This application is designed for tracking the work-related expenses which can be claimed in Tax Returns

Trax Expense Tracking

What is it about?

This application is designed for tracking the work-related expenses which can be claimed in Tax Returns. TRAX is an intuitive tax app to take the stress out of tax. One feature allows individuals to log all work trips made in a range of vehicles. There is automated trip calculation which then provides a live summary of the claim. Work-related expense tracking made easy through simple receipt capture OCR allowing you to scan receipts and keep accurate records of all work-related deductions. Everything is captured in a simple dashboard which exactly pinpoints your tax position at any time of the year, based on your salary range tax rate.

App Store Description

This application is designed for tracking the work-related expenses which can be claimed in Tax Returns. TRAX is an intuitive tax app to take the stress out of tax. One feature allows individuals to log all work trips made in a range of vehicles. There is automated trip calculation which then provides a live summary of the claim. Work-related expense tracking made easy through simple receipt capture OCR allowing you to scan receipts and keep accurate records of all work-related deductions. Everything is captured in a simple dashboard which exactly pinpoints your tax position at any time of the year, based on your salary range tax rate.

TRAX helps every-day people monitor their work-related expenses in an easy and practical way. Sign-up to TRAX to track expenses throughout the financial year and eliminate the stress of finding receipts, logbook entries while providing a live-indication of what return can be expected at the end of the year. Helping individuals to achieve their goals by using both financial and non-financial data is where the bookkeeper takes on the role of financial adviser. If an individual is audited they need to be able to produce records, documentary evidence and receipts – TRAX offers the solution to all of these issues.

KEY FEATURES:

• Scan and OCR receipt capture

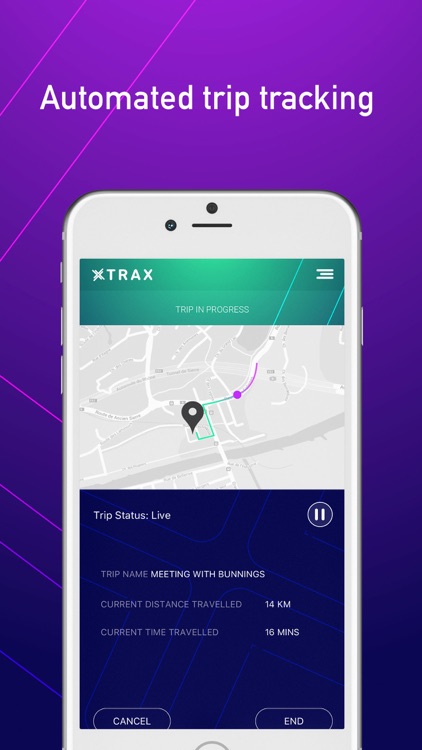

• Automated trip tracking

• Multiple vehicle logbook tracking

• Dashboard summary of all claimable expenses

• Expenses stored and categorised into deductions aligned to the tax return

• Exportable reports

The app has been developed by accountants for accountants and individuals. It is a way of simply a quickly logging receipts and trips to speed up the onerous task of submitting an annual tax return for both individuals and their accountants, whilst ensuring documentary evidence and compliance. TRAX also tracks every expense and trip the user takes so they can at a glance see what they are claiming at any point through the year.

You can use Trax app without any subscription for the first month. Within this month you can register 1 vehicle, up to 3 trips and 3 expenses. To remove these limitations, or to use the app longer than 1 month, you need to subscribe. Subscribing to Trax doesn't give any additional trial time, so please make sure the app works as you expect before subscribing. We offer two packages. A monthly package in which you are charged every month or a yearly package in which you are charged every year from the time you subscribe. You will be charged the first time right after subscription confirmation and then every month or year depending on the selected package. Any unused portion of a free trial period will be forfeited when you purchase a subscription.

Your subscription will auto-renew through iTunes each month or year unless you unsubscribe from the TRAX service within 24-hours prior to the end of the current period.

By using Trax and subscribing "Trax Full app access" you accept our Privacy Policy and Terms of Use:

Privacy Policy: http://trax.tax/privacypolicy/

Terms of Use: http://trax.tax/terms-of-use/

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.