For example, the basic amount you enter is 100 rupees and you choose a tax rate of 18%. You will automatically receive a net amount of Rs 118.

You can also use the reverse method. You can enter the net price of the product and choose a tax rate. It will automatically remove the tax from the net price and you will be able to get the base price.

For example, the net amount you enter is 100 rupees and you choose a tax rate of 18%. You will automatically get a reply of 84.75

The Goods and Services Tax Calculator application works offline, so you can use it whenever you don't have an Internet. This is not an official app, but we use the most reliable data provided by the tax department.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.