Do your banking at the touch of a button with Timiza from Absa Bank Kenya

Timiza

What is it about?

Do your banking at the touch of a button with Timiza from Absa Bank Kenya!

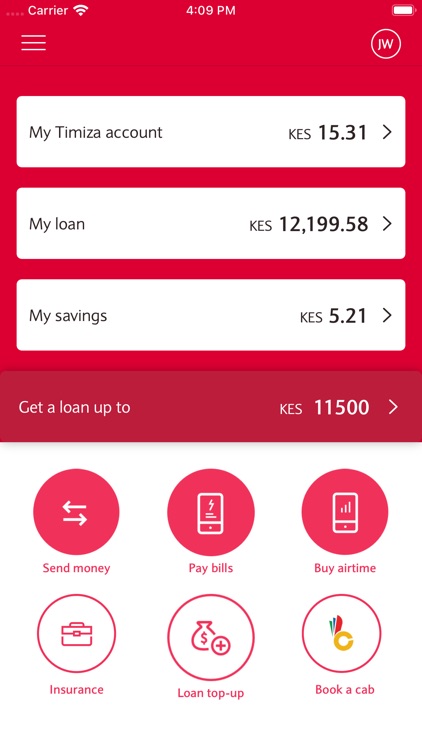

App Screenshots

App Store Description

Do your banking at the touch of a button with Timiza from Absa Bank Kenya!

With Timiza you can do your banking on your phone whether you want to open an account, get an instant loan, transfer funds or purchase insurance. But that’s not all. If registered for Timiza, you can also save and earn returns with our Zidisha savings account.

Get started with Timiza:

• Open an Account instantly.

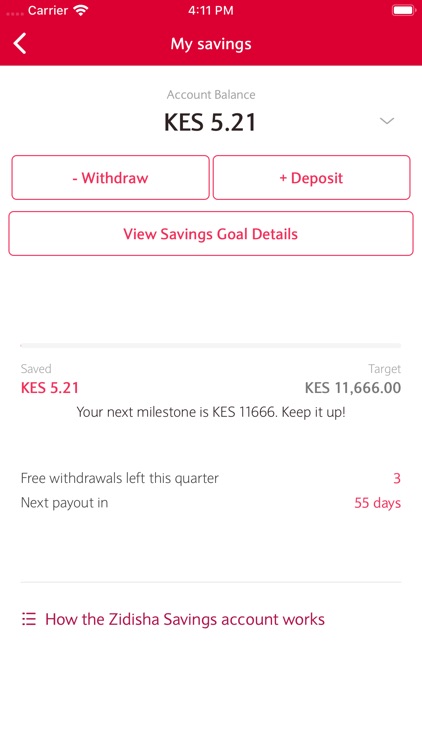

• Save and earn rewards with Zidisha.

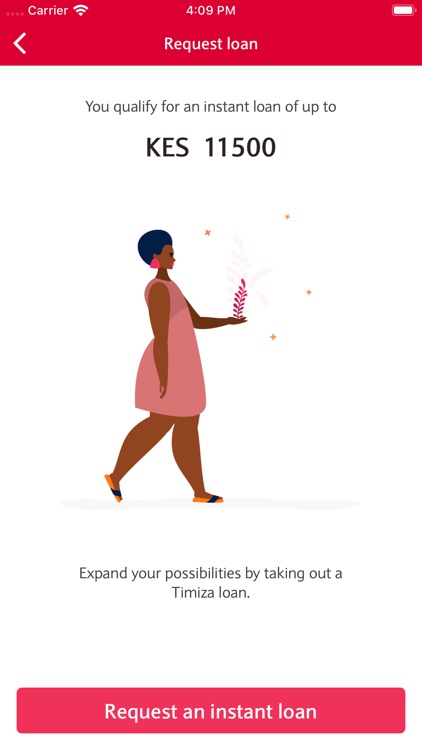

• Get instant loans on your phone.

