Mr

TradeAlert

What is it about?

Mr. Robert Lichello, (Sep 12, 1926 – Feb. 01, 2001), in his book “How To Make $1,000,000 in the Stock Market” created a mathematical investment method for the Stock Market that he called Automatic Investment Management or AIM.

TradeAlert is FREE but there are more add-ons

-

$0.99

TradeAlertFull

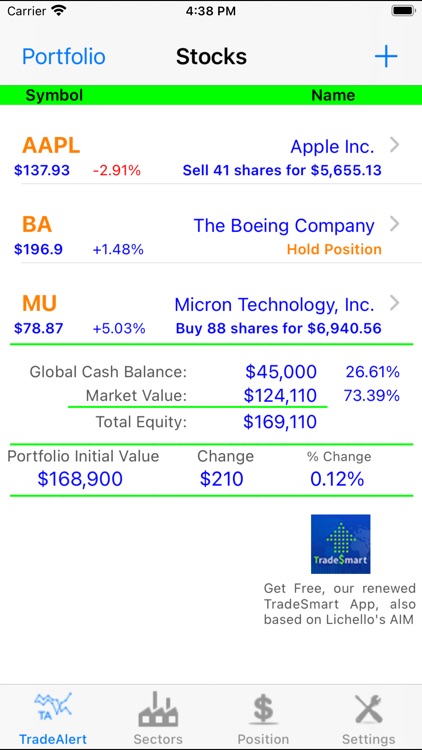

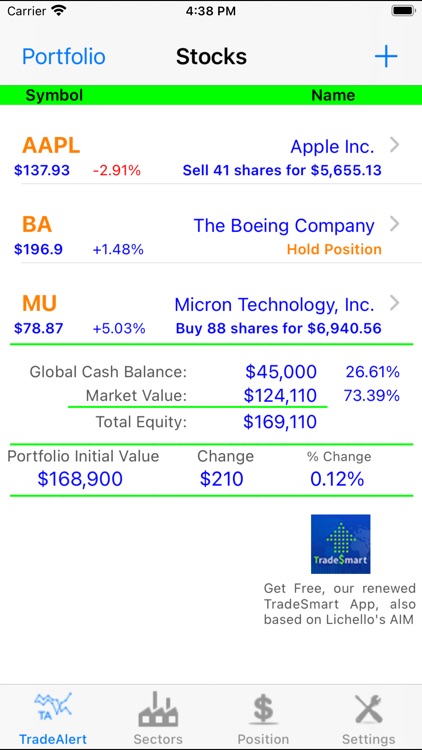

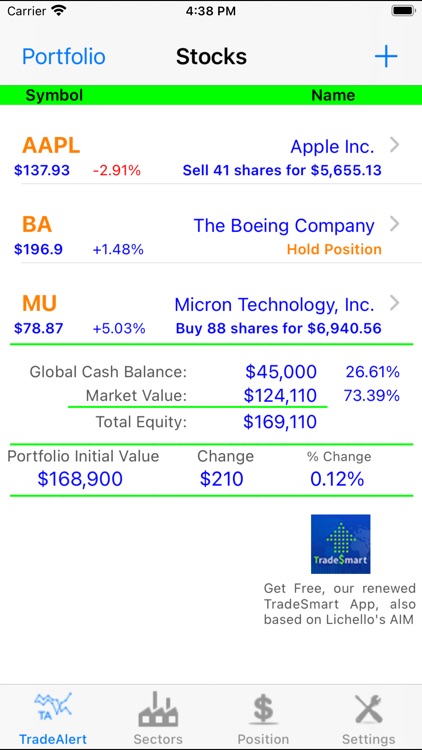

App Screenshots

App Store Description

Mr. Robert Lichello, (Sep 12, 1926 – Feb. 01, 2001), in his book “How To Make $1,000,000 in the Stock Market” created a mathematical investment method for the Stock Market that he called Automatic Investment Management or AIM.

This method is based on the natural up and down cycles of the stock market prices.

If you apply AIM with discipline during medium or long term periods, you will benefit from AIM's ability to calculate buy prices and quantities at low levels related to your portfolio cost, and to sell them at a higher price to cash the profit. All these buy and sell actions are made at a measured pace in order to protect the portfolio value and cash reserve and, on the other hand, to increase the portfolio value.

To know more about Mr. Robert Lichello's AIM method, we suggest that you read his book “How to make $ 1,000,000 in the Stock Market” where it is clearly and thoroughly explained, or visit http://www.aim-users.com

TradeAlert is also a simple and easy way to record all of your trading activity and keep track of your portfolio performance, even if you decide not to follow the calculated trade values.

With TradeAlert you will receive calculated market orders, including the price and the quantity of shares to sell, and also the price and the amount of shares to buy.

TradeAlert allows you to place a Limit Order with your brokerage account in order to execute the calculated buy or sell orders at the moment your stock reaches one of the calculated prices.

It is a Set-and-Forget system. You do not need to be watching the stock market every day. Just place your calculated order and let your broker do the work for you.

With TradeAlert you will know how much and when to buy, sell, or hold your position. It reduces the risk by continuously protecting the equity value as well as the cash reserve by selling stocks at a profit, and buying them at lower prices.

TradeAlert makes it possible to profit from a stock that may never even return to its original buy price. It benefits from the natural market price cycles going up and down.

It doesn’t matter if the market is high or low or if it is Bullish or Bearish, you take profits on either side of the cycle. Based on your parameter settings, TradeAlert will calculate the value and frequency of the trades for you to pocket the profit.

Anyone can use TradeAlert and feel comfortable in a short period of time without ever worrying about equity performance forecasts, complex graphs, or any past performance analysis.

You only need to choose the stocks, mutual funds, or ETFs that you like or trust. An equity that you believe is solid and it is worth owning for many years in the future. Then TradeAlert will make its calculations based on your parameter settings.

Every time you register a new trade or create a new stock, TradeAlert will calculate new Buy and Sell alert market orders.

You may also enter a stock price in the "Simulation" section and receive a calculated trade quantity for that price, or you may try various scenarios by entering simulated or actual trading prices, and then registering the calculated results as "New Trades", in order to see the simulated portfolio performance.

TradeAlert is NOT a trading platform and it does NOT provide any finantial advisories. TardeAlert only implements Mr. Lichello's AIM mathematical method with the benefit of computing power and some added features, like the customization of key parameters, calculating trade alerts values, showing portfolio position, trade history, performance comparison and more.

ALL of the information entered by the user is stored by TradeAlert in the device memory ONLY, and that information is NOT transmited, shared, or used for any other purpose. It is always in the device memory only.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.