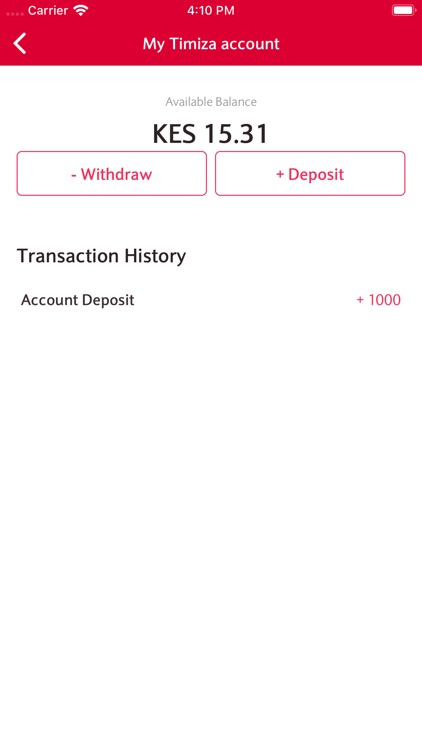

• Deposit funds into Timiza.

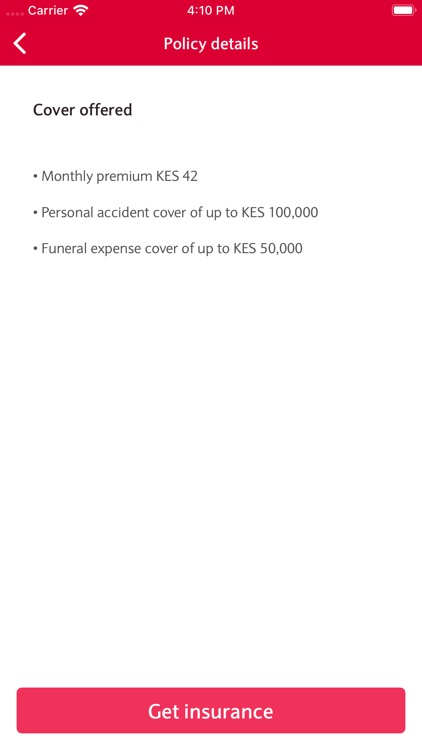

• Purchase insurance.

• Buy airtime.

• Pay for KPLC/ZUKU/DSTV/GOTV bills.

What are the requirements for a customer to have a Timiza Account?

• Be a registered Safaricom Subscriber.

• Be a registered Safaricom M-PESA customer.

• Have an active Safaricom M-PESA account/line.

• Hold a Kenyan National Identification Document (ID) Kindly note that Kenyan passports are not allowed.

Timiza Tariff and Guides

Please refer to the Timiza Tariff and frequently asked questions on the link below:

https://www.absabank.co.ke/personal/ways-to-bank/timiza/

Who is eligible for a Timiza Loan?

In order to qualify for a loan, you need to be an M-PESA subscriber for more than 6 months, actively use other Safaricom services such as voice, data and M-PESA. You will also need to have a good rating at the Credit Reference Bureau [CRB] and by Safaricom on Okoa Jahazi.

What are the features of the Timiza Loan?

• If you qualify, your loan limit will be displayed when you log in to your Timiza account and you can borrow.

• Timiza Loan attracts an interest charge of 1.083% charged once and a facilitation fee of 5% of the amount borrowed for a term of 30 days.

• Loans are disbursed to the Customer’s Timiza account (not directly to M-PESA). The Customer will access the funds by withdrawing from Timiza to M-PESA

• To grow your loan limit:

o Increase activity on your TIMIZA Account by transacting on other services offered on Timiza. For example, Deposit cash, Purchase airtime, Pay your utility bills, Subscribe to Insurance.

o Open and Increase savings on your Zidisha savings account on Timiza

o Increase usage of M-PESA services

Absa Bank Kenya Plc is regulated by the Central Bank of Kenya.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.